The partnership bonus months

The partnership bonus for parental allowance is a reward for those parents who share the care and upbringing of their child as partners for a period of time after the birth and work part-time during this time.

This article explains what exactly the partnership bonus is and what you should look out for when applying for the partnership bonus months:

The most important facts about the partnership bonus

- The partnership bonus months are parental allowance plus months.

- The bonus amounts to at least 600€, maximum 7,200€.

- The bonus months can be applied for at least 2, maximum 4 consecutive months of the child’s life in parallel

- Both parents must work at least 24, maximum 32 hours per week during this period.

- The partnership bonus months can also be applied for retrospectively.

Who should apply for the partnership bonus?

- Who planned to work part-time together anyway (or was already doing so before the birth of the child).

- Who can adjust the working time very flexibly and in the best case can positively influence the additional earnings/profit in the period of months

- Of 1.87 million parental allowance recipients, only just over 38,000 parents claimed the partnership bonus months in 2021 (only approx. 2.06%; source: Destatis; “Elterngeldbezüge 2021”).

How can you apply for the partnership bonus?

- The partnership bonus months can be (co-)applied for in the normal application forms

- If you decide to apply for the partnership bonus months at a later date, you can apply for them informally at a later date.

- In addition to the months of life in which the partnership bonus months are to be claimed, the parental allowance office requires proof of the minimum/maximum working hours and the expected additional earnings.

- The partnership bonus months are always granted provisionally at first; after the reference period, the actual proof of income must be submitted, and the final decision will be issued afterwards.

- Due to the tight and strict requirements, we recommend that the allowance is only used by you after the final decision has been submitted.

Please note:

In our opinion, the partnership bonus months are an important part of a good and complete parental allowance consultation. That is why you will always receive the needed information on the partnership bonus for your individual situation in every parental allowance consulting package we offer.

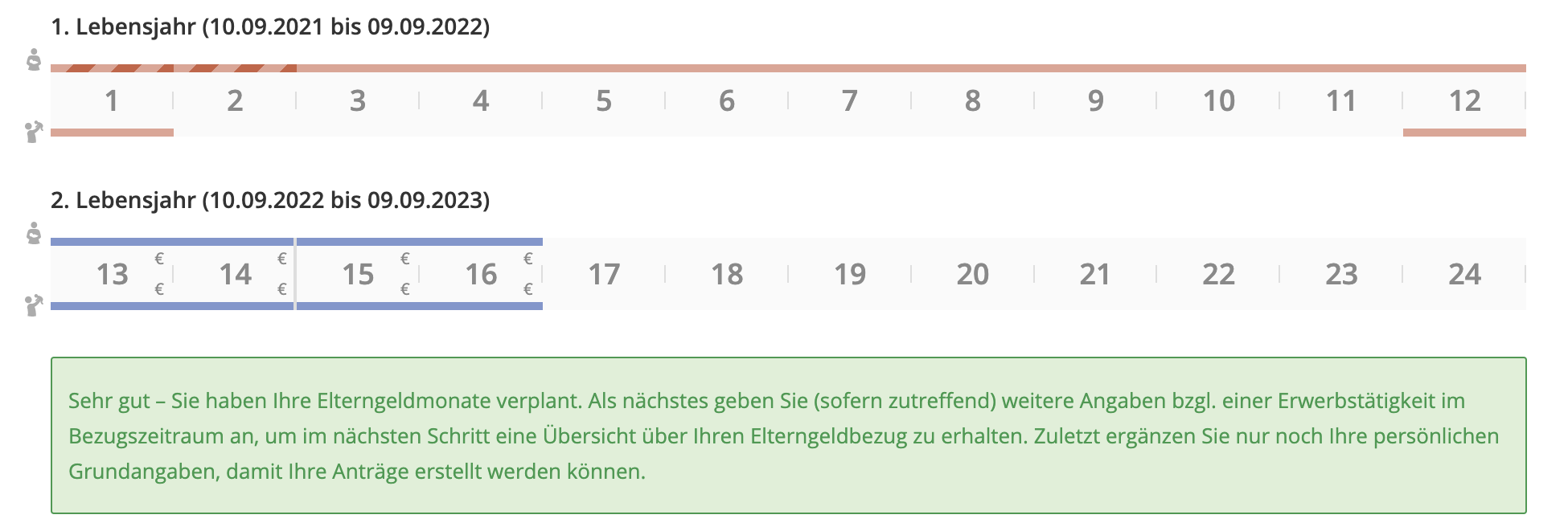

In our parental allowance software, you can easily select the partnership bonus months in the parental allowance configurator.

