Parental allowance maximum

Who gets the maximum amount of parental allowance?

Parental allowance is a state benefit that replaces prenatal income. Parents receiving the basic parental allowance receive at least €300 and a maximum of €1,800 per month of life.

Answer: Parents whose average prenatal parental allowance net exceeds the amount of 2,770€ receive the parental allowance maximum of currently 1,800€. However, the parental allowance net is not the net you find on your pay check or on your tax statement. The calculation of the parental allowance net is complex and is explained in detail in this article.

How do I reach the maximum amount?

Parental allowance replaces a pre-birth comparative income. Here, the parental allowance office calculates an average income from a 12-month period before the birth (also called the assessment period). The parental allowance-relevant income from these months is added up and divided by 12 to reach the monthly average.

Employees

In the case of salaried employees, the regular and flat-rate taxed salary counts, i.e. one-off payments, other payments and tax-free salary components do not count here. In the next step, the parental allowance office deducts lump sums for social security contributions from the average gross income. If you are compulsorily insured, this would be 21% of the gross (10% for pension insurance, 9% for health and nursing care insurance and 2% for unemployment insurance contributions. In addition, taxes are deducted according to your income tax class. The tax class that counts here is the one that you had predominantly in the assessment period. We explain which tax class counts for you in the article “Parental allowance and tax class”. The resulting net income is the parental allowance net income, which is partially replaced in the form of the parental allowance. If it is greater than or equal to 2,770€, you will receive the maximum amount.

Example

The parental allowance in this case is 1,577€ (2,427€ x 65%).

Example in the maximum amount

The parental allowance in this case is 1,800€ (2,915€ > 2770€ x 65%).

Notice:

Due to the birth of a child well before the expected date, maternity leave is generally extended. Mothers who receive maternity leave payments (e.g. from their health insurer, employer, etc.) must apply for basic parental allowance for all months of the child’s life during which they receive maternity allowance. The maternity leave payment will be credited against the basic parental allowance.

Conclusion:

In order to achieve the maximum amount of parental allowance as an employee, there are several “adjusting screws”. On the one hand, it is logical to achieve the highest possible gross income, on the other hand, you can get a lot out of the deductions for social insurance and taxes if you have optimization options in this regard, for example, in the form of a tax class change. How employees can increase their gross income relevant for parental allowance is explained in our article “Increase parental allowance”.

Self-employed

In the case of self-employed persons, the taxable profit within the meaning of Section 4 (1) or (3) EStG counts, i.e. the annual surplus according to the profit and loss account of the balance sheet or the surplus of income over operating expenses a revenue surplus account. The annual profit is divided by 12 to obtain a monthly average. In the next step, the parental allowance office deducts lump sums for social security contributions from the average profit. If you are compulsorily insured, this would be 21% of the gross (10% for pension insurance, 9% for health and nursing care insurance and 2% for unemployment insurance contributions. Self-employed persons are in some cases exempt from the statutory social insurance obligation and can, for example, make private provision, participate in voluntary statutory insurance or be a member of a professional pension scheme. In addition, taxes are deducted at a flat rate for self-employed persons according to tax class 4. There is no option here. The resulting net income is the parental allowance net income, which is partially replaced in the form of the parental allowance. If it is greater than or equal to 2,770€, you receive the maximum amount.

Example

In this case, the parental allowance amounts to 1,184€ (1,822€ x 65%). From the parental allowance, self-employed persons must generally continue to pay the voluntary or private pension insurances, please inform your insurance provider in good time if you are affected in order not to be surprised here.

Example in the maximum amount

The parental allowance in this case is 1,800€ (2,821€ > 2770€ x 65%).

Caution with additional earnings

Parental allowance law is unfortunately very unfair in places. Parents who are entitled to the maximum amount are hit particularly hard if they choose parental allowance with additional earnings. The problem is that here the real loss of earnings is not replaced proportionally (as the parental allowance system actually provides for), but the cap on the prenatal comparative income of €2,770 remains in place. This makes additional earnings less worthwhile for parents at the maximum amount than for parents who earned below the net comparative income of €2,770. It is less and less worthwhile the higher the real parental allowance net is away from the 2,770€.

Example "not in the maximum amount"

Example "in the maximum amount"

Actually, the loss of earnings would be 1,155€, the parental allowance claim therefore 750€. In the example case, parents “lose” €100 in parental allowance each month due to the maximum amount cap.

This effect is even more serious in the following scenario:

In this situation, one receives only the minimum amount because there has been no loss of income compared to the prenatal net, whereas the parental allowance should actually be 866€ (4,608€ – 3,275€ = 1,333€ x 65%).

Conclusion:

In particular, high earners should pay particular attention to parental allowance with additional earnings, so that it will not come to unwanted repayment obligations. This can quickly become very expensive, especially with these amounts.

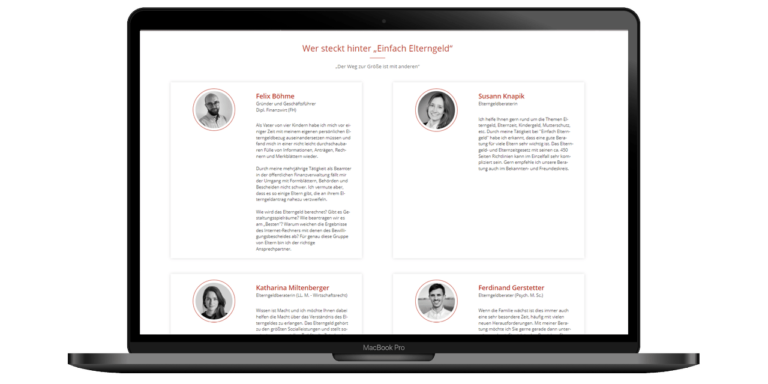

The regulations on parental allowance can be very confusing in some places. Parents want to be as financially secure as possible for the time after the birth, which is why we recommend our consulting services, where we calculate your parental allowance and show you your options:

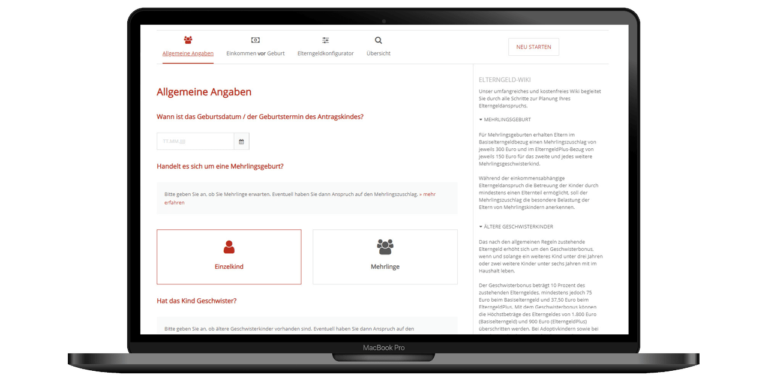

Create your parental allowance and child benefit applications quickly and easily with our specially developed software:

You might also be interested in