Apply for child benefit - information and guidance on applying for child benefit.

You would like to apply for child benefit for your child? We inform you about everything you need to know when applying for child benefit! You will learn from us who is entitled to child benefit and how to successfully apply for it. Einfach Elterngeld provides you with free samples and templates for your child benefit application. We also provide you with information on where to apply for child benefit and what the child benefit procedure looks like.

Einfach Elterngeld answers your questions about child support!

We offer a comprehensive guide, checklists, forms and samples, as well as software, free calculators and videos.

Contents

The most important facts at a glance

- In principle, parents who are responsible for the regular maintenance of their minor child and live with the child in a common household in Germany are entitled to child benefit.

- Child benefit can also be claimed for children between the ages of 18 and 25 – in this case, further requirements must be met

- Other groups of people are also entitled to child benefit if the relevant evidence is provided (e.g. people from abroad)

- Child benefit is paid retroactively for a maximum of 6 months

- Child benefit is applied for at the child benefit department (employment agency) or office/employer (public service)

- Child benefit can now also be applied for via the ELSTER certificate (online tax office)

- The application for child benefit must be made in writing and no fees are charged

- Child benefit represents tax support for families (it is not a social benefit)

Requirements: Who is entitled to child benefit?

In the following, we will explain which requirements must be met in order to be entitled to child benefit and which regulations apply to different groups of people.

Requirements for parents

As a parent, you can claim child benefit if you are responsible for the regular care of your child, he or she lives in your household and is not yet of age. In addition, your place of residence must be in Germany, the EU, Norway, Iceland, Liechtenstein or Switzerland.

Requirements for children

Children receive child benefits until their 18th birthday. In exceptional cases also until the 25th birthday.

Child under 18 years (minor)

You can claim child benefit for your minor child if the child lives with you in a household and the place of residence is in Germany, a country of the EU, Norway, Iceland, Liechtenstein or Switzerland. In addition, you must be responsible for the regular maintenance of the child. If no parent is responsible for the regular maintenance of the child, the child benefit can also be paid directly to the child, other persons or authorities. In this case, a “application for payment of child benefit to the applicant, other persons or authorities” (Abzweigungsantrag) is necessary.

Child over 18 years (adult)

Under certain conditions, child benefits are also paid after the 18th birthday until the 25th birthday. Young adults are entitled to child benefits after the age of 18 if they are undergoing vocational or school training or studying for the first time. Child benefits can also be received during a second apprenticeship with part-time work of up to 20 hours per week or an additional mini-job. Child benefits can also be paid during “transitional periods” (e.g. between leaving school and starting training or studies). However, the transition period may not last longer than 4 months. They also receive child benefits between the ages of 18 and 25 if they complete an internship in the intended field or do voluntary service. If they are younger than 21 and have not obtained an apprenticeship, they may continue to receive child benefits. In this case, they must provide proof that they are trying to find a training position and be registered as a jobseeker with the employment agency or job center.

Stepchildren, grandchildren, foster children

You can claim child benefit for your stepchild, grandchild or foster child if they are under the age of majority. Between the ages of 18 and 25, exemptions apply. In addition, the child must live in your household and you must be responsible for the regular maintenance and care of the child. You can only claim child benefit for your stepchild, grandchild or foster child if your place of residence is in Germany, the EU, Norway, Liechtenstein, Iceland or Switzerland.

Child benefit for people in or from abroad

If you have German citizenship and are subject to unlimited tax liability in Germany, you can claim child benefit. You are also entitled to child benefit if you have German citizenship and are employed with limited tax liability but subject to social security contributions. With a foreign citizenship, you are entitled to child benefits if you are a citizen of the EU, EEA (European Economic Area) or Switzerland. You may also be entitled to child benefit if you are a citizen of Algeria, Bosnia-Herzegovina, Kosovo, Morocco, Montenegro, Serbia, Tunisia or Turkey. In addition, you must be employed in Germany subject to social insurance contributions or receive unemployment payments or sickness payments. You can also provide proof of a valid settlement or residence permit with a work permit. People who belong to one of the unappealably recognized refugee groups or asylum seekers can also apply for child benefit. For cross-border cases, you must provide additional proofs.

