Parental allowance for officers

Officers, judges and soldiers can also apply for parental allowance. In this article we explain why their parental allowance is usually higher and what special features they should be aware of.

Contents

Here are the most important facts for officers:

- Parental allowance is also available to officers

- Officers take parental leave on the basis of the ordinances of their employers

- Female officers do not receive maternity leave payment, but instead receive salaries during the maternity leave period.

- During parental leave, officers are entitled to the benefit for health insurance by federal or state government (Beihilfe)

- During parental leave, officers (if applicable) must continue to pay their private health insurance contributions

- In some federal states, officers receive a birth benefit (Geburtspauschale) for initial equipment from the benefit for health insurance by the federal or state government

- After birth, officers receive family bonuses (Familienzuschläge) in the salary

Who is actually an "officer"?

Officers are employees of the state. They are appointed on the basis of officer service laws and are not employees. They are subject to special obligations of loyalty and service and in return receive alimentation (provision for themselves and their families). There are different officer statuses:

- Officers on revocation (preparatory service)

- Probationary officers (probationary period)

- Officers for life (“Permanent position”)

- Temporary officers (usually politicians)

Judges and soldiers are basically also officers. The provisions of this article therefore apply to them accordingly.

In which professions do officers work?

Officers basically perform sovereign tasks, i.e. activities within the scope of the executive of the state. But not every employee in the public sector is a officer.

The federal, state and local governments currently employ about two million officers in the public sector. “Officer” is not a profession, however, but rather an occupational status. In principle, all professions for which there is a demand in the public service are suitable for the officer career.

The term “officer” covers many different occupational fields, which can vary greatly. Depending on the profession and training or educational qualifications, officers enter the public service at the lower, middle, upper or higher levels.

“Classic” officer occupations are:

- Police officers

- Teacher

- Fire department employees

- Finance Officers

- Administrative Officers

- and so on.

Specifics of parental allowance for teachers

Not every teacher is automatically an officer. In

- Berlin and

- Thuringia

teachers are currently not officers, in all other federal states teachers can be officers.

While there are basically no noteworthy specifics for teachers with officer status when it comes to parental allowance, two questions frequently asked in this context stand out again and again:

How can I best combine my parental leave with the vacations?

Parental allowance is always and without exception paid for the months of the child’s life. Only in the rarest cases does this fit seamlessly with the vacations of the respective federal state. Good and thoughtful planning is the key here. If necessary, it may make sense for you to start from a Parental allowance consulting to profit from Einfach Elterngeld, as we have already scheduled parental leave in the best possible way with a lot of teachers.

The best way to illustrate the problem is with an example:

Example:

The child is born on 16.07.2022. The father is a teacher in NRW and he would like to claim his two months of parental leave around the child’s first birthday. Now he could simply apply for basic parental allowance in months 13 and 14 of life and would have “paid time off” (vacation) from Thursday, 06/22/2023 to 07/15/2022 and would forgo “paid time off” from 07/16/2023 to 07/30/2023.

He might consider the following:

Apply for basic parental allowance in months 11 and 14 of life and show parental leave in two sections deviating from the months of life:

First section:

05/16/2023 to 06/21/2023 (parental leave with basic parental allowance until 06/15/2023).

Then “paid time off” (vacation) from 06/22/2023 to 07/30/2023, inclusive.

Second section:

07/31/2023 to 09/15/2023 inclusive (parental leave with basic parental allowance from 08/16/2023-9/15/2023).

In this model, he would have a full four months off, would receive two full basic parental allowance months, and would have 5 full vacation weeks of “paid time off” (already back on parental leave during the prep week).

Notice:

Unfortunately, parental leave can only be planned after the birth, because only then are the concrete months of life determined. Since only 4% of all children arrive “on time” on the calculated date, many a well thought-out ideas can quickly be ruined if the delivery date deviates from this.

Many a school administration authority or school management sees such “optimized” parental leave applications in part as an abuse of rights. In such cases, keep calm and seek clarification together. The parental leave regulations give you complete freedom in how you want to structure your parental leave periods (a maximum of three within the first two years of the child’s life).

