Einfach Elterngeld

The portal for parents and families

If you want to see more reviews, click here: change Cookie options

How we support parents

With expert knowledge, tools and personal advice

In addition to detailed information, you will also find individual advice and practical tools for parental allowance, parental leave, child benefit and maternity leave payment. From now on, apply for your family benefits more easily, securely and quickly and take advantage of all the services for your family!

We provide information on parental allowance, parental leave, child benefit and maternity leave payment.

Expertise on calculating parental allowance to applying for parental leave. Here you will find parental help, instructions, downloads and expert tips. Use our resources on parental allowance, parental leave, child benefit and maternity leave payment.

We empower parents with knowledge and service

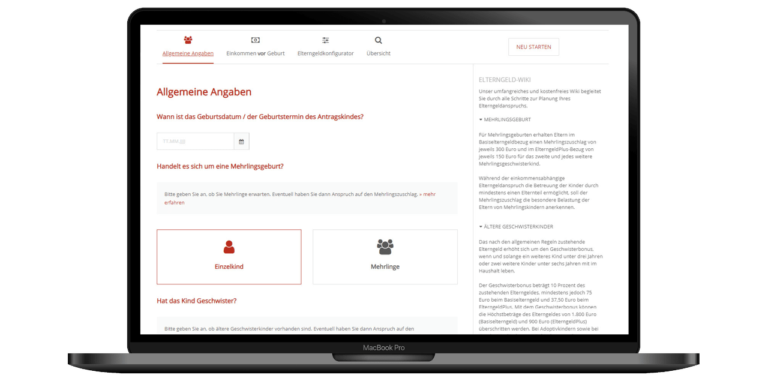

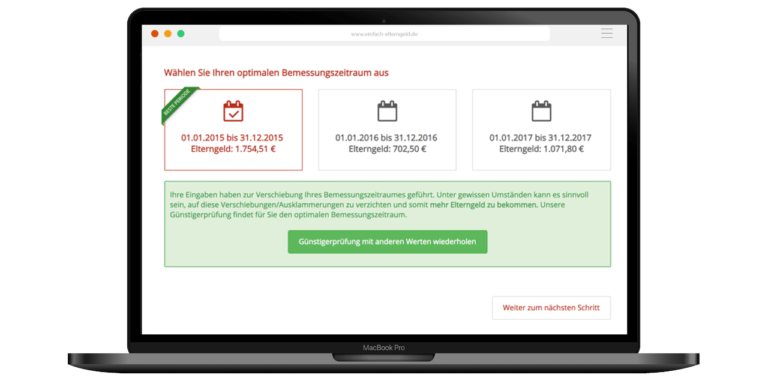

Create the parental allowance application faster, easier and safer on your own with the right tools.

The most important information about parental allowance

++++ Reduction of the income limit 2024 ++++

Would you like to find out everything about the annual income limit for parental allowance as part of the public Budget Financing Act 2024? Here you will find all the information and news –> Annual Income limit for parental allowance

With us you are well advised

Our parental allowance experts provide reliable and competent advice to help you get the most out of your parental allowance application. We support you in your individual situation with expertise and helpful tips for an optimal result.

Thats what Chat-GTP says about us:

The website “Einfach-Elterngeld.de” seems to be a well-organized portal aimed at providing information and resources to parents and families in Germany, particularly regarding parental benefits (Elterngeld), parental leave (Elternzeit), child benefits (Kindergeld), and maternity benefits (Mutterschaftsgeld). It offers various sections for each of these topics with calculators, how-to guides, and advice on how to apply for these benefits.

Furthermore, there’s a section for personalized advice and a software tool to help individuals calculate and apply for parental benefits.

The site also mentions that their parental benefit advice service has been tested and awarded by Stiftung Warentest, which could provide an extra level of trust for visitors. Overall, the website appears to be a comprehensive and user-friendly resource for German families seeking information and support in these areas.

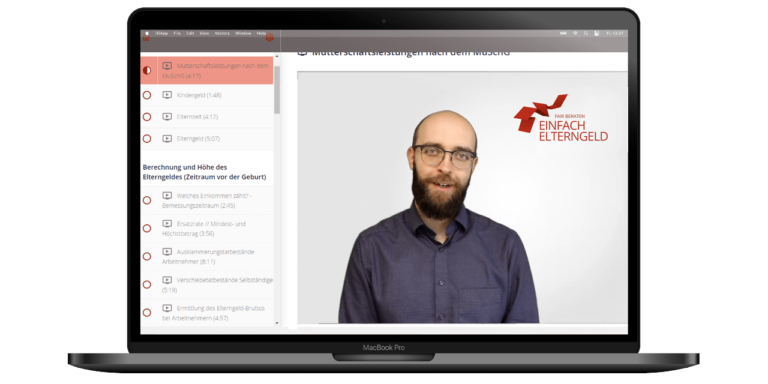

YouTube

Discover our helpful videos on YouTube