What is the partnership bonus?

The so-called partnership bonus months are a minimum of four and a maximum of eight additional Parental Allowance Plus months (two to four per parent) that can be claimed for two, three or four consecutive months of the child’s life. To be eligible for partnership bonus months, two conditions must be met:

- The general requirements for receiving parental allowance must be met by both parents in parallel for two, three or four consecutive months of life, and

- Both parents must work at least 24 hours per week during this period and no more than 32 hours per week during each of the months of life.

The legislator thus promotes part-time employment for both parents with the aim of ensuring that both parents take on the care and upbringing of the child as equally as possible and that both parents return to work “gradually”.

The partner bonus can be claimed at any time after the birth, so it is not necessary to have applied for the “basic entitlement” first. Due to the forced part-time employment, however, it is recommended to claim the months regularly at the end of the parental allowance.

For whom are the partnership bonus months worthwhile?

In everyday consulting, the question often arises “Is it worth it for us?” – As is so often the case with parental allowances, this question cannot be answered in a blanket manner. It therefore depends on your individual case situation.

Experience shows, however, that the partnership bonus months are claimed when both parents want to work part-time after the birth anyway. If the requirements for the bonus are met anyway, so to speak. In this case, you should definitely think about taking the minimum subsidy of EUR 600 (for 4 months = EUR 1,200) for the family.

In addition, we recommend parents to look into the partnership bonus, who can very easily influence/shape their working hours and additional earnings. This concerns in particular self-employed persons and tradesmen, partner-managers and co-entrepreneurs of partnerships.

How is the bonus calculated?

The partnership bonus months are “normal” parental allowance plus months with additional earnings. This can be an advantage on the one hand, but also a disadvantage on the other:

Fundamental:

Parental allowance replaces a pre-natal comparative income as a payment substitute. The loss of earnings is regularly replaced. During the partnership bonus months, you will probably not have a full loss of earnings that would lead to the unreduced parental allowance plus.

Example:

prenatal parental allowance net income: 2.153,85€.

replacement rate: 32,5% –> parental allowancePlus = 700€

Parental allowance net income during partnership bonus months: 1.615,39€ (corresponds to part-time rate of about 75%)

Loss of income = 538,46€

replacement rate: 32,5% –> parental allowancePlus = 175€

Conclusion:

Due to the “high” part-time rate, the parental allowancePlus is “only” 175€. Compared to a full-time net income in the example case, the parent here thus has a net income loss of 345€. This is offset by 10 free additional hours in a 40-hour full-time week.

Tip:

Calculate your expected claim quickly and easily with our parental allowance calculator.

Important Notice:

The partnership bonus months are considered to be parental allowancePlus months with gainful employment, which means that anyone who has already applied for parental allowancePlus with additional earnings outside of the partnership bonus months may subsequently influence their total parental allowancePlus.

Example:

Marie is employed and has applied for basic parental allowance for the first 6 months of her child’s life. During this time, she was on 100% parental leave. From month 7 up to and including month 18, she claimed parental allowance plus for 16 hours per week of part-time employment with additional earnings amounting to the following “optimal parental allowancePlus gross”, so that she receives the unreduced parental allowancePlus during this time.

Now, in month 15 of her child’s life, she decides, in consultation with her partner, that they would like to claim the partnership bonus months together in months 19-22 of her child’s life because she wants to continue working part-time. She intends to work a 4-day week at 32 hours per week.

As a result, her additional earnings gross amount significantly exceeds the “optimal additional earnings gross amount,” resulting in a retroactive parental allowancePlus reduction for months of life 7-18.

Calculation:

Parental allowance net before birth: 2,200€.

Parental allowance plus in the months of life 7-18 = 715€ with a parental allowance net of 1,100€.

The parental allowance net in the 4 partnership bonus months is 1,760€, which increases the average net income in the life months 7-22 to 1265€. The monthly parental allowance plus entitlement is therefore only 607.75€, which is why for the months of life 7-18 she must pay back a total of 1,287€ to the parental allowance office.

Conclusion:

Partnership bonus months carry the risk of a repayment obligation, especially if they are

- are claimed subsequently and

- you have already chosen parental allowance plus with gainful employment.

Tip:

However, you can take advantage of this “problem” by earning such a low additional income through previous parental allowancePlus months with gainful employment that the average income of all parental allowancePlus months is entirely located below the “optimal parental allowancePlus gross“.

Example:

As above, but Marie already receives parental allowance plus directly after maternity leave, from month of life 3. However, she does not work up to and including month of life 22, but has a monetary benefit of 100€ gross (e.g. e-vehicle). The parental allowance net in these 20 months is “0,00€” due to the tax and social security deductions.

She claims the bonus months in month of life 23-26 together with her partner and achieves a parental allowance net income of 1,760€ (32 hours per week) during this time.

The average net income during all parental allowance plus months is thus only 293.33€ (4 x 1760 € /24 months). This means that she is below the imputation-free limit in all months and receives the unreduced parental allowancePlus of €715/month of life throughout.

Is there anything I need to consider when applying?

Yes, because what sounds great at first moment can become a nightmare in the next. The current legal situation provides for the following procedure when applying for the partnership bonus: The bonus months are first provisionally approved by the parental allowance office after you have forecast/credited the expected working hours, as well as the expected income in the period.

This means that the parental allowance office will check the eligibility again after the partnership bonus months. If, for example, the working hours have not been adhered to (also due to sickness-related absence with sick pay (!) or due to a one-time under- or overrun of the working time corridor – for example due to a flexible working time arrangement), the entitlement will lapse for the relevant months of life. Repayment of the corresponding parental allowance can then no longer be prevented.

Furthermore, it should be noted that according to the current legal situation, the partnership bonus months do not represent an independent type of entitlement, but are added to the parental allowancePlus months (with income). If parents have designed their parental allowancePlus reference period optimally (income in the amount of the gross income not subject to imputation), there is then a risk that this construct will be jeopardized by the bonus, because the part-time income during the partnership bonus months generally increases the overall average of the income in the parental allowancePlus reference period, resulting in a reduction of the parental allowance. In this case, the reference period should be planned and calculated precisely, otherwise you may be surprised with repayments. We write more about this under the heading “How is the bonus calculated“.

In addition, the topic of minimum and maximum working hours during the partnership bonus months is a constant subject of dispute between parents and parental allowance offices.

We explain quite comprehensively how the parental allowance office calculates/double-checks working hours in our article Parental allowance and additional income – working while receiving parental allowance. Recently, the Social Court of Saxony-Anhalt (decision from 15.12.2022 – L 2 EG 3/21) ruled on the former legal situation (min. 25, max. 30 hours per week) that periods of on-call duty are fully taken into account when considering the number of hours worked per week:

To the Decision in detail:

No bonus months for parental allowance due to on-call duty

The on-call duty of employed hospital doctors is to be taken into account as a period of gainful employment within the meaning of parental allowance law and can therefore result in a doctor not receiving any partnership bonus months in parental allowance. This has been clarified by the Saxony-Anhalt Regional Social Court. The lawsuit filed by a female hospital physician was thus unsuccessful.

Activity may not exceed 30 hours per week (former legal situation)

After the birth of her child in 2016, the doctor had received the basic parental allowance for eleven months, and her husband subsequently for three additional months. After that, they both worked part-time and took advantage of the four partnership bonus months. According to the law at the time, this required that both parents worked a monthly average of no less than 25 and no more than 30 hours per week during these four months at the same time. In retrospect, it turned out that the doctor had worked more than 30 hours per week in some months, if her on-call duties at the clinic were counted in full. For this reason, the authority demanded the return of the parental allowance initially paid only provisionally for the four partnership bonus months.

The claimant was successful at first instance

The doctor took legal action against this. She argued that on-call duty was not gainful employment within the meaning of the law. Although she had to be in the clinic, she was largely free to use the time in the on-call room. Counting only the times she actually came on duty, she consistently worked less than 30 hours per week. With this argumentation, she was successful at first instance before the SG.

Stay in the clinic on the instructions of the employer

On appeal by the parental allowance office, the LSG has now dismissed her claim. In the court’s opinion, the on-call duty is to be fully taken into account as a period of gainful employment because the doctor had to be at the clinic on the instructions of her employer and because this duty was remunerated. Another point of view was that the doctor could not take care of her child during her on-call time. In addition, the amount of the parental allowance is based on the income before the birth. In this case, income from on-call duty also has a positive effect for the person entitled to parental allowance. However, it would then be consistent to also take such periods into account in the requirements for the partnership bonus months.

Design of the parental allowance through the partnership bonus months

The partnership bonus months offer, in particular, self-employed persons and employees with a lot of room for maneuvering (shareholder managing director, employee in family business, etc.) a lot of opportunities. However, one should not overdo it with the optimization, as shown by a social court ruling of the Social Court of Stuttgart (ruling of 07.06.2019 – Ref: S 9 EG 3281/18):

In the case of the judgment, the father of the family was the managing partner of his GmbH. The child’s mother met the requirements of the partnership allowance without any further problems. The father, however, agreed – with himself (because of his position in the company so basically possible) – on a weekly working time of 25 hours. However, he did not pay himself any money as salary, but only paid tax on his company car (gross list price: just over EUR 159,000) as part of a non-cash benefit. He thus even remained within his imputation-free limit and was able to claim EUR 3,600.00 in parental allowance plus during the partnership bonus months.

The parental allowance office argued that the information on income and the number of weekly hours of 25 during the partnership bonus months was not credible and that the legal arrangement was an abuse of rights.

The Social Court of Stuttgart has now confirmed the decision of the parental allowance office.

In the opinion of the Social Court, the plaintiff was not entitled to parental allowance during the partnership bonus months because the legal arrangement he chose circumvented the meaning and purpose of the partnership bonus months and would therefore constitute an impermissible exercise of rights.

On the one hand, the chosen legal structure had a favorable effect on the amount of parental allowance. Secondly, the salary waiver took place close to the reference period, since the plaintiff did not pay himself a salary during the first seven months of his childs life, but only again at the beginning of the eighth month of his childs life.

In addition, according to the plaintiff’s own statements, he had only made this legal arrangement in order to obtain a salary payment in excess of the pecuniary advantage for the use of the car by drawing parental allowance. Thus, the income was not lost due to the care of the child, but due to the decision of the plaintiff as managing director to reduce his own salary in order not to burden his own company with a managing director’s salary, but to claim social benefits for it.

This contradicts the purpose of the partnership bonus months, which is to secure the economic existence of both parents in the long term, to reduce the risk of dependency on state transfer payments, to secure time for fathers and mothers with their children without losing touch with working life, and to improve professional development opportunities for women.

This objective is accompanied in particular by the fact that the working time for the gainful employment taken up must not only amount to between 62.5 and 75% of a full gainful employment, but this must also be reflected in the salary paid for this. This was not the case with the plaintiff.

Finally, the legal arrangement of the plaintiff also does not correspond to what is customary among strangers, so that the third-party comparison also speaks for the inadmissibility of the legal arrangement.

FAQ

-

What is the partnership bonus?

-

When do you get the partnership bonus?

-

What is the difference between partner months and partnership bonus months?

-

How much is the partnership bonus?

Old legal situation before 01.09.2021

concerns only parents of children born before 01.09.2021

Parents of children born before Sept. 1, 2021, must meet the following requirements to receive partnership bonus months:

- The general requirements for receiving parental allowance must be met by both parents in parallel for four consecutive months of life and

- Both parents must work at least 25 hours per week during this period and no more than 30 hours per week during each of the four months of their child’s life.

The old legal situation provides for the following procedure when applying for the partnership bonus: The bonus months are first provisionally approved by the parental allowance office after one has forecast/credited the expected working time, as well as the expected earnings in the period (employees submit working time and earnings forecasts from the employer).

This means that the parental allowance office will check the eligibility again after the partnership bonus months. If, for example, the working hours have not been adhered to (also due to absence due to illness with sick pay (!) or due to a one-time under- or overrun of the working time corridor – for example due to a flexible working time arrangement), the entire partnership bonus will be forfeited for both parents. And that can be expensive, especially if both parents have received more than just the minimum amount.

Moreover, the old legal situation is no different from the current legal situation.

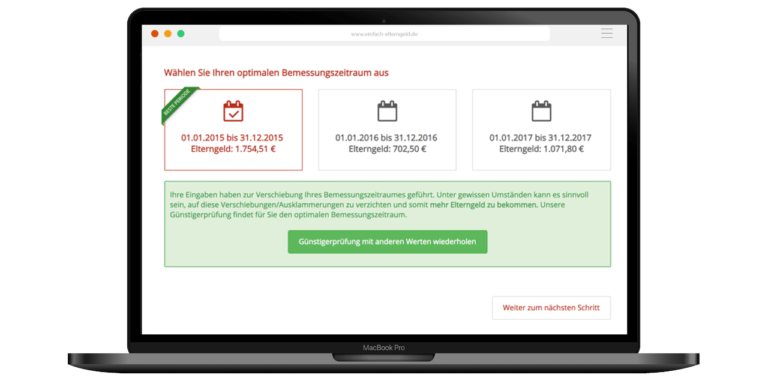

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in