Parental allowance - How long is it paid

How long do I get parental allowance and what do I have to consider?

How long do you actually get parental allowance? On this page, we answer questions about the payment duration of parental allowance. We inform you about the parental allowance variations, the duration of payment for basic parental allowance, parental allowance plus and a combination of both. In connection with the payment duration, we also talk about partner months, free division, single parents, simultaneous receipt of parental allowance, and the duration of payment for twins and preemies.

The most important facts at a glance

- You can receive parental allowance from the birth of the child at the earliest

- The monthly payment is based on the principle of “months of life” (not calendar months)

- The duration of payment depends on the parental allowance variant selected or the combination of variants

- Parental allowancePlus doubles the duration of payment

- Parental allowancePlus corresponds to half of the basic parental allowance (without part-time employment)

- Parents are free to divide the monthly payments between themselves (however, they must apply for at least 2 months, but may apply for a maximum of 12 months).

- Single parents are not disadvantaged, as they can also claim partner and partnership bonus months

- Parents of children born prematurely may receive extra months

- No extended parental allowance for multiples, but Multiple birth bonus possible

Contents

Overview of parental allowance variations and duration of payment

Generally speaking:

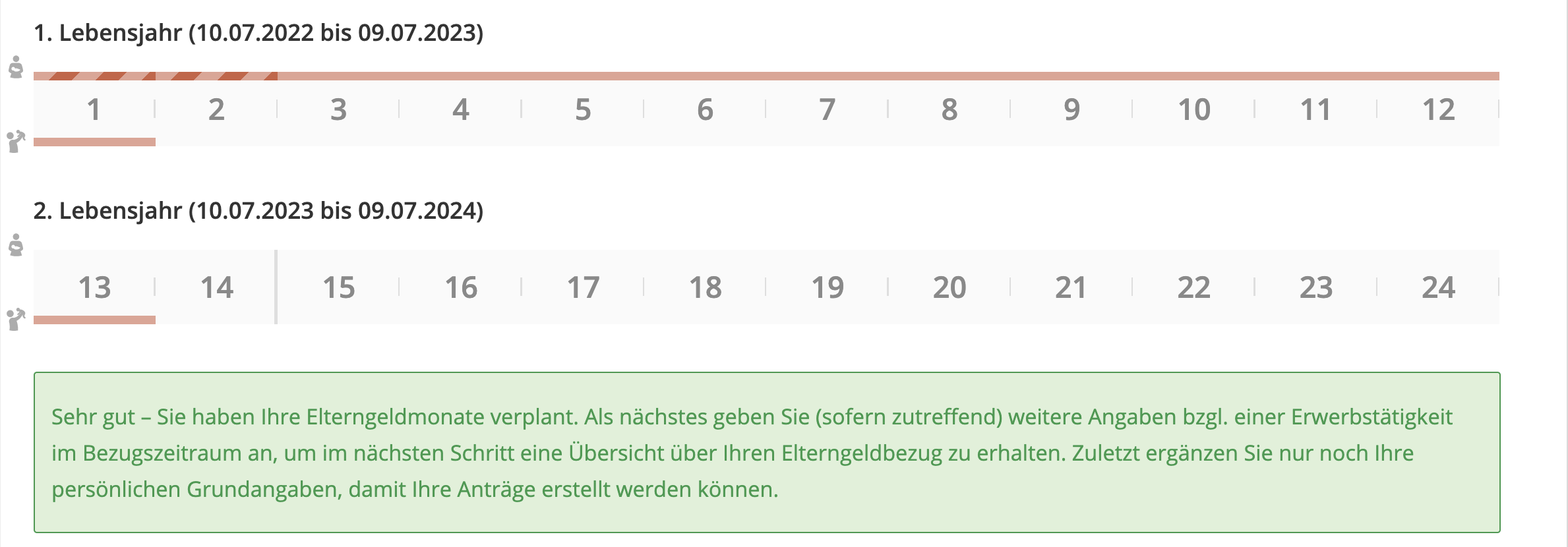

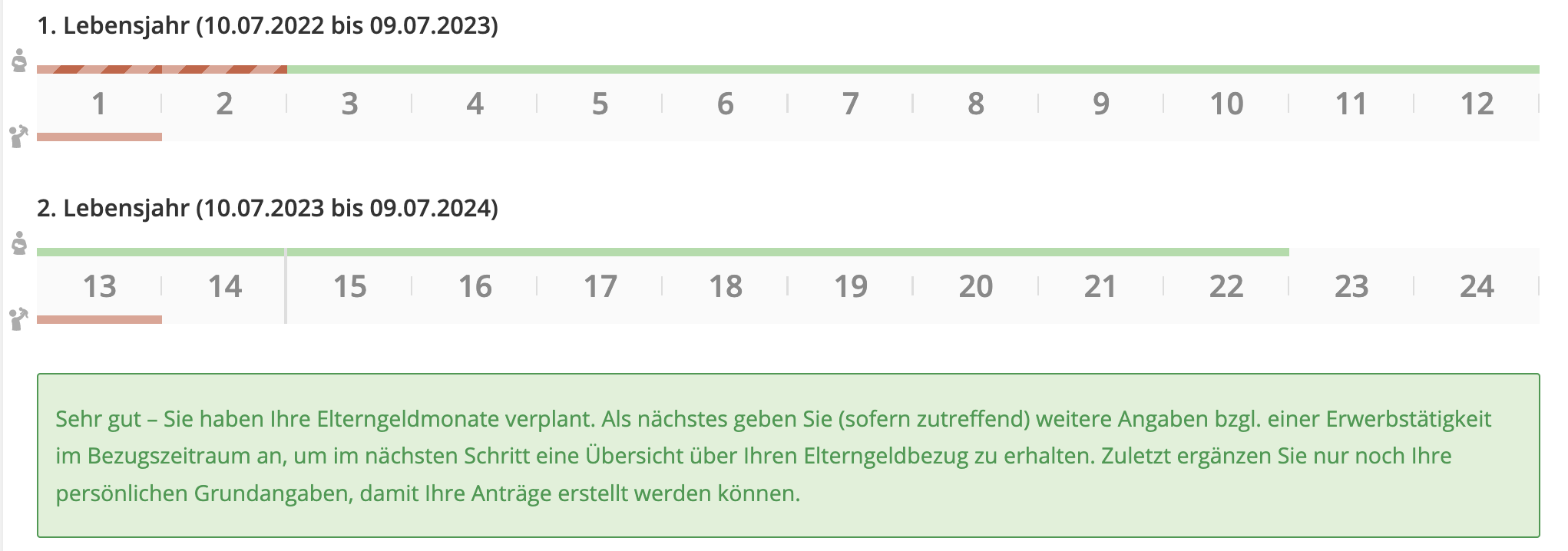

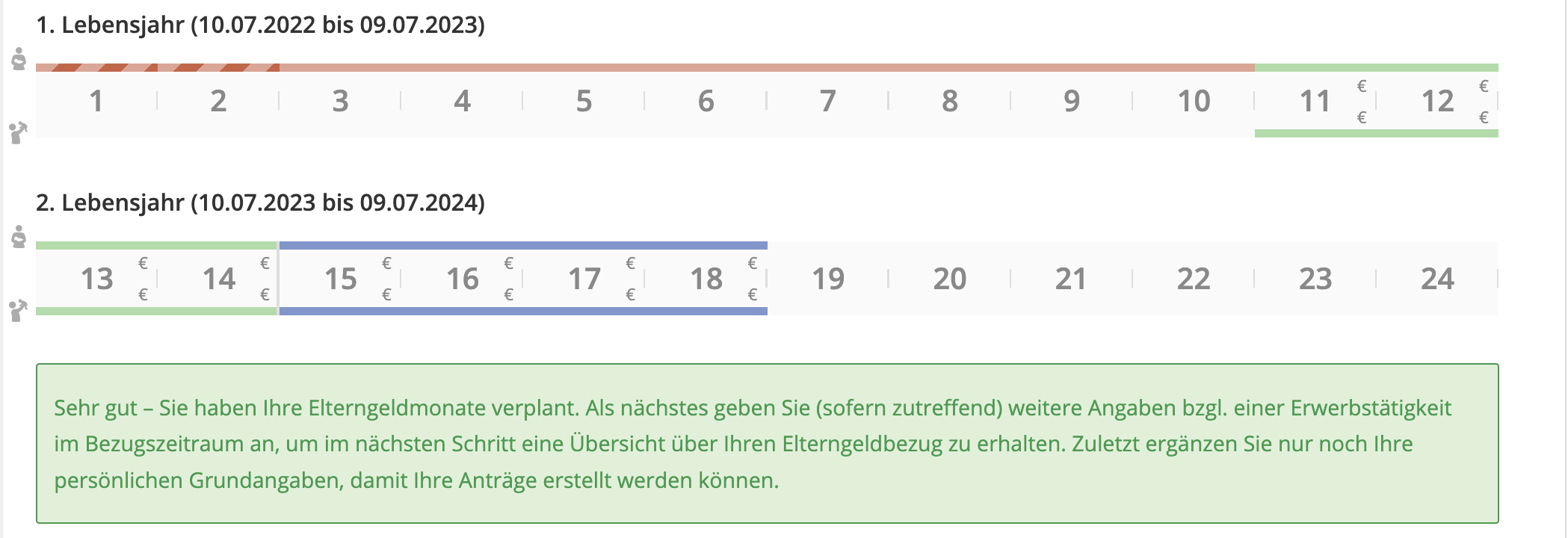

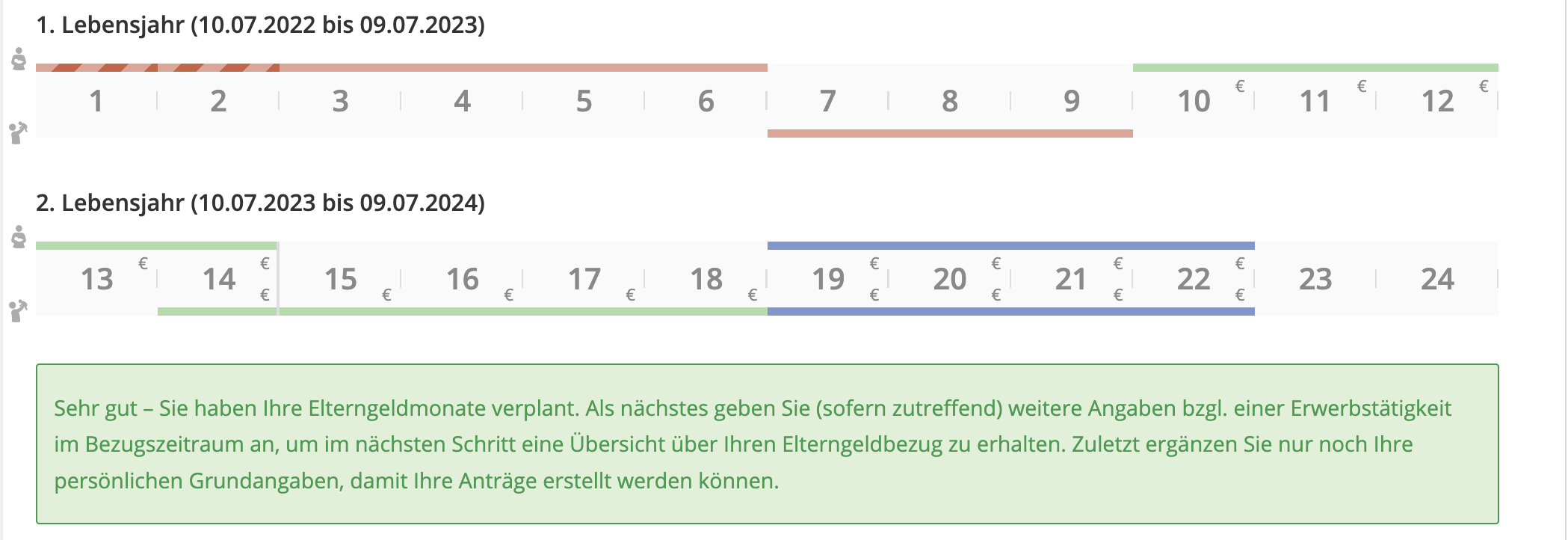

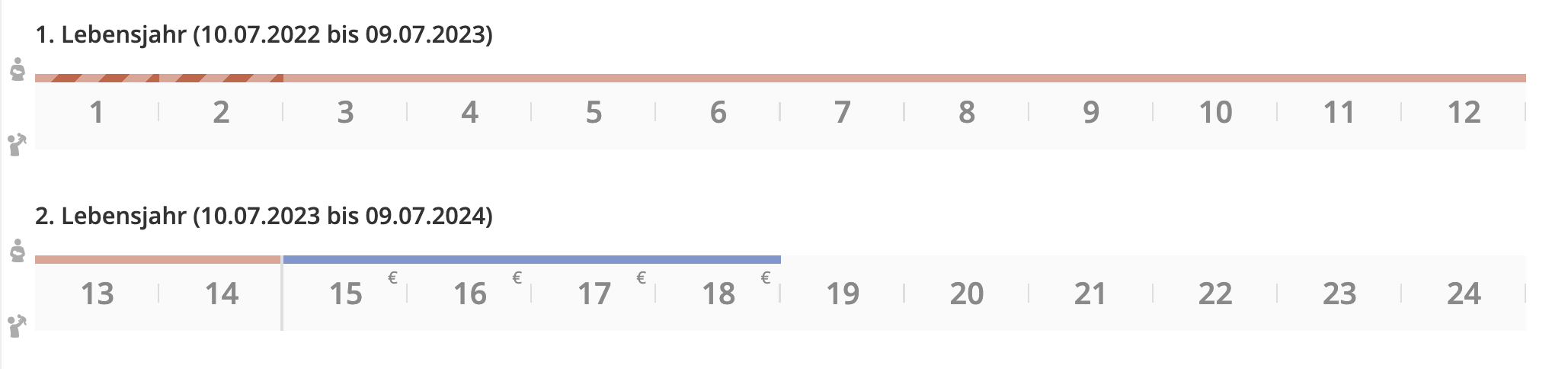

Parental allowance can be drawn from the birth of your child at the earliest. Payment is based on the principle of “months of life” and is not paid according to calendar months. For example, if your child is born on July 10, 2022, you will receive the first parental allowance payment for the first month of life from July 10, 2022 to August 09, 2022.