What applies to single parents?

Single parents receive the child benefit paid in full for the support of your child, as you provide e.g. accommodation, food and clothing. As a prerequisite for single parents, the child must live in the same household and your place of residence must be in Germany, the EU, Switzerland, Norway, Iceland or Liechtenstein.

Children with disabilities

Children with disabilities are also entitled to child benefit. This is provided that the disability occurred before the 25th birthday. If the child was born up to and including 1981, the disability must have arisen before the age of 27. If you want to apply for child benefit for a child with a disability, another requirement is to prove that the child’s financial resources are not sufficient for living expenses. This condition must have the disability as a reason. As proof, the letter “H” is entered in the severely disabled person’s ID card. To apply for child benefits for mentally or physically disabled children, you can submit the following documents as proof in addition to the severely disabled ID card: Determination notice from the pension office, pension notice, care allowance notice, and a medical certificate. For children over the age of 25, it must be mentioned how long the disability has existed.

Applying for child benefit: instructions and tips

Below we provide tips for applying for child benefit for your family.

Step 1

Download, print and fill out forms or fill out and print forms online

Step 2

Sign child benefit application and attach documentation (e.g. birth certificate).

Step 3

Send completed application with supporting documents by registered mail to the child benefit department or office

When do I have to apply for child benefit?

Child benefit application at birth

You can apply for child benefit at the child benefit department from the day of childbirth. You can also apply earlier, but you must submit your child’s birth certificate at a later date. Child benefit can also be paid retroactively for 6 months. Please note here that the actual payment can be significantly delayed due to the processing time.

Apply for child benefit for children over 18 years old

For children between the ages of 18 and 25, there is no set time for applying for child benefit. If child benefit is to be claimed for children who have already reached the age of majority and the requirements for this are met, you can submit the child benefit application and the necessary supporting documents in writing or online.

Note:

Your child’s eleven-digit tax identification number is required for a successful child benefit application. This will be automatically assigned to your child about 2-3 weeks after the birth certificate is issued (recorded in the population register) and sent by mail from the Federal Central Office.

If you have lost or not received the letter, or for whatever reason do not know the tax ID, you can request it again here: Request tax ID from BZSt.

Who should apply for child benefit?

Parents who apply for child benefit after the birth of their child will initially receive child benefit. The child itself is generally not entitled to receive the payment.

Since it is a tax incentive in income tax, the tax office automatically checks whether the child allowance is more worthwhile for the parents. A child allowance is not paid out like child benefit, but is taken into account in the income tax assessment. As a result, parents pay less tax. A child allowance often only has a better effect than the child benefit paid for parents with an above-average gross income. This favorability test is also called family benefit equalization, § 32 EStG.

Child benefit is usually paid to only one parent. If the parents live together, it does not matter whether the mother or father applies for and receives the child benefit.

An exception applies to parents with so-called paying children (children for whom one already receives child benefit). For example, you can choose the parent for whom the child benefit is higher because older children from a previous relationship are to be taken into account. This also works if one of you is not a natural parent, but you are married or live in a registered civil partnership. For this, there is the so-called beneficiary provision.

If you cannot agree on who gets the child benefit, then you can ask the family court to decide who gets the child benefit.

How to apply for child benefit?

After deciding to apply for child benefit for your child, you must first determine your responsible child benefit department via your employment agency. If you work in the public sector, your employer may be responsible for the child benefit application (in some federal states, however, this responsibility has already been returned to the Federal Agency).

If you have all the requirements to claim child benefit, you can complete the child benefit application and all relevant attachments by hand or online. Attach the supporting documents appropriate to your situation to your application and sign the child benefit application. Send your completed child benefit application to the appropriate office. If your child benefit application is approved, you will receive the amount paid monthly to your account.

Alternatively, parents can now also apply for child benefit via the ELSTER certificate (online tax office). This digital application also no longer requires a paper signature.

What documents are needed?

Here we inform you about the documents that must be submitted in addition to the completed child benefit application to the child benefit department of the employment agency or your office.