How is the maximum working time calculated for my mandatory hours?

For numerous occupational groups, regulations for the assessment of working hours or scope of work deviate from the classic model of working hours. Depending on the activity, the calculation is based on compulsory hours, flight hours, maximum load limits or also on workloads (case numbers). The regulations made in individual cases follow the needs of the occupational field and can result from service agreements, collective bargaining agreements, EU law or state regulations.

If it becomes apparent during the examination of the parental allowance application that a special working time arrangement could exist, the maximum number of hours permitted under Section 1 (6) BEEG must be determined by conversion. In relation to a full-time working time of 40 hours, 32 hours correspond to a scope of employment of 80%, 24 hours in the partnership bonus correspond to a scope of employment of 60%.

Example:

Teacher with a compulsory number of hours of 27:

The activity within the framework of a basic compulsory number of hours of 27 per week (full-time) corresponds to a scope of employment of 32 working hours = 21.6 compulsory hours (27 * 0.80). A workload of 24 hours corresponds to 16.2 hours.

In the calculation, the number of hours is neither rounded up nor down. Existing different state regulations, e.g. of teachers with officer status, must be taken into account.

Calculation of parental allowance for officers

As a state social benefit, parental allowance replaces prenatal taxable income to the extent that this is lost due to the care and upbringing of the child.

Officers receive remuneration on the basis of the relevant Officers’ Act (Beamtengesetz). The salary is generally relevant for parental allowance. Annual special payments, achievement bonuses or tax-free supplements (e.g. for weekend or holiday work) are not taken into account.

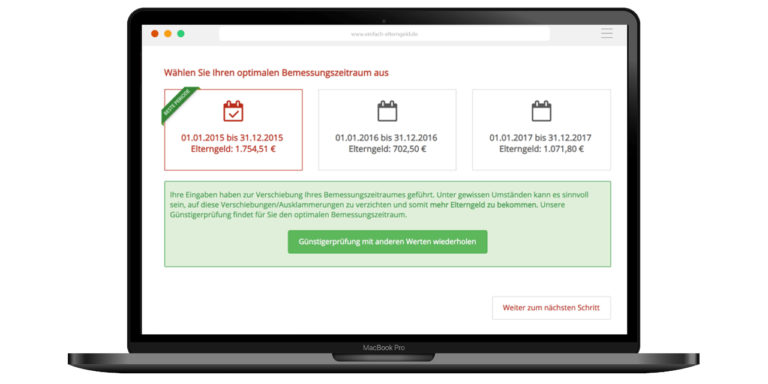

If civil servants do not have a second job and do not have any other income from gainful employment (e.g. mini-job), the comparison period for the parental allowance is without exception the income of the last 12 months before the month of birth.

Example:

The child was born on August 19, 2022. The assessment period comprises the earnings for the calendar months August 2021 to July 2022 inclusive.

Tip:

Calendar months of maternity leave are also included in the assessment period for female civil servants – in contrast to employed mothers. The background to this is that the remuneration during maternity leave is paid as ongoing taxable remuneration, which is relevant for parental allowance. It is therefore not necessary to exclude them because the mothers are not at a disadvantage.

The advantage of this is that female officers have at least one month more to complete a parental allowance-relevant change of tax class to be performed during pregnancy.

Why do officers receive a higher parental allowance?

As part of the parental allowance calculation, the parental allowance office determines an average prenatal net income. Since 2012, this has been calculated as a standard amount on the basis of individual social insurance and income tax deduction data, which can deviate considerably from the actual net income.

Officers are not subject to social security deductions, which is why their net income is higher for the same gross income, but this is taken into account when calculating income tax, which is why they are subject to income tax table B, which takes into account higher deductions. Nevertheless, the net income is significantly higher due to these circumstances, which is why officers benefit from a higher parental allowance.

The easiest way to show the differences is through a comparative calculation:

Do you want to calculate your parental allowance exactly? Our Parental allowance calculator can also take into account the special deductions for officers and will calculate your parental allowance correctly.

