One-time payments, even paid quarterly, do not increase parental allowance

Here are the most important facts about parental allowance and one-time payments:

- Parental allowance is calculated exclusively from current and flat-rate taxed wage components

- Unfortunately, tax-exempt emoluments, other emoluments and one-time payments are not taken into account

- We explain how you can determine your parental allowance-relevant gross from your pay checks in the video of this article

Tip:

- Talk to your employer at an early stage (if necessary already when you want to have a child)

- If necessary, one-time payments and the like can be apportioned to current wages

- You can find more tips in our article “Increase parental allowance“

In 2016, the Berlin-Brandenburg Regional Social Court ruled in favor of parental allowance recipients (case number: L 17 EG 10/15). If Christmas and/or vacation bonuses are paid in the form of a 13th and/or 14th month’s salary according to the employment contract, these payments – even if they are taxed as so-called other remuneration – are to be taken into account as increasing the parental allowance. In the meantime, the Federal Social Court ruled that the one-time payments do not increase the parental allowance (BSG, 29.06.2017 – B 10 EG 5/16 R).

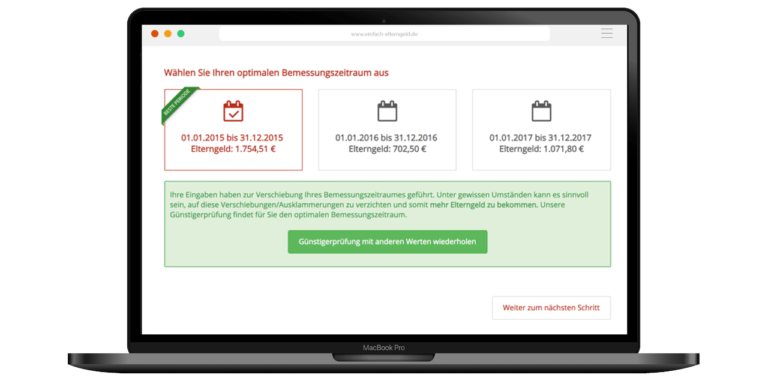

In the opinion of the court, parental allowance for employees is calculated on the basis of the average of the current, usually monthly, wages in the assessment period. Usually, the current wages in the twelve calendar months before the birth month of the child are the basis for the calculation. This current income does not include vacation pay or Christmas bonuses, which are only paid once in the assessment period. They are not relevant for the calculation of parental allowance and are treated as other income for income tax purposes.

The fact that vacation and Christmas bonuses are to be calculated as part of the total annual wage does not mean that they are to be allocated to regular wages. The fact that they are paid in the same amount as regular monthly wages does not justify repeated or ongoing payments. Rather, the payment is made once before the vacation period and once before Christmas.

Although this opinion confirms the unambiguous wording of the law, in our opinion there is still an obvious unequal treatment compared to self-employed persons. If the taxable profit of the relevant assessment period is used as a basis for the self-employed, it is of no interest under parental allowance law how the relevant sales revenues are composed.

There is no correction of profit due to proceeds from auxiliary or secondary business, and also no correction of private shares on which the entrepreneur can influence more in total than on the proceeds of the main business.

Unfortunately, even quarterly commissions/one-time payments cannot increase parental allowance, the Federal Social Court ruled in a decision dated December 14, 2017 (B 10 EG 4/17 R).

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in