You must submit these proofs and certificates for children up to 18 years old:

- Tax identification number of the requesting parent

- Tax identification number of the child

- Birth certificate of the child with the purpose “To apply for child benefit” (in principle, however, no longer required since the beginning of 2019)

- If applicable, proof of child relationship between child and applicant or household registration certificate

You must submit these proofs and certificates for children from 18 to 25 years old:

- Proof that the child is registered as unemployed or seeking work (employment agency, job center).

- School, training or study certificate (e.g. matriculation certificate)

- If the child is disabled: Disability certificate, pension certificate or assessment notice from the pension office.

The most important tips for applying for child benefit

We explain what to look for when applying for child benefit for your child.

Send the application by registered mail (with advice of receipt, if applicable). In this way, you can prove the date of dispatch in due time and have a receipt for your records.

Prepare the application as far as possible so that you only have to add your child’s tax ID. Then you can send the application promptly.

You can fill out the forms for the child benefit application conveniently on the PC. Afterwards, the application should be printed out and signed without fail.

Tip:

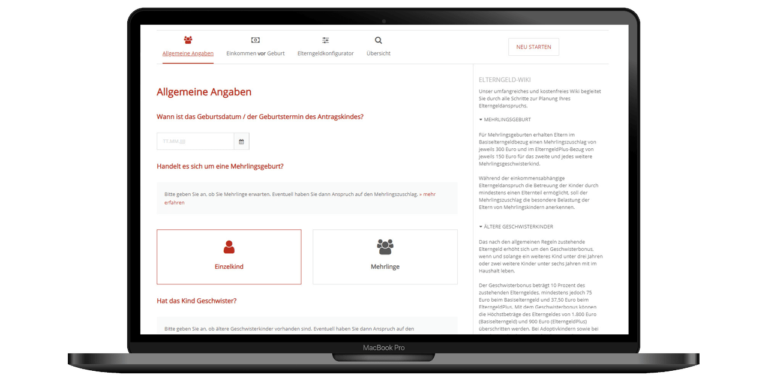

Take advantage of our Parental Allowance Software, then you can also quickly and easily prepare your child benefit application after the birth. You will receive an accompanying letter, where to send the application and which documents to include.

The Federal Employment Agency offers an online service that allows you to submit the application data electronically. However, you still have to print out and sign the application. Only a few parents from Bremen can benefit from the paperless application via ELFE.

These 3 mistakes you should avoid when applying for child benefit

If you are applying for child benefits for your child’s support at the child benefit department or service office, you should avoid the following mistakes:

If you receive child benefit and do not comply with your notification obligations, money may be reclaimed. Inform your child benefit department about changes in your personal situation as soon as possible.

If you submit your child benefit application too late or if documents are missing, processing and payment will be delayed.

However, do not submit the application too early (e.g. before the birth), this will only lead to problems.

If your application is severely delayed, your entitlement to child benefit may be forfeited in retrospect. Child benefits are only paid retroactively for the last 6 months. The application for a child born on 15.07.2022 should therefore be submitted to the child benefit department by 31.12.2022 at the latest.

Child benefit application: official forms

Here you will find all the important forms that you can download and fill in for child benefit. You can also find all templates and forms for applying for child benefit on the website of the Federal employment agency (Agentur für Arbeit).

Tips:

- For each child, you must fill out an application for child benefit as well as the child form.

- If you have more than one child, fill out the application once and attach a child form for each multiple child.

- You can also fill in the forms online, but you cannot send them digitally (except in Bremen).

- The completed forms must be printed out and signed (written form required)

- Personal appearance is not necessary

- The processing time is usually a maximum of 4 weeks, depending on the child benefit department.

Where do I apply for child benefit?

In order to claim child benefit for the support of your child, your application must be received by the correct office. We explain where you can apply for child benefit.

Responsible office: Who should I contact?

If you want to claim child benefit for your child, the Child benefit department of your deployment agency is responsible. You can find out which agency for work is responsible for you by entering your postal code or by looking at your place of residence. We have provided you an overview of all child benefit departments of the individual federal states. Detailed information on the topic Child benefit departments can be found in this article from Einfach Elterngeld.

Parents who are employed in the public sector or receive pension benefits must contact the relevant department to apply for child benefit. In this case, the child benefit department of the employment agency is not responsible. However, some federal states have already returned responsibility to the child benefit departments; if in doubt, ask your personnel administration office.

