Parental allowance and assessment period

The most important info on the comparison period

Parental allowance is basically a payment in place of wages and salaries. The income of the assessment period determines which remuneration is replaced. The assessment period is a 12-month period prior to the birth of the child, from which not only the income relevant for parental allowance is determined, but also the lump-sum deductions for taxes and social insurance.

Contents

Here are the most important facts about the assessment period:

- Since parental allowance is a payment in place of remuneration, it must be determined which remuneration is being replaced.

- This determination of remuneration is regulated in detail in § 2b BEEG.

- The comparative period under parental allowance law always comprises a 12-month period before the birth of the child

- The assessment period can be postponed due to exclusion and postponement facts

- The assessment period can only be excluded/shifted uniformly for all types of income (principle of congruence of the assessment periods).

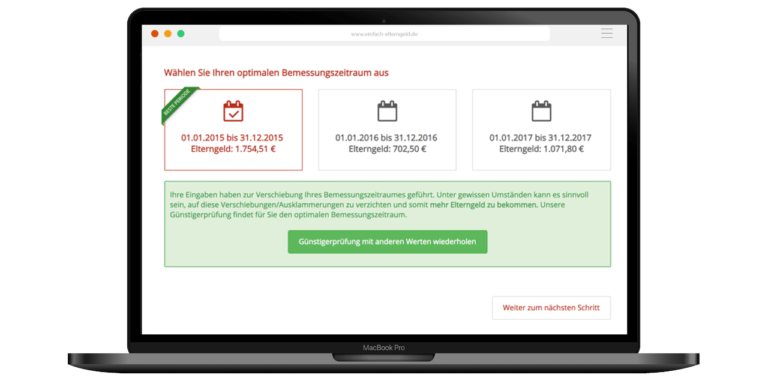

- There are various tests of the most favorable assessment period to determine the best assessment period

General information on the assessment period

Types of income relevant for parental allowance

Although parental allowance law is part of social law, it is linked to tax law to a considerable extent (so-called tax accessoriness). The following procedure always applies when determining the assessment period:

- In principle, the income of the 12-month period before the birth of the child is considered as the comparison period , § 2b para. 1 sentence 1 BEEG.

However, if the person entitled to parental allowance earns income from a self-employed gainful activity, the following applies in derogation thereof

- the income of the last completed calendar year before the birth of the child, § 2b para. 2 sentence 1 BEEG.

Income from self-employment within the meaning of parental allowance law includes the following types of income under income tax law:

-

-

- Income from agriculture and forestry (§ 13 EStG)

- Income from trade (§ 15 EStG)

- Income from self-employment (§ 18 EStG)

-

Types of income that are classified as private asset management (e.g. income from capital assets, § 20 EStG, and income from renting and leasing, § 21 EStG) are excluded from parental allowance. A special feature is other income (§ 22 EStG), which is generally not relevant for parental allowance, unless it is a benefit that replaces remuneration (e.g. pension benefits). Private sales transactions (§ 23 EStG) are also generally excluded.

Notice:

The disposal (sale) of a business or parts of a business can also lead to commercial income within the meaning of Section 15 EStG (cf. Section 16 EStG). The profit from the sale is consequently relevant for parental allowance and should not be realized in the reference period under parental allowance law.

In addition, the same applies to the sale of shares in corporations (Section 17 EStG). In principle, the mere holding of shares does not generate commercial income, whereas the sale of such shares does.

Note for parents with a secondary self-employed activity:

Parents are considered self-employed under parental allowance law even if they are self-employed only “on the side” or on a small scale. This means that the most recently completed calendar year is then generally considered the assessment period. This is a disadvantage for many employees.

However, the legislator has introduced a test of the most favorable assessment period for parents of children born after 01.09.2021, which makes it possible, in the case of minor self-employed income, to be treated as an employee only. You can find out more about this in the test of the most favorable assessment period in this article.

Example:

The father is employed and his child is born on June 13, 2022. The assessment period covers the calendar months June 2021 to May 2022 inclusive (12-month period before birth).

Example self-employment:

The mother is a self-employed person and thus generates income within the meaning of Section 15 of the German Income Tax Act (EStG). Her child is born on 13.06.2022. The assessment period comprises the calendar months January 2021 up to and including December 2021 (last completed calendar year).

Exclusion and deferral facts

In the assessment period determined by the aforementioned principles, personal life situations may have resulted in an “unjustifiably” lower parental allowance than one is actually entitled to when income from these months is strictly taken into account.

The legislator has also recognized this and has included an exhaustive list of so-called exclusion and deferral cases in § 2b (1) sentences 2 and 4 BEEG.

The exclusion and postponement criteria mean that calendar months are not taken into account when calculating parental allowance if taking them into account would lead to a worse parental allowance result.

It can therefore be very worthwhile to check carefully whether or not such facts exist in order to optimize the amount of parental allowance.

Instructions for applying for parental allowance:

If you are affected by exclusion and deferral facts, the following applies:

Generally, exclusions for salaried employees (other than Covid-19 exclusions) are to be considered automatically and do not require a separate application.

The situation is different for self-employed persons: In order to obtain a postponement, the self-employed must apply separately for a postponement of the assessment period together with the application for parental allowance.

The deferral due to corona-related loss of income, on the other hand, must be applied for separately in each case and is not taken into account automatically.

Receipt of parental allowance in the assessment period

In principle, calendar months in which the person entitled to parental allowance received parental allowance for an older sibling can be excluded, i.e. left out of the calculation of parental allowance for the “current” child, Section 2b (1) sentence 2 no. 1 BEEG.

However, calendar months in which you received parental allowance plus from month of life 15 onwards cannot be excluded.

An exception applies for basic parental allowance months up to the 18th month of life of the older child (premature infant regulation; for more information, see “3. basic parental allowance according to LM 14”.

Example:

A father received parental allowance for his child born on 04/14/2021 in months 13 and 14 of life. This means that he received parental allowance in the period from 04/14/2022 to 06/13/2022 inclusive.

His second child was born on November 28, 2022. The assessment period of the second child basically comprises the calendar months November 2021 up to and including October 2022. The calendar months April 2022 up to June 2022 can be disregarded due to the receipt of parental allowance.

The assessment period therefore comprises the calendar months August 2021 to March 2022 and July 2022 to October 2022.

Unfortunately, there are currently various legal uncertainties regarding this exclusion, which we explain below:

1. Can parental allowance plus months also be excluded?

The wording of the law refers to “periods during which parental allowance was received in accordance with section 4(1) sentences 2 and 3”. However, parental allowance plus month is only legally defined in sentence 3. For this reason, commentators on the Parental Allowance Act sometimes assume that only months with basic parental allowance can be excluded (see Dr. Michael Schnell (presiding judge at the Saxony State Social Court in Chemnitz) in “Bundeselterngeld- und Elternzeitgesetz”, commentary, 3rd edition 2021, on § 2b, marginal no. 7).

In contrast, it can be argued that sentence 2 refers to both basic parental allowance and parental allowance plus month (reference to § 4 para. 1 sentence 1).

The official guidelines of the Federal Ministry for Family Affairs on § 2b clarify that the specific type of reference is irrelevant for the exclusion:

“When determining the assessment period, calendar months shall not be taken into account for the parental allowance in which, for an older child in the period of § 4 para. 1 sentence 2 […] Basic parental allowance or parental allowance plus was obtained.” (Guideline 2b.1.2.1 on Section 2b (1) Sentence 2 No. 1 BEEG).

The ambiguity results from the fact that the legislator removed the reference to Section 4 (1) Sentence 1 BEEG (reference to both types of reference) from the law during the last reform (2021). When § 2b para. 1 sentence 2 no. 1 BEEG was originally introduced, the legislator wrote the following in the explanatory memorandum to the law:

“The amendment in number 1 is a consequential amendment to the introduction of parental allowance plus. Accordingly, the Determination of the assessment period for parental allowance does not take into account calendar months in which a older child in the period of § 4 paragraph 1 sentence 1 parental allowance as defined in § 4 paragraph 2 sentence 2 (basic parental allowance) or parental allowance plus was obtained in accordance with § 4 (3).” (BT-Drucks. 18/2583 page 24).

Due to this legal uncertainty, parents must expect that calendar months with parental allowance plus months will not be excluded by the parental allowance office. In this case, those affected should take legal action and hope that the judges will take the original legislative intent into account instead of judging strictly according to the wording of the law.

Parents who have predominantly received parental allowance plus month and are expecting another child would be particularly affected. If necessary, they should check whether a retroactive conversion to basic parental allowance could make sense. However, this is certainly not the case for parents who receive parental allowance with additional earnings.

2. Can parental allowance months with additional earnings (“gainful employment”) also be excluded?

The wording of the law refers to “periods during which parental allowance was received in accordance with section 4(1) sentences 2 and 3”. It therefore does not matter whether parental allowance with or without additional earnings was received during these periods.

However, we are aware of cases from administrative practice in which the parental allowance office does not want to exclude these parental allowance months. However, there is no legal basis for this legal interpretation. The official parental allowance guidelines also do not permit such a legal interpretation.

Tip:

Those affected should file an objection against a corresponding parental allowance notice and, if necessary, consider taking legal action in the social courts.

3. Can basic parental allowance months also be excluded under LM 14?

The text of the law explicitly allows the exclusion of months in which

“the entitled person has received parental allowance for an older child in accordance with section 4(5) sentence 3 no. 2 BEEG.” (Section 2b (1) sentence 2 no. 1 second alt. BEEG)

Since the reference to Section 4 (5) sentence 3 number 2 is too vague, the standard must be interpreted according to its meaning and purpose. The official guidelines to the Parental Allowance Act interpret the point as follows:

• If the older child was born at least 6 weeks before the calculated date, up to his or her 15th month of life, all calendar months in which parental allowance was claimed are excluded;

• if it was born at least 8 weeks before the calculated date, until 16 months of life;

• if it was born at least 12 weeks before the calculated date, until 17 months of life;

• if it was born at least 16 weeks before the calculated date, until 18 months of life.

The exclusion applies to assessment periods for the younger child born after September 1, 2021, if the older child was a premature child within the meaning of section 4(5). It does not matter that the older child was also born after September 1, 2021. (Guideline 2b.1.2.1 on § 2b para. 1 sentence 2 no. 1 BEEG).

Tip:

If your parental allowance office has a different legal opinion, you should file an appeal against the decision and, if necessary, consider taking legal action in the social courts.

Want to optimize your parental allowance for the second/next child?

We have a comprehensive knowledge article on this very topic “Parental allowance for the second child” which contains important tips and information for you.

Maternity leave payment received in the assessment period

Calendar months in which the mother has taken advantage of protection periods in accordance with § 3 of the Maternity Protection Act (MuSchG) can be excluded from the assessment period, as can months with or without Maternity leave payment received (statutory or privately insured employees).

Example:

The child was born on August 22, 2022. The employed mother went on maternity leave on July 11, 2022 and received the Maternity leave payment of the health insurance fund and the employer’s contribution to maternity leave payment.

The assessment period covers the 12 months prior to the start of maternity leave, i.e. July 2021 to June 2022 inclusive.

Info for female civil servants, soldiers and judges:

During the prenatal employment prohibitions due to the protection periods, you will receive full remuneration for the entire period in accordance with the relevant provisions of civil service and military law. The reason for the exclusion (less income relevant to parental allowance) therefore no longer applies, which is why there is no exclusion here.

Maternity leave payment received for older siblings is also excludable:

The exclusion criterion can also be fulfilled in the case of a pregnancy with an older child who does not trigger entitlement to parental allowance. Proof can be provided in the form of a certificate from the health insurance fund confirming the maternity leave payment received at the time (Guideline 2b.1.2.2 on § 2b para. 1 sentence 2 no. 2 BEEG).

Info for self-employed:

Self-employed persons are not subject to the protection periods of the Maternity Protection Act because it only applies to employees. Nevertheless, self-employed persons may be entitled to maternity leave payments that are subject to postponement (e.g. self-employed persons who are members of the statutory health insurance scheme pursuant to Section 9 SBG V and receive maternity leave payment pursuant to Section 24i (2) sentence 7 SGB V).

If in doubt, check with your health insurance provider.

Loss of income due to pregnancy-related illness

Calendar months in which the mother suffered loss of income due to a pregnancy-related illness can be excluded upon request. Two conditions must be met for this:

1. Loss of income

The income relevant to the parental allowance must be lower in the relevant month than in the month that is added as a result.

2. pregnancy-related disease

The connection with the pregnancy must be proven by a medical certificate/certificate of incapacity for work (the connection must be recognizable from the diagnosis code on the certificate.

Note for employed mothers:

As a rule, employed mothers are excluded from this exclusion because, as a rule, there is either no loss of income due to the continued payment of wages in the event of illness for up to 6 weeks or because the mother goes directly into an individual employment prohibition and receives full (parental allowance-relevant) maternity leave payment during this time.

These months cannot (and need not) be excluded.

Tip:

The causality with a pregnancy-related illness does not necessarily have to be related to the current pregnancy, so there can also be a pregnancy-related illness with loss of income if there was incapacity to work in the assessment period because of depression due to a previous miscarriage, cf. in this regard Federal Social Court judgment dated March 16, 2017 – B 10 EG 9/15 R.

Moreover, not only pregnancy-related new illnesses but also pregnancy-related exacerbation of an illness that already existed before pregnancy are covered by the standard (see also Hessisches Landessozialgericht, judgment of February 15, 2012, L 6 EG 18/10).

Loss of income due to compulsory military or alternative service

Anyone who suffered a loss of income during the assessment period due to compulsory military or alternative service may exclude the corresponding months.

Tip:

Compulsory military or alternative service was already abolished by law in 2011. In this respect, this exclusion de facto plays no role in current administrative practice.

Loss of income due to the corona crisis

The corona crisis ultimately affected everyone in Germany in some way. The legislature decided early on that parents who suffered income losses due to the Covid 19 pandemic should not be disadvantaged in terms of parental allowance. The official parental allowance guidelines (RL 2b.1.4 to § 2b para. 1 sentence 4 BEEG) state the following:

Under the fourth sentence of section 2b(1), an eligible individual may, upon request, exclude calendar months if he or she had a loss of income due to the Covid 19 pandemic during the period from March 1, 2020, through December 31, 2021. The provision is to be interpreted broadly. Loss of income due to the Covid 19 pandemic may be due to, for example, short-time work, time off, unemployment, illness of the eligible individual or a child in need of care who is a member of the household, or closure of the trade or business being carried on.

Reductions in income due to the Covid 19 pandemic also include indirect changes in the income situation, such as reduction of working hours, interruption or non-resumption of employment in favor of childcare or care for a dependent person, if this cannot be ensured in any other way. This also includes periods of receipt of compensation for loss of earnings under the Infection Protection Act and extended children’s sick days if daycare centers and schools are closed due to the pandemic or care is restricted. Only individual calendar months can also be excluded.

The eligible person must provide credible evidence of the loss of income due to the Covid 19 pandemic. Suitable documents for this purpose include certificates, instructions or orders from the employer and – in the case of self-employed persons – a comparison with the previous year’s tax assessment.

Causality between loss of income and the pandemic can also be made plausible by presenting, for example, orders from public health departments to close certain businesses or facilities, or by presenting notices, for example, that unemployment compensation will not be received until March 1, 2020, or later.

If parents are unable to provide concrete evidence in individual cases (e.g. employer’s certificate), prima facie evidence is sufficient. A simple statement may be sufficient to establish credibility if it is suitable to justify the conviction of the probability of the facts that have been made credible. If the applicant’s statement is obvious according to general life experience and there is no reason to doubt the probability of the facts presented, it may not be necessary to obtain further evidence (cf. Stelkens/Bonk/Sachs, Verwaltungsverfahrensgesetz, 9th edition 2018, Section 32 marginal no. 40).

In the case of income reduction for the benefit of childcare, written proof from the daycare center or school of the closure or limited operation is sufficient.

Note from the practice:

The guidelines sound almost too good to be true. We experience in particular that in non-standard cases such as short-time work or a lower profit for the self-employed, the parental allowance office does not want to grant the exclusion and parents are formally “forced” to object or to file a lawsuit.

In these cases, the parental allowance due is paid considerably later due to the long duration of the proceedings, which makes a very bad impression in the context of the Corona crisis and the already financially strained situation associated with it.

Notice:

Currently, only calendar months between 03/01/2020 and 09/23/2022 are excludable.

Test of the most favorable assessment period

Notice:

In principle, the exclusions for salaried employees (apart from the Covid-19 exclusions) are to be taken into account automatically and do not require a separate application.

The situation is different for self-employed persons: These must, in order to obtain a postponement, apply separately for the postponement of the assessment period with the parental allowance application.

The postponement due to corona-related loss of income, on the other hand, must be applied for separately in every case and is not taken into account automatically.

Due to the above-mentioned facts, parents can therefore postpone, stretch, split, etc. the parental allowance comparison period under certain circumstances.

However, an exclusion, or postponement is unfortunately not always useful, because due to the complexity of the various calculation parameters in the parental allowance calculation, it is also possible to achieve a better parental allowance result by waiving all or fewer exclusions/ postponements.

Therefore, the best result is to be determined by a test of the most favorable assessment period. The parental allowance law provides for 2 tests:

1. Test of the most favorable assessment period | waiver of exclusion

Since not only the parental allowance-relevant gross income of the assessment period plays a supporting role in the parental allowance calculation, but also the flat-rate tax and social security deductions, there may be cases in which, despite a higher parental allowance-relevant gross income due to the exclusion, a better parental allowance result would be achieved if the exclusion/deferral is waived.

Example:

The mother gives birth to her child on August 22, 2022. Maternity leave began on July 11, 2022. Maternity leave payment received in July 2022 is the only exclusion event, which is why the assessment period includes the income of the calendar months July 2021 to June 2022 inclusive.

Now, in February 2022, the applicant has changed her tax class from 5 to 3. This means that tax class 3, which is favorable for the mother, counts for the maternity allowance calculation without any problems. However, the situation is different for parental allowance.

Due to the change of tax class in the assessment period, the predominant tax class is to be determined according to the relative majority ratio. In the assessment period, tax class 5 was present in 7 out of 12 months and tax class 3 in only 5 out of 12 months. As a result, tax class 5, which is unfavorable for the mother, counts, resulting in lower parental allowance.

It can only make use of the exclusion waiver test of the most favorable assessment period by formally waiving the exclusion of the calendar month July 2022 in the context of the parental allowance application in accordance with section 2b (1) sentence 3 BEEG. As a result, the assessment period includes the calendar months August 2022 up to and including July 2022.

Now, in the assessment period, tax class 5 existed in 6 out of 12 months and tax class 3 in 6 out of 12 months. In the event of a tie, the tax class that existed in the last month of the assessment period, i.e. tax class 3, which is more favorable for the mother, will again count.

The parental allowance is very likely to be higher due to the exclusion waiver, even though she had lower gross income relevant to the parental allowance in July 2022 than in July 2021 due to the tax-free Maternity leave payment received.

Notice:

Always check if you are affected by exclusions/deferrals to see if you can get parental allowance that is more favorable to you by waiving the exclusion/deferral, if applicable.

Our Parental allowance software naturally also includes the exclusion waiver test of the most favorable assessment period, so that you really achieve the best parental allowance result for you.

Attention:

The exclusion waiver test of the most favorable assessment period can only be claimed by salaried employees if their child was born on or after 01.09.2021. Unfortunately, parents of children born before 01.09.2021 cannot use this test of the most favorable assessment period.

2. Test of the most favorable assessment period | employees with (marginal) self-employed activity

Salaried parents, if they earn a “small amount” of part-time income from self-employment, can choose whether to be treated as solely salaried or self-employed for purposes of calculating parental allowance.

The following conditions must be met for this test:

- The income (= profit) from self-employment, business or agriculture and forestry in the calendar year before birth and

- in the calendar months of the year of birth up to the birth

not more than 35€ per month (average, that is 410€ per calendar year).

Example:

Birth on 08.10.2022 – mother is employed and self-employed.

Normally, her assessment period would be the calendar year 2021 (postponed to the last completed tax assessment period due to self-employment). Now the profit from self-employment in 2021 was “only” 400€ and in the period January to September 2022 “only” 200€.

The mother can now choose whether the assessment period should include the income of the calendar year 2021 (January to December 2021) or the 12-month period before the start of maternity leave, or before the birth (i.e. October 2021 to September 2022).

If she chooses the former, the employee income from January to December 2021 and the profit of 400€ will count in the parental allowance calculation. However, if she chooses the 12-month period before birth, only her employee income counts. The self-employed income is then excluded (but not in the reference period).

The parents concerned should therefore in any case check which variant entails the higher parental allowance.

Attention:

The test of the most favorable assessment period for employees with minor self-employed income can only be claimed by parents whose child was born on or after 01.09.2021. Unfortunately, parents of children born before 01.09.2021 cannot use this test.

In our comprehensive article on the Parental allowance reform 2021 we explain this test in more detail.

FAQ

-

What are the 12 months for parental allowance?

-

Which assessment period counts for me?

-

What counts in the calculation of parental allowance?

-

What are exclusion and deferral facts in parental allowance?

You might also be interested in