Parental allowance and sibling bonus

Benefit from a higher parental allowance!

Parents of siblings are to receive special support in the form of a sibling bonus in connection of parental allowance. The legislator has set itself the goal of especially supporting parents who have additional children within a short period of time. This article explains what the sibling bonus is and who receives it.

You can get more videos with all info about parental allowance in our Parental allowance course.

Here are the most important facts about the sibling bonus:

- The sibling bonus is paid to parents who have other siblings living in the household who have not reached certain age limits.

- The sibling bonus increases the parental allowance by 10%

- The sibling bonus is at least 75€, maximum 180€ per month of the child’s life.

- The sibling bonus can also be paid in addition to the multiple birth bonus

What is the sibling bonus?

The sibling bonus for parental allowance is a supplement to the parental allowance entitlement if the recipient of parental allowance has additional children in the household. Please do not confuse the sibling bonus with the multiple birth bonus. Parents of multiples receive this as a supplement to the parental allowance.

Prerequisite for the parental allowance sibling bonus

To qualify for the sibling bonus, the person eligible for the parental allowance must live in a household with

- two children who are not yet three years old, or

- three or more children who are not yet six years old, see section 2a(1) sentence 1 nos. 1 and 2 BEEG.

Example:

The parents live together in a household with two children and apply for parental allowance for child 2.

→ The parents receive the sibling bonus up to and including month 14 of the child’s life, because child 1 will be three years old on 05.03.2022. From month of life 15 of child 2 (= 29.03.2022-28.04.2022), the parents have only one child under the age of three in the household.

Note:

Possible additional month of sibling bonus (“Geschwisterbonus”) – Social Court Duisburg (S 18 EG 23/23)

- The entitlement to the sibling bonus only ends at the end of the calendar month in which the older child turns three.

- The sibling bonus is therefore still payable for the life month of the younger child that includes the end of this calendar month.

This is a first‑instance decision of a Social Court. Most Elterngeld offices follow the BMFSFJ guidelines and currently do not grant this additional month automatically. In individual cases, it may be worthwhile to file an objection (“Widerspruch”) and explicitly refer to the decision of the Social Court Duisburg (S 18 EG 23/23).

- Older child: born 10 August 2020

- Younger child: born 25 May 2023

- Life months of the younger child:

- 2nd LM: 25 June – 24 July 2023

- 3rd LM: 25 July – 24 August 2023

- 4th LM: 25 August – 24 September 2023

- Basic Elterngeld: €1,800 per month

- Sibling bonus (10%): €180 per month

- 2nd life month: €1,800 + €180 sibling bonus

- 3rd life month: €1,800 + €180 sibling bonus

- 4th life month: only €1,800 without sibling bonus, because under the guidelines the bonus ends with the end of the life month in which the older child turns three (here: 24 August).

- The sibling bonus ends only at the end of the calendar month in which the older child turns three – here 31 August 2023.

- The calendar month of August (ending 31 August) lies within the 4th life month of the younger child (25 August – 24 September).

- Result under the court’s approach:

- 2nd LM: €1,800 + €180

- 3rd LM: €1,800 + €180

- 4th LM: €1,800 + €180 (one extra month of sibling bonus)

- Without applying the judgment: sibling bonus 2 × €180 = €360

- Applying the judgment: sibling bonus 3 × €180 = €540

- Advantage: +€180 sibling bonus for one additional life month.

Higher parental allowance with the next child due to sibling bonus

Tips and tricks on the amount of parental allowance for the next child we show in our popular article “Parental allowance for the second child“. Learn there how your parental allowance can be even higher with the next child than with child 1 due to the sibling bonus.

If there are more than two children, the sibling bonus will therefore cease to apply in the month of the life in which the third youngest child is no longer five years old.

Tip:

The sibling bonus can be worth cash. Make sure that especially the partner months are claimed with the bonus entitlement and, if possible, take the bonus with your basic parental allowance entitlement, even if you had perhaps planned to draw parental allowancePlus for longer. You may be giving away several “half sibling bonus months.” However, this is only the case if you planned to receive parental allowance without additional earnings.

Notice:

Eligible for the sibling bonus are children for whom the person entitled to parental allowance meets the requirements of Section 1 (1) and (3) BEEG. Thus, the requirements for the granting of parental allowance that apply to natural children and to adopted children or children taken into the household with the aim of adoption must exist on the merits. This means that, for example, children of roommates do not qualify for the sibling bonus.

Amount sibling bonus

The sibling bonus increases the parental allowance by 10%.

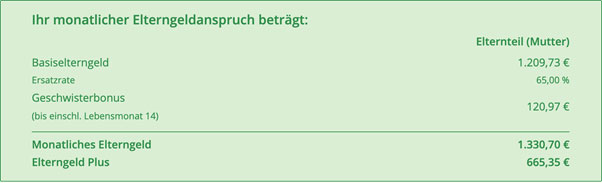

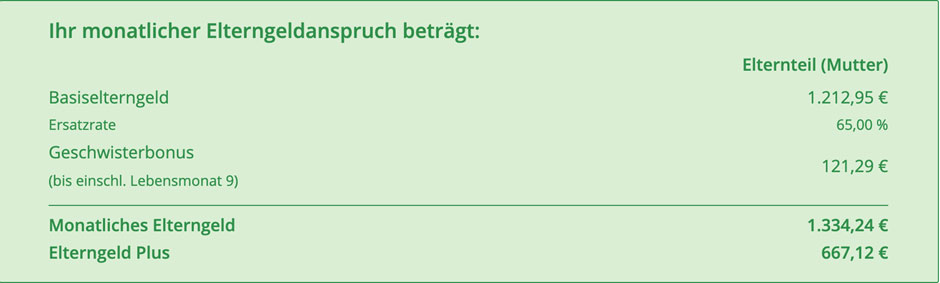

Example:

Parental allowance entitlement = €1,209.73 (basic parental allowance).

During months of the life with the sibling bonus entitlement, the basic parental allowance is €1,330.70 because the sibling bonus of €120.97 is paid in addition. During parental allowance plus months, one thus receives 665.35€ (604.87€ parental allowance plus 60.49€ sibling bonus).

Minimum amount sibling bonus

The sibling bonus amounts to at least €75 in the case of basic parental allowance, and at least €37.50 in the case of parental allowance plus (and thus also during the partnership bonus months).

Example:

The applicant’s basic parental allowance is 616€. The sibling bonus would actually amount to 61.60€. Due to the minimum supplement regulation, the person receives the sibling bonus in the amount of 75€, thus a total basic parental allowance of 691€ per month of life with sibling bonus entitlement.

When is the sibling bonus paid in parental allowance?

You will receive the sibling bonus together with the parental allowance, there will be no separate payment.

How long do I get paid the sibling bonus with parental allowance?

In each month of the child’s life, the parental allowance office checks whether the conditions for the sibling bonus are met. The sibling bonus is paid until the older child reaches the age of three in the case of two children, or until the third youngest child reaches the age of six in the case of three or more children. The first month of life in which these requirements are no longer met in full is the first month in which the sibling bonus ceases to apply.

Example:

The parents live together in a household with three children and apply for parental allowance for child 3.

→ The parents receive the sibling bonus up to and including month of life 9, because child 1 turns six on 05.03.2022. From month of life 10 of child 3 (= 05.03.2022-04.04.2022), the parents have only one child under the age of six in the household. This child has already reached the age of three on 29.01.2021, which is why the parents are not entitled to a sibling bonus for this child in accordance with §2 Para. 1 Sentence 1 No. 1 BEEG.

Please note:

Please read above note on “Possible additional month of sibling bonus (“Geschwisterbonus”) – Social Court Duisburg (S 18 EG 23/23)” in order to read about chances to receive the bonus a month longer than normal.

Can I apply for the sibling bonus for parental allowance retroactively?

Yes, the general deadlines apply as for parental allowance itself. Parental allowance is paid retroactively only for the last three months before the beginning of the month in which the application for the respective benefit was received, see Section 7 (1) sentence 2 BEEG.

Example:

Birth on 05.03.2021 / application on 20.08.2021

The parental allowance application was received by the parental allowance office in the sixth month of the child’s life. Therefore, parental allowance can only be paid for the third, fourth and fifth months of life. The application was therefore submitted too late for the first and second month of life.

Example:

Birth on 05.03.2021 / Application on 29.06.2021

The parental allowance application was received by the parental allowance office in the fourth month of the child’s life. Therefore, parental allowance can be paid for the first, second and third month of life. As the last date to receive parental allowance for the first month of life, in this example the application must be submitted by 04.07.2021 (last day in the fourth month of life).

Special forms sibling bonus

Sibling bonus for the 3rd child

Parents receive the sibling bonus for the third child until the first child turns six or the second child turns three. See example above under “How long do I get paid the sibling bonus with parental allowance”

Sibling bonus for twins

Multiple births do not qualify for the sibling bonus because there is a multiple birth bonus of €300 per multiple birth, see § 2a para. 4 BEEG. Parents of twins who later have a single child, however, receive the sibling bonus until the multiples reach the age of six.

Parental allowance Sibling bonus for a disabled child

For children with a disability within the meaning of § 2 SGB IX (degree of disability must be greater than 20), the age limit for the sibling bonus is 14 years.

Example:

The parents live together in a household with two children and apply for parental allowance for child 2. Child 1 has a disability within the meaning of Section 2 (1) sentence 1 SGB IX.

→ The parents receive the sibling bonus up to and including month of life 9, because child 1 will turn fourteen on 10/14/2021. From month of life 10 of child 2 (= 29.10.21-28.11.2021), the parents have only one child under fourteen in the household.

Parental allowance Sibling bonus for an adopted child

In the case of adopted children who have not yet reached the age of 14, the period for sibling bonus eligibility is not the child’s date of birth, but the period since the child was taken into the household of the person entitled to the parental allowance. This also applies to children whom parents have taken into their household with the aim of adopting them as a child.

Example:

The parents live together in a household with two children and apply for parental allowance for child 2. Child 1 was born on 03.05.2015 and was admitted to the parents’ household on 10.09.2019 with the aim of adoption as a child.

→ The parents receive the sibling bonus up to and including the 20th month of the child’s life, because child 1 will be fourteen years old on 03.05.2029 and will have lived in the parents’ household for three years as of 10.09.2022. From month of life 21 of child 2 (= 29.09.2022-28.10.2022), the parents have child 1 in the household for more than three years.

Parental allowance Sibling bonus with Hartz 4

Unfortunately, the parental allowance entitlement is offset against Jobcenter benefits, i.e. the standard rate is reduced, so that you have just as much money available with the parental allowance as without it. It is therefore wrong that Hartz 4 recipients would not receive parental allowance, rather they do receive the benefit, but it has no added value in the wallet. Unfortunately, the sibling bonus is not excluded from the offsetting.

Before 2011, the system was different. Many court cases against the offsetting practice failed. This was the case, for example, with a 2013 lawsuit before the Rheinland-Pfalz Regional Social Court. A constitutional complaint before the Federal Constitutional Court was also unsuccessful.

Nevertheless, we have provided important advice on this very topic in our article “Parental allowance and Hartz IV“, which can certainly help you.

Tip:

However, there is an exception that you can take advantage of: If your entitlement to parental allowance comes from gainful employment, a maximum of 300 EUR can be spared from being offset. This means that if you have worked in the twelve months before the birth, even if it is only a 450 EUR job, you should definitely have it checked whether you are entitled to the parental allowance as an allowance.

If this is the case, you will receive the tax-free allowance, i.e. up to EUR 300 per month, in addition to your ALG II rate. The amount of the tax-free allowance depends on the average salary you earned before the birth. If this was an average of 230€, these 230€ remain free from the imputation.

Sibling bonus for basic parental allowance

The sibling bonus for the basic parental allowance is a minimum of €75 and a maximum of €180 per month of life.

Sibling bonus with parental allowance plus

The sibling bonus for parental allowance plus is a minimum of €37.50 and a maximum of €90 per month of life. As with parental allowance plus, you will receive the payment for longer, but only half as much as with the basic parental allowance. If you have opted for parental allowance plus with a sibling bonus, you should make sure that you are still entitled to the sibling bonus in each month, otherwise you could “leave money lying around”.

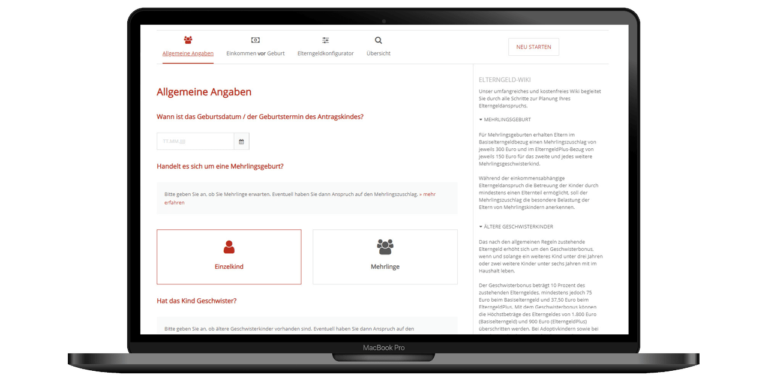

Calculate sibling bonus

The sibling bonus is always 10% of the parental allowance entitlement, at least €75 in basic parental allowance, or at least €37.50 in parental allowance plus. Example:

Apply for parental allowance sibling bonus - How & where?

What kind of application do I have to submit for the sibling bonus? In every application for parental allowance, there is an area where the applicant can enter information about other children living in the household. If you enter the data there accordingly, the parental allowance office will automatically grant the sibling bonus.

Notice:

For sibling bonus eligibility, the parental allowance office usually requires proof of current child benefit payments for the siblings. Therefore, when applying for parental allowance, attach a copy of the account statement showing the last child benefit received, or a copy of the last child benefit notice received.

FAQ

-

Does the parental allowance sibling bonus exist for both parents?

-

When is the sibling bonus cut in half for parental allowance?

-

How do multiple births count toward the sibling bonus?

-

Stretching parental allowance to 24 months - what about sibling bonus?

-

Is the sibling bonus also paid for half-siblings?

-

What applies to the sibling bonus for adopted children?

-

Is an imputation of the sibling bonus legal?

-

Can I apply for the sibling bonus for older children?

You might also be interested in