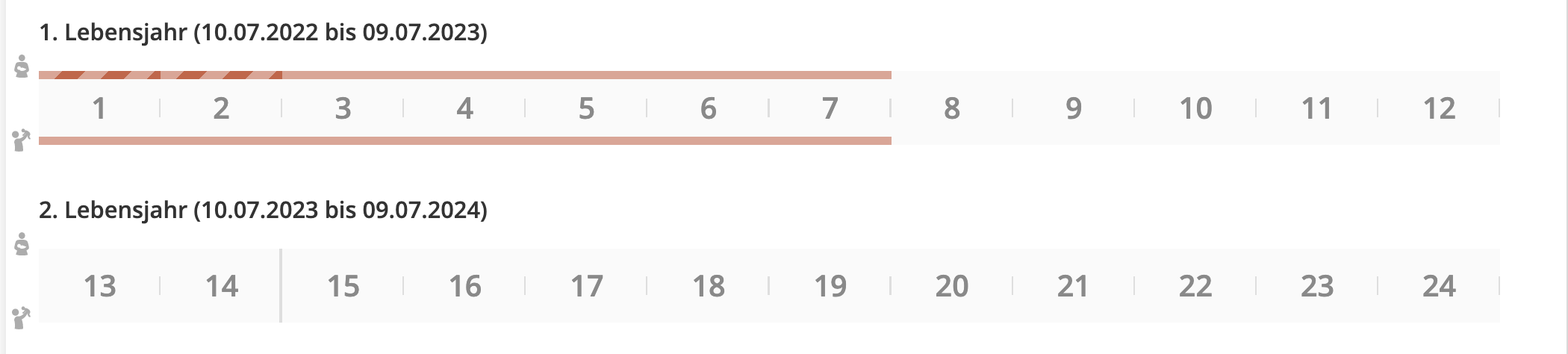

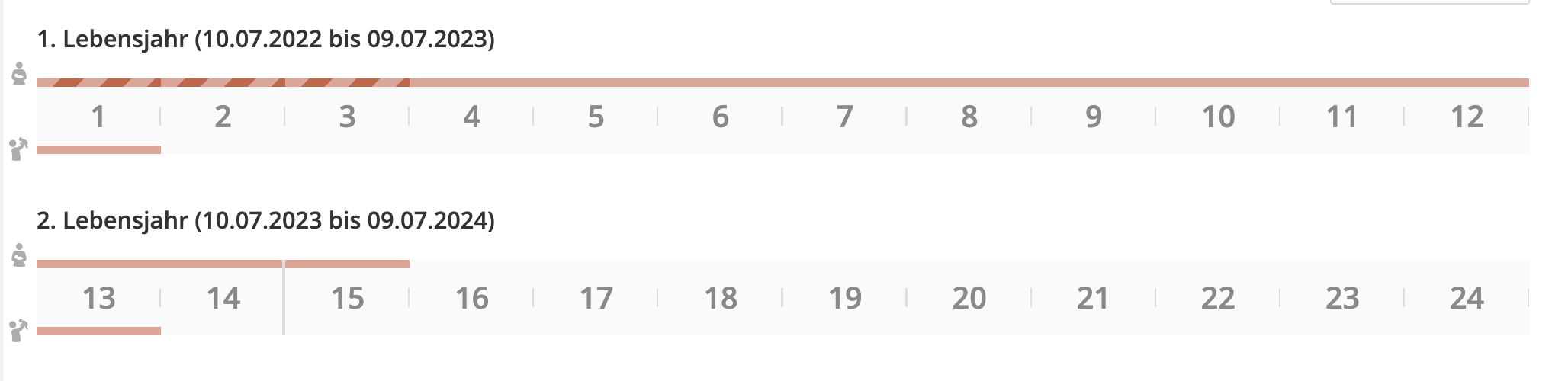

How long you can claim parental allowance depends on the variant of how you want to receive parental allowance. Parents can choose between basic parental allowance, parental allowancePlus, a combination of both, and the partnership bonus. Parents are entitled to a maximum of 14 monthly payments of parental allowance up to the child’s 14th month of life. The prerequisite for this is that the second parent applies for at least 2 months of parental allowance (so-called partner months), otherwise a maximum of 12 months is available.

With basic parental allowance, you receive up to 14 months of parental allowance

If you opt for basic parental allowance, you can receive parental allowance for a period of up to 12 months. If both parents opt for parental allowance and at least one parent receives less income after the birth than compared to the income before the birth, basic parental allowance is even possible for a period of 14 months. These two additional months are called partner months.

With parental allowancePlus you receive up to 24 months of parental allowance

Parental allowancePlus is intended especially for parents who want to work part-time in addition to receiving parental allowance. Parental allowancePlus can be drawn for up to 24 months – twice as long as basic parental allowance. One month of basic parental allowance therefore has the same value as two months of parental allowancePlus.

If the parents do not work after the birth of their child, parental allowancePlus is only half of the possible basic parental allowance. If the parents work part-time after the birth, the monthly parental allowance plus can even be drawn without reduction up to a certain gross income/profit (we call the “optimal parental allowancePlus gross amount”). Anyone earning more than this must expect a reduction in parental allowancePlus. Basic parental allowance does not have such a credit-free additional earnings amount.

Notice:

The Parental Allowance Act states that months of the child’s life during which the mother receives maternity leave payments are compulsorily regarded as basic parental allowance months (so-called basic parental allowance fiction), cf. section 4(4) sentence 3 BEEG.

In the previous example, the mother receives the maternity leave payment from the health insurance fund and the maternity leave contribution from the employer from birth until August 05, 2022. This means that months 1 and 2 of life must necessarily be taken as basic parental allowance months. The maternity leave payment received is offset against the basic parental allowance entitlement, Section 3 (1) sentence 1 nos. 1-3 BEEG.

It is not uncommon for maternity leave to last until the third or fourth month of life (delivery before the calculated due date, multiple births, etc.), so that these months of life are also subject to the basic parental allowance fiction. Accordingly, parental allowancePlus can be claimed for a shorter period.

With a combination of basic parental allowance and parental allowancePlus, you receive up to 18 months of parental allowance

There are various options for combining basic parental allowance and parental allowancePlus. The decisive factor is always the professional situation of both parents. If both parents simultaneously receive 14 months of parental allowance plus after the birth (without the mother receiving maternity leave payment), and then both work part-time and claim the partnership bonus months for this period, they will each receive 18 months of parental allowance. With this combination, the couple receives 36 months of parental allowance together.

In another combination, the mother receives basic parental allowance for 10 months immediately after the birth. During this time, the father works full-time. Subsequently, both parents work part-time and receive parental allowance plus for 4 months per parent and 4 additional months Partner bonus per parent. Since the combinations are flexible, we recommend our Parental allowance consulting. Our experts will discuss with you the best combination for your parental allowance.

