Parental allowance and tax class

The (relatively) prevalent tax class counts in the case of multiple changes

On March 28, 2019, the Federal Social Court (file number: B 10 EG 8/17 R) ruled on which tax class is to be taken into account when determining the fictitious net parental allowance if the tax class was changed more than once in the assessment period.

Granted, this issue does not affect the majority of applicants, but the impact of the decision, if one is affected, is nothing to sneeze at.

In principle, Section 2c (3) Sentence 1 BEEG states that for applicants with non-employed income, the wage tax class to be used in the fictitious parental allowance net calculation is the one that was shown on the salary notification in the last month of the assessment period.

The first exception to this is described in the second sentence of Section 2c (3) BEEG: If the income tax class has changed during the assessment period, the tax class that was primarily decisive shall apply.

Example:

Assessment period = January to December 2022. In January to April, the claimant had wage tax class 4, but from May to December 2022 he had wage tax class 3. Pursuant to Sec. 2c (3) Sentence 2 BEEG, wage tax class 3 is now decisive for determining the fictitious net parental allowance because it was predominantly used as the basis in the assessment period (4 months tax class 4 and in contrast 8 months tax class 3).

Until now, there was a gap in the law, which the Federal Social Court has now filled: Namely, which wage tax class is to be taken into account if there was more than one change in the assessment period.

In the case in dispute, the applicant’s assessment period comprised the calendar months December 2014 to November 2015. During this period, the following tax bracket was used as the basis for her salary notifications:

The mother requested that, due to the regulatory gap in the case of several changes, the tax class that was decisive in the last calendar month, i.e. tax class 3, be taken into account. The judges of the Federal Social Court did not uphold this request and gave the following reasons:

In the case of equal distribution (6 months to 6 months), the income tax class that existed in the last month of the assessment period is also taken into account.

Too complicated? - Our tip

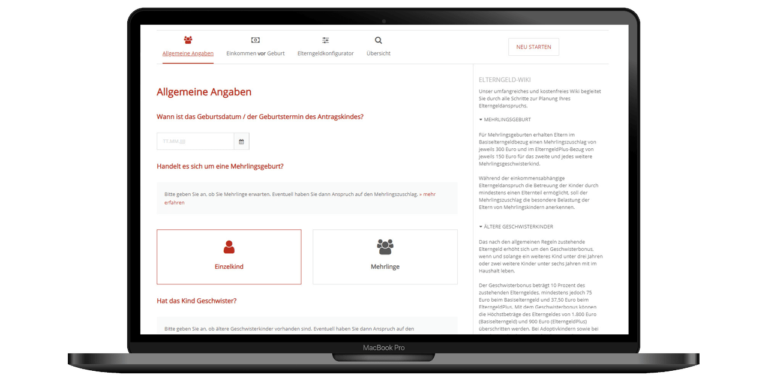

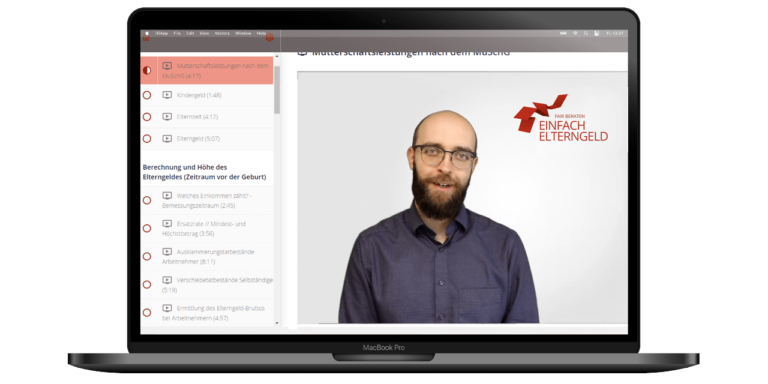

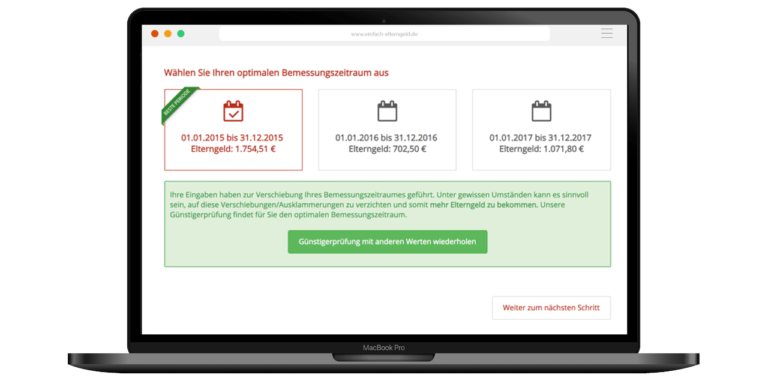

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in