Important note:

While officers receive a higher parental allowance, they often still have to pay contributions to private health insurance from the higher parental allowance, because the employer pays the contributions in most states the contributions only up to the grade A9 (formerly middle service). From the A9 higher grade, the employer usually subsidizes the expenses with only one euro tax-free per day.

Specifics for civil servants

Parental leave according to the Parental Leave Regulation (Elternzeitverordnung) not according to the BEEG

The regulations on parental leave of the Federal Parental Allowance and Parental Leave Act (Bundeselterngeld- und Elternzeitgesetz) do not apply to officers, as they are not covered by its terms. The employers have therefore issued their own maternity leave and parental leave ordinances, which, however, adopt the provisions of the Parental Leave Act in full.

Thus, officers are also entitled to 36 months of parental leave per child per parent. Postnatal periods of maternity leave are nevertheless considered as used parental leave, as is the case for employed mothers.

Parental leave application tip:

The authorities usually have their own application forms that are to be used. Therefore, if you use your own informal application, you must expect that you will be sent the application forms.

We recommend that mothers wait until the child is born to apply for parental leave. This has several advantages – do not be “pressured” to submit your application before the birth.

Salaries during the maternity leave periods

Unlike salaried mothers, officers who expect a child receive “salaries during the maternity leave” during the periods of protection before and after the birth. This is regulated in the maternity leave regulations of the respective employer.

With the announcement of pregnancy, the mother should indicate the expected date of delivery so that the employer can calculate the beginning of the six-week protection period before the birth. The date shall be evidenced by a medical certificate or a midwife’s certificate. If the expected date of delivery is corrected in the course of the pregnancy, the start and end of the protection period shall be adjusted accordingly.

Pregnant female officers may not be employed during the last six weeks before the expected date of birth. They are not required to be on duty during this period. They may continue to work voluntarily if they expressly agree to do so. A female officer who does not work during the maternity leave period may, on a voluntary basis, attend in-service training or take an examination, for example. Willingness to serve or to participate in the relevant measure must be declared in advance in writing or verbally. The declaration may be revoked at any time.

If the calculated date of birth is exceeded, the maternity leave period is automatically extended. This extension does not shorten the protection period after childbirth. The time for recovery after the birth therefore remains unchanged.

During the first eight weeks after the birth, there is an absolute prohibition on employment. This means that the civil servant may not work during this period, even if she would like to work. In the case of multiple births, the maternity leave period after delivery is twelve weeks (More info in the article Multiple birth bonus).

During the maternity leave periods and the period of an individual employment prohibition, the full entitlement to salary remains in force. The payment of service and candidate salaries is not affected. However, previous pay may be reduced if previously paid overtime compensation is eliminated because of the prohibition on working more than eight and one-half hours per day. Allowances shall continue to be granted.

Family bonuses (Familienzuschläge)

The salary of officers consists primarily of the basic salary according to the salary scale. This is supplemented by the family bonus and, if applicable, by other allowances. Achievement levels, achievement bonuses or achievement supplements, as well as special supplements based on the labor market, may also be paid.

If the officer is assigned overseas, there are specific payments for foreign service.

The family bonus is the family-related component within the salary (level 1: married civil servants or civil servants living in a registered partnership; level 2: married civil servants or civil servants living in a registered partnership and children) and is paid as a social component in addition to the basic salary.

The amount of the family bonus depends mainly on the marital status and the number of children entitled to child allowance. In some cases, it has been significantly restructured in the federal states, for example by abandoning the so-called supplement for married couples (“Verheiratetenzuschlag”) in favor of the so-called child benefit bonus (“Kinderzuschlag”).

The family bonus for officers will be paid as follows from 01.04.2022:

Note on the amount of family bonuses:

The amount of the family bonuses varies depending on the federal state. Please refer to your salary tables to find out what amounts you can expect.

Only the family bonuses according to level 1 are eligible for pension, i.e. the child-related family bonuses are not included in the calculation of your pension. Nevertheless, you may be entitled to the child-related family bonuses while receiving your pension.

Note for civil servants with additional income during the reference-period for parental allowance:

Parental allowance replaces the loss of income from prenatal income compared to postnatal income. Officers often forget to take family bonuses into account when planning income in the reference period. Particularly, if both partners are eligible for the family bonus, you will be paid the full family bonus if you are jointly work 100%, even if you are only work part-time yourself.

Example:

prenatal gross: 3.000€

postnatal part-time gross: 2.250€ (linear to 75%); but: family bonus level 2 in the amount of 214€ (75%) has to be added

==> The postnatal part-time gross amount is therefore 2,464€ for 75% employment and therefore higher than initially expected. Of course, this has a corresponding effect on the parental allowance calculation:

prenatal parental allowance net: 2,414€

postnatal parental allowance net: 2.046€

Loss of income: 368€

Parental allowance entitlement as a result: 300€ in basic parental allowance entitlement and 239€ in parental allowancePlus entitlement.

Officers should therefore plan carefully, especially when receiving parental allowance with additional earnings, so that there is no surprise when it comes to the parental allowance approval notice. In addition, scheduled salary increases due to working time on a specific level, salary adjustments due to public pay scale adjustments and any promotions should also be taken into account in the planning. If in doubt, seek advice from Einfach Elterngeld.

Child benefit from the HR-office (Bezügestelle)

The Act on the Ending of the Special Responsibility (“Gesetz zur Beendigung der Sonderzuständigkeit”) of the child benefit departments (Familienkassen) of the public service in the area of the federal government of December 8, 2016, reorganizes the responsibilities. The law fundamentally reforms the responsibility and structure of the child benefit departments of the public sector:

- In the federal sector, the responsibility of the family funds of the civil service is to be transferred to the Federal Employment Agency (Bundesagentur für Arbeit) by December 31, 2021, unless the Federal Office of Administration is entrusted with the calculation and payment of child benefits.

- For the area of federal states and local authorities, public employers are given the option of also handing over responsibility and case processing to the child benefit department of the Federal Employment Agency. There is no fixed deadline for the transfer of child benefit processing for the federal states and local districts.

Important tip:

Find out from your HR-office whether child benefit should be applied for at the child benefit department of the Federal Employment Agency or at the employer’s office.

Benefit for health insurance by the federal or state government (Beihilfe)

The employer has a special duty of care for its officers. In the event of illness, nursing care or childbirth, the employer undertakes to reimburse part of the costs incurred within the framework of the benefit for health insurance by the federal or state government (Beihilfe).

The benefit for health insurance by the federal or state government only supplements what is known as reasonable personal provision. The person entitled to the benefit must therefore pay for the costs of treatment, medication and the like that are not covered by the benefit for health insurance by the federal or state governemnt. As a rule, a corresponding private health insurance policy is therefore taken out.

Not all expenses are recognized as eligible for assistance. For example, some treatment methods or medicines are fully or partially excluded from reimbursement. It is also possible to deduct deductibles from the eligible expenses. This means that the officer must bear part of the costs himself or herself. The regulations are generally based on the statutory health insurance system. There are no uniform federal regulations governing the benefit. In addition to the German Federal Ordinance on Federal Benefits (Bundesbeihilfeverordnung, BBhV), most of the federal states have their own state benefit ordinances, which have the same basic structures as the BBhV, but differ in detail.

Important Tip:

Some federal states pay a one-time birth benefit (“einmalige Geburtspauschale”) as part of the benefit after the birth. This is intended to at least partially cover the expenses for the so-called initial equipment (e.g. costs for crib, diaper changing unit, stroller, clothing, cosmetics, etc.).

The following states pay the one-time birth benefit:

The one-time birth benefit is usually applied for by means of a long form application and a copy of the birth certificate at the HR-office of the respective federal state.

FAQ

-

Do officers receive parental allowance?

-

How much is the parental allowance for officers?

-

Do officers employed as teachers have to pay attention to anything when it comes to parental allowance?

-

Is there maternity leave for officers?

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service opportunities to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in