Parental allowance calculator - calculate and plan parental allowance amount precisely

Calculate and plan your parental allowance quickly and easily

Parental allowance is a governmental social benefit for parents whose earned income is suspended for a certain period of time due to child care. With our parental allowance calculator, you can quickly and easily calculate your parental allowance entitlement and plan the reference period.

With our parental allowance calculator, you can precisely calculate your parental allowance. Find out for free how much basic parental allowance and how much parental allowance plus you are entitled to.

The parental allowance calculator will not only correctly calculate your individual parental allowance based on the information you provide, but with our reference period configurator you can conveniently and easily test how to best draw your parental allowance.

Who can use the parental allowance calculator?

With our parental allowance calculator, anyone can calculate their entitlement. It doesn’t matter if you are a full-time employee, self-employed or both. The calculator can take into account any prenatal employment. Of course, single parents, civil servants, soldiers, judges, co-entrepreneurs of partnerships and shareholder-managers can also make full use of our parental allowance calculator.

Quick calculator for parental allowance

Calculate the amount of your basic parental allowance and your parental allowance plus quickly and easily.

Parental Allowance Quick Calculator

Explanation

With the quick calculator you can get a quick overview of your expected parental allowance. Please note that this calculator provides only an imprecise result. For more accurate results, please use our extensive calculator!

Precisely calculate parental allowance with the parental allowance calculator and planner

Parental allowance-Wiki

For multiple births, parents receive a multiple supplement of € 300 each in the basic parental allowance and € 150 each in the Parental allowance Plus subscription for the second and each additional multiple sibling child.

While the income-based parental allowance entitles the child to be cared for by at least one parent, the multiple supplement should recognize the special burden on the parents of multiple children.

The parental allowance due under the general rules increases by the sibling bonus if and as long as another child under the age of three or two other children under the age of six live in the household.

The sibling bonus amounts to 10 percent of the parental allowance, but at least 75 euros for the basic parental allowance and 37.50 euros for the Parental allowance Plus. With the sibling bonus, the maximum amounts of the parental allowance of 1,800 euros (basic parental allowance) and 900 euros (Parental allowance Plus) can be exceeded.

Adopted children and sibling children with disabilities are subject to special regulations:

Adopted children For the granting of the sibling bonus up to three resp. six years from the beginning of the budget until they are 14 years old.

Siblings with disabilities can be considered for the sibling bonus up to the age of 14 years. With regard to the sibling bonus, you will therefore receive additional sibling children under three resp. equal to six years old, as long as they are not yet 14 years old.Prerequisite is a degree of disability of at least 20.

You are considered a single parent if you qualify for the single parent tax relief (tax class 2) and the other parent does not live with you or the child in an apartment. The child has to live with the single parent in a household and the single parent may not have a household with another adult.

Single parents are also entitled to twelve reference months of the basic salary. They also have the option of using Parental allowance Plus instead of reason Parental allowance. Single parents who lose income for at least two reference months can apply for basic parental allowance (or four months Parental allowance Plus) for another two months.

The conditions within the meaning of § 24b EStG may also apply to the marginally employed, the inactive and the self-employed. For single parents, too, the months of life of the child in which they are entitled to maternity allowances should be regarded as reference months for the basic parent and should also be applied for in this variant.

Table of Contents

The most important facts about the calculation of parental allowance at a glance:

- Parents can receive between €300 and €1,800 basic parental allowance per month

- Parental allowance plus is half of the basic parental allowance, but can be received for twice as long

- Your parental allowance is calculated from your gross prebirth income

- Your income tax deduction characteristics and social security status play a significant role in the calculation of the parental allowance

- There are countless ways in which you can receive parental allowance – our calculator will help you find the best option for you

How does the parental allowance calculator work?