Partner months

The terms partner months and partnership bonus do not mean the same thing.

Partner months only apply to couples or single parents if one parent receives less income after the birth and both parents apply for parental allowance. They include two additional months of basic parental allowance or 4 additional months of parental allowancePlus (or 1 month of basic parental allowance and 2 months of parental allowancePlus). The partner months can also be split. Up to the child’s 14th month of life, partner months can be taken in the form of basic parental allowance and parental allowance plus. Later, partner months can only be taken in the parental allowance Plus variant. After the child’s 15th month of life, parental allowance may no longer be interrupted in order to avoid forfeiture of the remaining entitlement. Everything about the Partnership Bonus Months we explain in our specially written article.

Free partition

Except for the partner months, parents are free to divide the monthly parental allowance payments between themselves. It is therefore possible for one parent to receive parental allowance for months 1 to 12 and then for the other parent to receive parental allowance for months 13 and 14.

Due to the freedom of choice, very many variants are possible – take sufficient time to determine the best variant for you.

How long do single parents receive parental allowance?

If you meet the requirements of a single parent, you can take advantage of the same parental allowance options as parent couples. Accordingly, you are entitled to the full parental allowance alone. You are also entitled to partner months and partnership bonus months. For example, you will receive up to 4 additional months of parental allowance plus if you work part-time for between 24 and 32 hours during these months.

You are considered a single parent if you meet two requirements:

- The other parent does not live with you or the child, and

- You are considered a single parent for tax purposes, which means that you can get the relief amount for single parents. This is usually only possible if you do not live and reside with another adult.

In addition, you can still get parental allowance as if you were a single parent in the following cases:

- If it is impossible for the other parent to care for the child, for example because he or she is ill or disabled. This must be proven, in case of medical reasons, for example by a medical certificate. It is not sufficient, for example, if the other parent cannot look after the child for professional reasons.

- If care by the other parent would be a threat to the child’s welfare. This occurs in exceptional cases, for example if the youth welfare office is of the opinion that damage to the physical or mental well-being of the child must be expected if the other parent looks after the child.

Simultaneous reference

If parental allowance is drawn at the same time, the total payment period is reduced accordingly. For example, if both parents receive parental allowance for 7 months at the same time, the maximum payment period of 14 months is reached.

How long will I receive parental allowance for multiples?

In the event of a multiple birth, the period of parental allowance is not extended. However, you will receive a supplement, which is €300 for basic parental allowance and €150 for parental allowancePlus. You can find out more about this topic in our article on the Multiple birth bonus.

Additional parental allowance months for parents of premature babies

Parents whose children were born significantly before the expected date are sometimes confronted with major challenges. With the last parental allowance reform, the legislator took this as an opportunity to give precisely these parents more parental allowance and thus enable them to receive it for a longer period of time. If your premature baby was born on or after 01.09.2021, you can benefit from the new regulations as follows:

- in case of a birth at least 6 weeks before the calculated date, parents receive one additional month of basic parental allowance

- in case of a birth at least 8 weeks before the due date, parents receive two additional months of basic parental allowance

- in the case of a birth at least 12 weeks before the expected date, parents receive three additional months of basic parental allowance

- in the case of a birth at least 16 weeks before the expected date, parents receive four additional months of basic parental allowance

What are the restrictions?

Unfortunately, there is currently no completely free choice, e.g. within the first three years of life. The receipt of parental allowance is limited by some regulations:

Basic parental allowance can only be claimed for the first 14 months of the child’s life (exceptions for premature birth months and due to Corona). For the months thereafter, parents can only choose parental allowance plus (and thus also the partnership bonus months).

In general, however, the benefit is capped until the child’s 32nd month of life (age of the child is 2 years, 8 months). During this period up to the 32nd month of life, the parents can also alternate in receiving parental allowance plus. After the 32nd month of life, any further entitlement to parental allowance lapses. This particularly affects parents who, for example have used the Breastfeeding employment prohibition or for any other reason (e.g. moving to Germany from abroad), you will not start receiving parental allowance until late in the year.

Another restriction is the basic parental allowance fiction for mothers that we have described earlier in this article.

Calculate parental allowance now and plan the reference period

This might also interest you: