7 suggestions for improving parental allowance

Our ideas for improving the parental allowance (the ideas are not exhaustive)

Only to September 2021 “improvements and optimizations” in the parental allowance law were enacted by the Bundestag. In this article you will find 7 suggestions for improvement from us. First of all, it should be said that for reasons of financial feasibility, some of our points can certainly not be implemented, since parental allowance, as it is today, already consumes a lot of federal funds. We have therefore deliberately made our proposals for improvement independent of the question of funding, but have nevertheless taken care to ensure that the proposals are not “presumptuous”.

1) More staff in the parental allowance offices

The most urgent issue for us is the remuneration of the parental allowance office staff. We often hear and read that the processing time for parental allowance is too long and the advice is too short (if it takes place at all). The telephone accessibility is more than poor in many places. The conditions are/were sometimes so glaring that in Bremen, for example, the state-owned Aufbaubank paid out an interest-free bridging loan for interim financing until the parental allowance was approved.

In addition, one reads about job evaluations in the parental allowance offices, in which the “normal” entry-level clerk is grouped in a pay group 7 of the TVöD and a specialist area management even “only” in a pay group 9b. Not to mention general staff shortages due to a lack of replacements or general job cuts.

In our opinion, the fact that frustration arises among the processors from such situations cannot be blamed. Processing cases under the BEEG is by no means easy. The abundance of directives, orders, circulars and judgments is relatively high. All the more reason for us to advocate for the remuneration of parental allowance office clerks. Higher groupings, and/or general job allowances are the one way, around general job increases the administration will not get around in our opinion however. The bottom line is that everyone would benefit. Parents would be happier, employees would be more satisfied (keyword: sickness statistics) and parental allowance itself would become even more popular.

2) Consideration of miscellaneous and one-time payments for salaried employees

It is an injustice without equal. One-time payments and other forms of remuneration for employees are not taken into account when calculating parental allowance. Countless lawsuits have been dismissed, mostly with the comment that “by not taking these types of wages into account, the legislature’s broad scope for shaping social benefits is not unlawfully exceeded.”

Salaried employees lose hundreds of euros in parental allowance – simply because your employment or collective bargaining agreement provides for one-time payments in your annual salary. No argument of the administration or the courts is able to convince us conclusively as long as every revenue “counts” for self-employed persons, tradesmen and farmers and foresters. In the case of these parents, there is no examination of whether the revenue arose from a main, auxiliary or secondary business.

Our demand therefore:

Full consideration of taxable wage types in parental allowance without exception.

Or:

Close scrutiny of the distribution of revenues for self-employed persons and corresponding non-consideration of revenues from secondary businesses. Our clear favorite, however, is the first demand.

3) Extension of the exclusion criteria

We advocate an expansion of the exclusion criteria. In addition to the existing ones, at least the following periods should be excludable: Calendar months in which the claimant,

- Unemployment payments I or II,

- sickness payment or daily sickness payments or children’s sickness payment or daily children’s sickness payments

- or insolvency payments

are excludable

The already existing exclusion clause regarding the receipt of parental allowance for older siblings is to be repealed and instead read as follows: Calendar months in which the applicant was on parental leave due to an older sibling are generally and without time limit excludable.

However, in order not to exaggerate the exclusion excessively, we propose that the maximum exclusion period should be January of the 5th year before the year of birth (exceptions for cases of hardship should be possible; for example, if there are more than three older siblings) and the assessment period should not be divided into more than three sections (exceptions for cases of hardship should also be possible). This proposal would bring significant relief for parents and would not unreasonably “punish” parents in the case of difficult “strokes of fate”.

4) Increase of the minimum and maximum amounts, at least by the inflation rate since 2007.

The parental allowance minimum and maximum amounts have not been adjusted since their introduction in 2007. We therefore advocate that these amounts be adjusted. Our proposal:

Minimum amount: 400,- EUR

Maximum amount: 2.200,- EUR

Sibling bonus: 100,- EUR

Multiple birth bonus: 400,- EUR

Just considering the inflation rate since 2007, the amounts would have increased by 22.1% (2007-2021) as follows:

Minimum amount: 366.30 EUR

Maximum amount: 2,197.80 EUR

Sibling bonus: 91.58 EUR

Multiple birth bonus: 366.30 EUR

An increase would make parental allowance significantly more attractive, as in 2018 alone there were 14.5% of parental allowance recipients who would have benefited from the increase. The number of parents who did not even apply because of the current maximum amount would be added to this figure. We recommend a general anchoring of automatic parental allowance increases in line with the inflation rate in the Parental Allowance Act.

5) Making the partnership bonus months more flexible and considering them as a separate type of entitlement

In principle, we think the partnership bonus months are a good idea. Some of our suggestions mentioned here were actually implemented in the last reform, but we still see potential for improvement here:

- Reduction of the minimum working time from 24 to 20 hours per week

- Maximum of six parallel months instead of a maximum of four

- Introduction of more far-reaching hardship provisions (e.g., if working hours fall short due to long illness, the parent should not be “penalized” but should “only” receive the minimum amount)

- Claiming possible at any time within the first three years of the child’s life, independent of other parental allowance payments

In addition, we advocate that the partnership bonus months become an independent type of entitlement alongside basic parental allowance and parental allowance plus. There are two reasons for this:

a) No reduction of parental allowancePlus due to income during the partnership bonus months.

Currently, earned income during the partnership bonus months is taken into account pro rata for the parental allowance plus months claimed in the past. This regulation is even expressly provided for in the BEEG guidelines. This can be unjustifiably expensive for parents.

Example:

The mother applies for basic parental allowance for months 1 to 6 and for parental allowance plus for months 7 to 18. During these months of parental allowance plus, she was on parental leave (working part-time, e.g. 12 hours per week). Now, together with her partner, she decided to claim the partnership bonus months in the months of life 19 to 22 and works 30 hours per week.

Suppose your prenatal parental allowance net is 1.800,- EUR; her parental allowance net during during life months 7 to 18 is 560,- EUR and during partnership bonus months is 2.100,- EUR (found new employer with better conditions who employs her part-time).

Your parental allowancePlus maximum amount is exactly 585,- EUR per month of life. However, due to the income during the partnership bonus, her parental allowancePlus and the parental allowance during the partnership bonus month amount to only 150,- EUR, because the income in the months of life 19 to 22 is spread over the period of the months of life 7 to 22. As a result, she has “only” received parental allowance of EUR 2,400 and is de facto “penalized” for finding a better job.

If the partnership bonus months were a separate type of entitlement, their total parental allowance from months 7 to 22 = EUR 7,620, i.e. EUR 5,220 more in total. With regard to this example, however, it should be noted that this disadvantage can become an advantage if the constellation is reversed:

Variation example:

Assume that her prenatal parental allowance net amounts to EUR 2,770; her parental allowance net during the months of life 7 to 18 amounts to EUR 840 (approx. 12 hours per week) and during the partnership bonus months EUR 2,100 (approx. 30 hours per week).

Your parental allowancePlus maximum amount is then exactly 900,- EUR per month of life. Due to the income during the partnership bonus, your parental allowancePlus and the parental allowance during the partnership bonus month will even be 900 EUR unabridged, because the income in the months of life 19 to 22 is spread over the period of the months of life 7 to 22. As a result, she received a total of EUR 14,400 in parental allowance and was able to make the best possible use of the system for herself.

If the partnership bonus months were a separate type of entitlement, their total parental allowance from months of life 7 to 22 = EUR 11,400, i.e. EUR 3,000 less in total.

b) One could more simply adjust the minimum amount

Due to the “high” working time requirements for the partnership bonus months, the parental allowance is often reduced to the minimum amount because of the additional earnings. This is currently EUR 150 and is therefore not lucrative for many parents in view of the bureaucratic effort involved.

We advocate that the minimum amount of partnership bonus months be raised to EUR 250; in return, the maximum amount can also be reduced to EUR 800. This legal restructuring can best be implemented if the partnership bonus months were an independent type of entitlement.

6) Rewarding parental allowance Plus

Parental allowancePlus is a very good idea. By ensuring that claiming it does not result in higher parental allowance overall compared to “pure” basic parental allowance, we advocate that parental allowancePlus can be claimed for longer.

This can be implemented, for example, as follows:

Those who apply for at least four parental allowancePlus months receive four additional parental allowancePlus months in addition to their basic entitlement and in addition to the partnership bonus months. There are certainly other approaches, but this one seems to us to be a good solution. An increase in the minimum amount to make parental allowancePlus more attractive could also be considered.

7) More digitization / public API for programs outside own programs.

Many federal states and even the federal government itself have already reached the point where parental allowance applications no longer have to be filled out by hand or in PDF format on a computer, but instead digital application assistants are available. Various measures have been initiated to advance these procedures, which we very much welcome.

Nevertheless, there is still a lot of catching up to do when it comes to digitization. The fact that the applications generally still have to be printed out and documents that are already available at other authorities and have also been fed into their electronic files have to be submitted additionally to the parental allowance office makes the whole process enormously bureaucratic. Parents who give explicit consent should benefit from the technically possible progress of today’s age. In addition, the parental allowance offices would also be relieved.

In perspective, we would like the Parent Allowance offices to offer a freely accessible interface so that third-party providers (such as our Parent Allowance Software) can send application data to the processors paperlessly and electronically along the lines of ElStEr and various tax assistance programs. Everyone would benefit, parents and administration alike. Not to mention the environment.

Conclusion

Parental allowance is already complicated. But it is also one of the most important family benefits in the Federal Republic of Germany. It is allowed to be somewhat complicated and explicitly regulated. Nevertheless, parents should not be overwhelmed and “left alone” when applying for it. In particular, the legislature should work hard to support the parental allowance offices more and to further develop this exciting “project” parental allowance.

Our suggestions are intended to make a small contribution to supporting parents in their special life situation even more than before and to making parental allowance a little “better”.

Too complicated? - Our tip

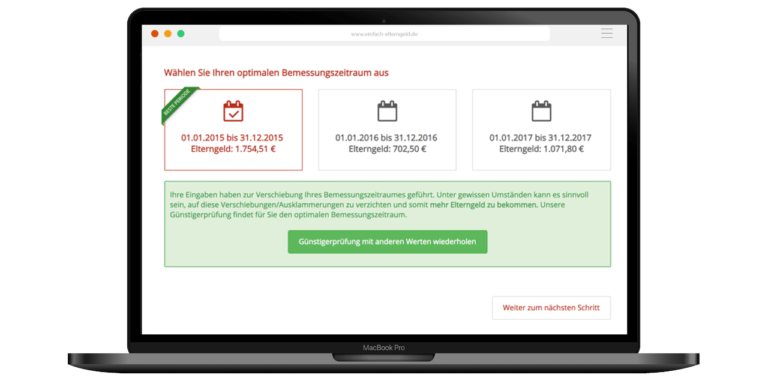

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in