Parental allowance and Hartz IV

Isn’t that a zero-sum game? This is a question one hears more often when it comes to the simultaneous receipt of parental allowance and the so-called Hartz IV. The payment of parental allowance to families receiving unemployment support II (ALG II) works according to the “zero-sum game” principle. The parents concerned receive parental allowance on the one hand, but just as much less ALG II on the other.

Incidentally, the Federal Social Court (BSG) found this to be legal in a decision of 1.12.2016 (file reference: B 14 AS 28/15 R). The case heard in Kassel was that of a mother of four children from Halle who had been granted the minimum parental allowance of €300.00 in 2011. The job center credited this money as income to the Hartz IV benefit and reduced the ALG II accordingly. The authority based this on the regulations that have been in force since 2011.

The family, on the other hand, saw the offsetting as income as a violation of the principle of equality. After all, parental allowance is not deducted from the social benefits received by BAföG and housing benefit recipients. This is regulated in § 10 of the Federal Parental Allowance Act. Paragraph 1 regulates the exemption of parental allowance from being offset against social benefits. Paragraph 5 clarifies that this exemption from offsetting has not applied to Hartz IV since 2011. In the end, the Federal Social Court considered this special status of Hartz IV to be constitutionally unobjectionable. This should put an end to the legal dispute about the basic offsetting of parental allowance against ALG II.

An important tip for affected parents

Few people are aware, however, that in many cases this offset can be avoided. This possibility is available to parents in receipt of ALG II, whose parental allowance fully or partially replaces a previously received earned income. Often, in fact, the minimum amount is selected in the application if the prenatal income is not sufficient to get above the 300, – EUR.

Recommended Action:

If the parental allowance notification has not yet shown that earned income was taken into account when calculating the parental allowance, even though the opposite was the case, those affected should now visit their parental allowance office as soon as possible and take the documents on their earned income before the birth of their child with them. The office will then determine the so-called parental allowance allowance. This amount is then exempt from deductions up to € 300.00.

The resulting decision only has to be submitted to the job center. The parents may then keep parental allowance in the amount of the parental allowance allowance in addition to ALG II. This is based on Section 10 (5) of the Federal Parental Allowance and Parental Leave Act (Bundeselterngeld- und Elternzeitgesetz), according to which up to €300.00 per month of the average income from gainful employment before the birth is disregarded as income when calculating ALG II and the child benefit bonus (Kinderzuschlag).

Those who have already received more than €300.00 parental allowance per month do not have to take action. Because in these cases it is clear: the parental allowance is a substitute for previous employment. The Federal Employment Agency has stated that in these cases, the first €300.00 of parental allowance is automatically not counted towards Hartz IV benefits and just as little towards the child benefit bonus (Kinderzuschlag) under the Child Benefit Act. Anyone who receives €750.00 in parental allowance will therefore have their Hartz IV benefit reduced by only €450.00, as has already been the case.

Important tip – use insurance lump sum:

Hartz IV recipients who receive parental allowance can claim an insurance lump sum of 30€ per month. The lump sum may not be counted as income. The purpose of the lump sum is that important insurances are paid from this. The lump sum is always deducted from income, regardless of whether insurance has been taken out or not.

However, only those who have no income from gainful employment benefit from the lump sum. Child benefit and advance maintenance payments for children under 18 are considered income in the case of children. In these cases, no insurance lump sum is granted on top of this.

Since parental allowance is not income from employment, Hartz IV recipients are awarded the flat-rate insurance allowance. Therefore, it is worthwhile to take advantage of the maximum period of entitlement in order to receive the insurance lump sum as long as possible. However, only as long as no income from gainful employment is earned.

The “normal” basic parental allowance lasts a maximum of 14 months of the child’s life. With 14 months, that would be 14 x 30 € = 420 EUR. However, those who claim parental allowancePlus can receive the flat-rate insurance benefit for twice as long, i.e. up to 28 months. The benefit would then amount to 840 EUR. Those who already receive basic parental allowance can still switch to parental allowance plus. We write more about this in our article “Apply for parental allowance”.

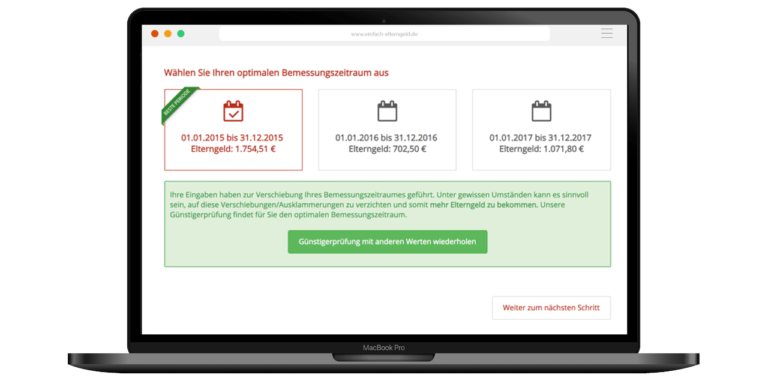

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in