Tip:

From now on, you can also apply for your child benefit at the child benefit department via the ELSTER certificate (online tax office). This digital application is paperless and requires no signature. You can obtain your digital ELSTER certificate from the tax office.

Child benefit procedure for written application

The written procedure for applying for child benefit is divided into the following 7 points:

- Determine your responsible child benefit department.

- Use the Forms your child benefit department or our Parental Allowance Software to print out and fill in.

- Send the completed and signed child benefit application by registered mail to your responsible child benefit department (Familienkasse).

- After processing the application, the child benefit department will inform you in writing, whether you are entitled to child benefit (child benefit notification).

- After a positive decision on your application, you will receive child benefit in the form of a monthly payment.

- For parents in the public service or in the case of pension payments the respective department or employer is responsible for the child benefit.

- If there are changes in your family situation (e.g., adult child ends education early) that affect child benefits, you must inform the child benefit department immediately.

Child benefit procedure for online application

When you fill out the application digitally to apply for child benefit, the process flow is divided into these 7 steps:

- Find out which child benefit department is responsible for you.

- Follow the instructions on the child benefit department’s website.

- After you have completed and printed your application online, send the signed documents of your child benefit application to the child benefit department.

- You will receive written notification from the child benefit department as to whether you are entitled to child benefit.

- If the decision is positive, you will receive monthly child benefits.

- For parents in the public sector and with existing pension benefits, your department or employer is responsible for processing the application for child benefit; you cannot use the online application from the Federal Employment Agency in this case.

- It is your duty to inform your child benefit department promptly of any changes that may affect your child benefit.

Processing time

The processing time for your child benefit application is usually a maximum of 4 weeks. If you have not received an answer after 6 weeks, we recommend that you contact the child benefit department, e.g. by telephone.

What are the deadlines for child benefit?

For children up to the age of 18, you can claim child benefit from the day of birth. Therefore, apply for child benefit for your child as early as possible at the child benefit department or your office to avoid waiting until the first payment.

Please do not apply for child benefit before the birth.

Attention – observe deadlines:

Child benefit is paid retroactively only for the last 6 months. The application for a child born on 15.07.2022 should therefore be submitted to the child benefit department by 31.12.2022 at the latest.

In the past, the 4-year statute of limitations for assessing income tax applied, but this is no longer the case.

Overview of the fees incurred

There are no fees for applying for child benefit.

Legal basis child benefit

As a basis for child benefit is the Income Tax Act (EStG) and the Federal Child Benefit Act (BKGG). If one parent is entitled to child benefit under the EStG and the second parent would receive child benefit based on the BKGG, the claim under the EStG has priority. We explain below which laws are particularly relevant for child benefit.

The Fiscal Code of Germany (Abgabenordnung, AO)

The Fiscal Code of Germany sets out general regulations and statutory provisions on the subject of tax and tax law. Since the AO contains substantive and procedural requirements for all types of taxes, the Fiscal Code of Germany is also called the “Mantelgesetzt” or “Steuergrundgesetz”. Concrete specifications for calculations are not listed in the AO, but can be found in the respective tax laws.

Income Tax Implementing Regulation (Einkommensteuer-Durchführungsverordnung, EStDV)

The Income Tax Implementing Regulation contains regulations implementing the German Income Tax Act (Einkommensteuergesetz, EStG).

Income Tax Act (Einkommenssteuergesetz, EStG)

The Income Tax Act (EStG) includes the taxation of natural persons. Income tax is levied, for example, as wage tax. The Income Tax Act distinguishes between unlimited and limited taxpayers. For the taxation of legal entities, the Income Tax Act is also used as a basis.

Tax Court Code (Finanzgerichtsordnung, FGO)

The Tax Court Code is a law on the admission and procedure of tax courts. The Tax Court Code is of particular importance for disputes in the area of public law and the execution of administrative acts in tax matters.

FAQ

-

Is it possible to apply for child benefit retroactively?

-

Can the child benefit claim become time-barred?

-

Who can apply for child benefit?

-

Is there an income limit?

-

How is the child benefit paid?

You might also be interested in