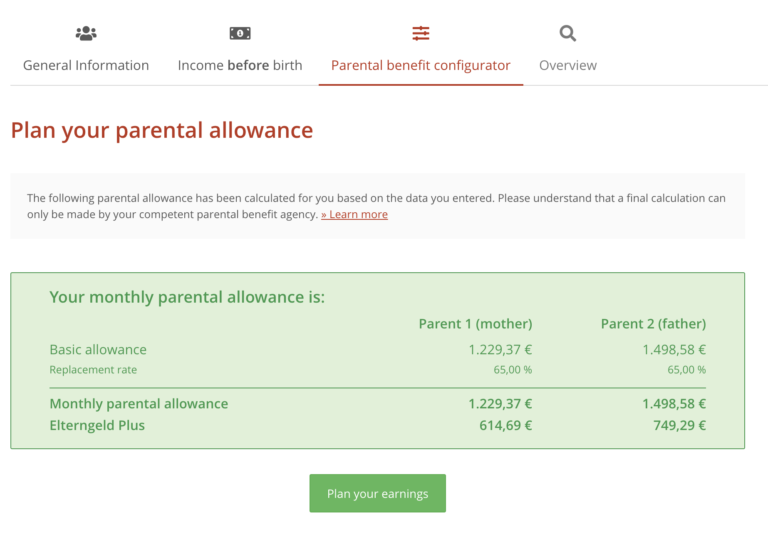

The parental allowance calculator leads you to the result in three steps. The parental allowance calculation itself is complex; parental allowance is paid to parents as a state social benefit in the form of a remuneration replacement. Which prenatal pay is actually partially replaced is determined by the parental allowance calculator based on your user input. With the help of your input on family income, your parental allowance can be calculated precisely and concretely.

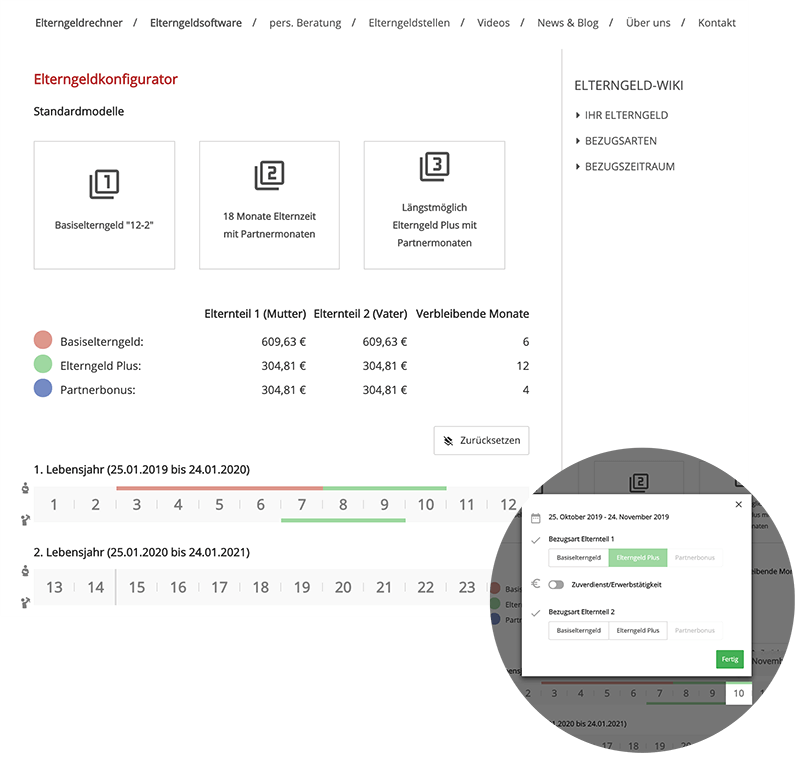

In the last step, you plan your reference period in our reference period configurator. With the help of the latest technology, we were able to develop a tool for you, with which you can perfectly plan your reference period in compliance with the legal regulations. In doing so, you distribute your basic parental allowance, parental allowance plus and partnership bonus months over the first months of your child’s life.

Instructions: Calculate and plan parental allowance in three steps

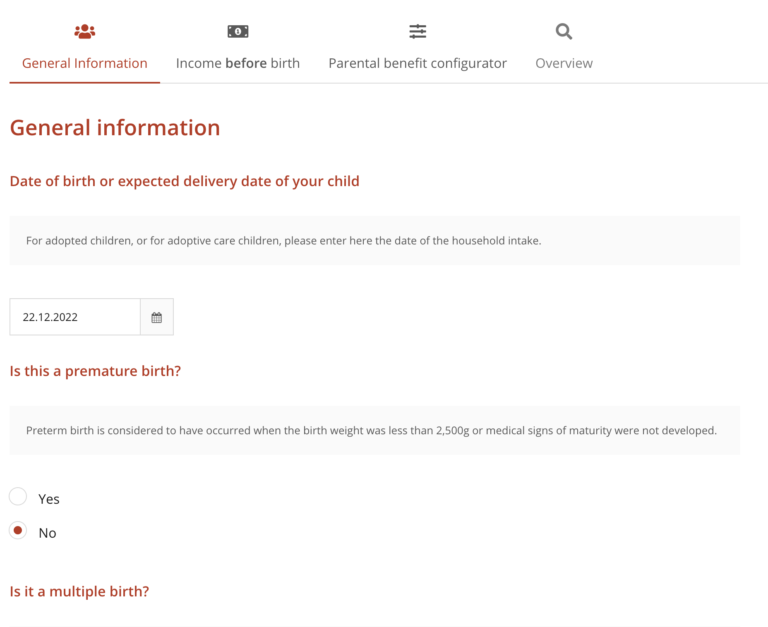

Step 1:

Enter your basic information such as date of birth application child, sibling child information, etc.

Step 2:

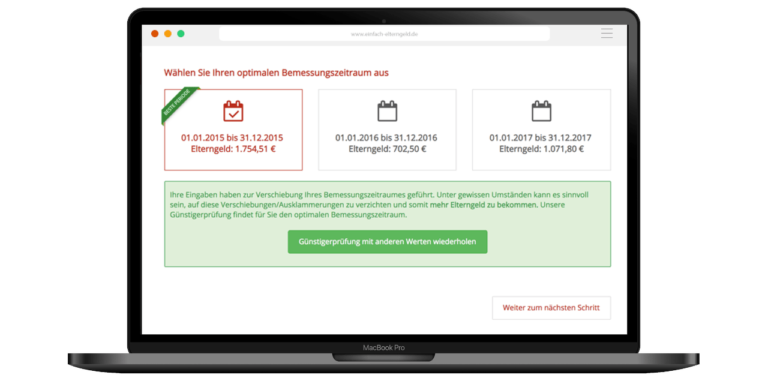

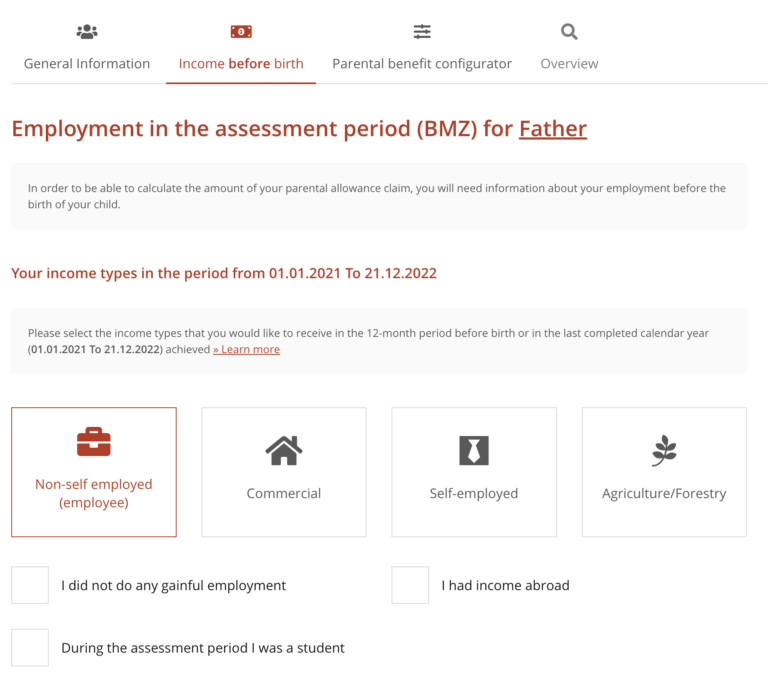

The parental allowance calculator will determine your assessment period for you based on the values you entered regarding your employment before birth, which is the comparison period that determines the amount of your parental allowance claim.

Step 3:

Now plan your parental allowance reference period using our interactive reference period configurator.

Calculation of parental allowance: important parameters

Date of birth of child

Dates of birth of any siblings

Maternity leave data

Salary statements

Wage tax and social security data

Profit calculation (if self-employed)

How parental allowance is calculated

Parental allowance is a payment in lieu of wages. The amount of income that is replaced is determined on the basis of your prenatal employment situation.

The gross income from the prenatal employment period forms the basis for a fictitious net calculation. Thus, amounts for taxes and social insurances are deducted from the average prenatal gross income (lump sum – not the actual!), from which the parental allowance calculator calculates a fictitious prenatal parental allowance net.

You will receive this parental allowance net in the amount of your replacement rate (between 65 and 100%). The parental allowance plus is only half as high as the basic parental allowance.

Special cases in the calculation of the parental allowance

Only in the case of income with foreign currencies (for example, Swiss francs – CHF), the parental allowance calculator user must convert the currencies himself.

Parental allowance calculator for all types of situations

Basic parental allowance calculator

The basic parental allowance is the “classic” parental allowance. It is a minimum of 300€ and a maximum of 1,800€ per month of life. Our parental allowance calculator calculates your basic parental allowance entitlement after entering your relevant gross income to parental allowance.

Parental allowance plus calculator

Parental allowance plus is a special form of parental allowance. It suggests at first a “more” in parental allowance, however, it is a “more ” in time. Parental allowance plus corresponds to half of the basic parental allowance entitlement and therefore amounts to at least 150€, maximum 900€. Our parental allowance calculator reliably calculates your parental allowancePlus.

Parental allowance calculator for self-employed

For self-employed persons, different calculation bases apply than for employees. With our parental allowance calculator, self-employed persons, tradesmen, etc. can calculate and plan their parental allowance entitlement in concrete terms.

Parental allowance calculator for partnership bonus months

The partnership bonus months are a special form of parental allowance plus months, which the legislator grants to parents who work part-time for four parallel months of the child’s life while receiving parental allowance.

Parental allowance calculator for civil servants

Civil servants are subject to the same regulations as employees when it comes to parental allowance. However, there are differences in the social security deductions and the lump-sum pension allowance. Our parental allowance calculator reliably maps the special features for civil servants.

Parental allowance calculator for part-time employees

The parental allowance is based on the prenatal income. Part-time income also counts in the calculation basis. With our parental allowance calculator, you can also calculate your parental allowance entitlement if you were employed part-time before the birth.

Parental allowance calculator second child

The amount of parental allowance for the next child can very quickly become a complex and obscure topic.

With our parental allowance calculator, you can conveniently enter the sibling child data and calculate the amount of parental allowance for your next child.

Parenting allowance calculator for mini-job

Income from a mini-job is taken into account for parental allowance.

Enter the mini-job income as income from non-independent work in our parental allowance calculator and calculate your parental allowance entitlement quickly and easily.

Parental allowance calculator for mixed income

Anyone who has income from non-independent and self-employed work is treated as a “mixed income” case for parental allowance.

This means that the regulations for self-employed persons apply. In our parental allowance calculator, you can easily and quickly calculate your entitlement based on mixed income and plan your reference period.

Parental allowance calculator for special cases

Co-entrepreneurs in partnerships (GbR, KG, oHG, PartGG, etc.), shareholder-managers quickly become a special case for parental allowance, as do employees with non-cash benefits such as company cars or company apartments.

Of course, our parental allowance calculator also covers these special cases.

Parental allowance calculator in case of unemployment

Job seekers are also entitled to parental allowance. With our parental allowance calculator, you can quickly and easily calculate your parental allowance entitlement and plan your reference period

Never apply for parental allowance without prior consultation.

We are here to provide you with competent advice and support.

Parental allowance calculator for all federal states

here you find all infos and forms

- Parental allowance application Baden-Württemberg

- Parental allowance application Bavaria

- Parental allowance application Berlin

- Parental allowance application Brandenburg

- Parental allowance application Bremen

- Parental allowance application Hamburg

- Parental allowance application Hessen

- Parental allowance application Mecklenburg-Vorpommern

- Parental allowance application Lower Saxony

- Parental allowance application North Rhine-Westphalia

- Parental allowance application Rhineland-Palatinate

- Parental allowance application Saarland

- Parental allowance application Saxony

- Parental allowance application Saxony-Anhalt

- Parental allowance application Schleswig-Holstein

- Parental allowance application Thuringia

FAQ

-

What income is used as the basis for calculating parental allowance?

-

What income before birth is used to calculate the parental allowance?

-

Father is self-employed, mother is employed - how is the parental allowance calculated?

-

How is the parental allowance calculated for self-employed persons with irregular income?

-

How is parental allowance calculated if I was unemployed before the birth?

-

How is parental allowance calculated if the second child is born during the first child's parental leave?

-

How is parental allowance calculated for twins?

-

Can parental allowance be deducted from taxes?

-

Is the husband's or wife's salary also taken into account for the parental allowance?

You may also want to read: