Parental allowance and additional income

Parental allowance as a state payment replaces about 65% of the net prenatal income. With parental allowance plus, it is even only half of that (32.5%). This often enormous financial cut brings some parents to the limit of what is financially feasible, which is why many parents ask themselves whether and, if so, how much additional income can be earned during parental leave or while receiving parental allowance. This article deals with this topic in detail and provides valuable tips and tricks on how to best master the topic of parental allowance and additional income:

Here are the most important facts about parental allowance and additional earnings:

- Regardless of the type of allowance (basic parental allowance or parental allowance plus), you are allowed to work up to 32 hours per week.

- During basic parental allowance, income is generally not worthwhile because of the deduction.

- In the case of ElterngeldPlus, parents have the option of earning additional income without having to reduce their allowance due to it.

- There are various models for earning additional income; in some cases there are uncertainties in the legal situation due to social court decisions.

- Early planning provides advantages

- Self-employed persons usually have better optimization options

Employed and additional income with parental allowance

Income from non-independent work is generally relevant for parental allowance, i.e. if you receive parental allowance and also have income from employment, you must prove your additional income to the parental allowance office. (Hours per week and gross income). Proof is regularly provided in the form of an employer’s certificate. Incidentally, it is irrelevant whether the job is a mini, midi or “regular” job.

Notice:

Only those wage types that also increased the parental allowance in the assessment period count. Therefore, if you receive other Payments, such as bonuses or Christmas bonuses, while receiving parental allowance, your parental allowance will not be reduced as a result.

Tip:

First find out your Optimal parental allowance plus gross. Then agree with your employer that they will pay you the optimum parental allowance plus gross amount as a regular taxable payment. All other benefits should be paid to you as other/non-recurring benefits. In this way, you can receive parental allowancePlus free of charge. The requirements of the wage tax guidelines for wage type taxation must of course be met. Therefore: Approach your employer.

Self-employment and additional income with parental allowance

1) Births before 01.09.2021

Self-employed persons, tradesmen and farmers/forestrymen have enormous potential while receiving parental allowance. They may be up to 30 hours per week gainfully employed and in that case submit a profit calculation for the specific parental allowance reference period. In particular, if you determine your profit according to the principles of Section 4 (3) of the German Income Tax Act (so-called “Einnahmen-Überschuss-Rechnung”), you can positively influence your operating result while receiving parental allowance by influencing the inflow of operating income.

Example self-employment and gap in the reference period:

The mother is self-employed and receives basic parental allowance for the months of life 1-6 and 8-13. She works approx. 10 hours per week in the months of life 1-6, but settles her work at the end of the month of life 6. The inflow of income into her business account occurs in life month 7 (known as a gap month). In life months 8-13, she works about 20 hours per week and settles her accounts at the end of life month 13. The inflow of income occurs in life month 14, i.e. also outside the reference period.

Now she submits profit calculations for the months of life 1-6, as well as 8-13, from which a tax loss is recognizable, because the operating expenses exceed the income. Thus, she could be employed part-time, draw her unreduced basic parental allowance and even make profits, only slightly delayed.

Notice:

The gap model works in the aforementioned example because the parent determines the profit by means of revenue surplus accounting (Section 4 (3) EStG), whereby the tax inflow and outflow principle of Section 11 EStG of operating income and operating expenses applies.

However, if the parent prepares a balance sheet, the realization principle applies in deviation from this, i.e. it is not the inflow or outflow that is decisive, but the time of economic accrual.

2) Births from 01.09.2021

If your child was born after Sept. 1, 2021, you can still use the gap model as described above and now even work up to 32, instead of 30, hours per week. We explain the weekly hours limit in more detail here: Working while receiving parental allowance

Working while receiving parental allowance

Rumors about the possibilities of gainful employment during parental allowance persist. False statements such as “you are not allowed to work during basic parental allowance” or “you have to work during parental allowance plus” are heard time and again. The regulations for basic parental allowance and parental allowance plus are clear:

1) Weekly hours limit

The weekly hours limit applies to all types of parental allowance, i.e. to both basic parental allowance and parental allowance plus. The weekly hours are to be regarded as an average value for the month in which the child lives. This means that it is possible to work 40 hours in a week without any problems if fewer hours are worked elsewhere.

Parents whose children were born before Sept. 1, 2021, can work up to 30 hours per week, while parents of children born after Aug. 31, 2021, can work up to 32 hours per week. A mandatory number of hours per week only applies to the Partnership Bonus Months.

Exception:

Incidentally, gainful employment for employment during vocational training (apprenticeship, studies, etc.) and in the case of day carers who do not look after more than five children in day care are exempt from the limit.

The maximum number of hours allowed in the partnership bonus is deemed to have been complied with for these persons.

How does the parental allowance office check the working time for employees?

In order to check whether the working time limit is complied with, the parental allowance offices determine the working hours to be taken into account ex officio. The hours actually worked are decisive. Overtime must be taken into account in the same way as any undertime. On the other hand, periods during which earned income is received without work being performed must be taken into account, in particular vacation days, public holidays, periods of a ban on employment outside the protection periods before or after childbirth, and sick days with continued payment of wages.

Periods of leave to care for a sick child must also be taken into account, irrespective of whether earned income is available. In this case, the contractually agreed working time attributable to these periods is deemed to be the working time. In the case of a five-day week with 32 hours per week, for example, this would be 6.4 hours per day of leave.

In the event that residual vacation from full-time employment is taken during part-time employment, the planned working time applicable during part-time employment shall be taken as the basis for each day of vacation. Periods of activity that are not considered working time according to the Working Hours Act (e.g. periods of on-call duty) are not taken into account as working hours.

If a person does not work more than 32 hours in any week, the permissible weekly working hours have been met.

If this is not clear, the parental allowance offices usually use 2 methods to check whether the working hours have been observed:

1. The monthly calculation according to calendar days is sufficient if the average weekly working time does not exceed 30 or 32 hours per month. All working hours to be taken into account in the reference month (monthly working hours) are added up. The sum thus determined is compared to the permissible working time in the reference month; the permissible working time may not be exceeded.

30-hour per week limit:

If there are 28 days in a month of life, the permissible working time is 120 hours,

at 29 days 125 hours,

129 hours for 30 days, and

at 31 days 133 hours.

32-hour per week limit:

If there are 28 days in a month of life, the permissible working time is 128 hours,

at 29 days 133 hours,

138 hours for 30 days, and

142 hours for 31 days.

2. In the event of a disproportionately large number of working days in a reference month, a monthly calculation according to working days:

If a person in an employment relationship never works on certain days of the week, for example, due to a working time regulation, collective agreement or employment contract (for example, within the framework of a five-day week, never on Saturdays and Sundays), the parental allowance office checks whether the person has not worked more on average on the agreed working days than is permissible on a weekly basis.

If the monthly working time worked in a reference month exceeds the maximum permissible total number of hours calculated on the basis of calendar days, this may be due to the fact that a disproportionately large number of the agreed working days (coincidentally) occur in the month in question. In such cases, it is checked whether the maximum permissible working time was observed on average over the working time of the month in question.

The part-time agreement (employer’s certificate) is used to check how many and which days are worked per week. Then the maximum average number of hours per working day allowed for the parent is determined by dividing the average total number of hours allowed per week (30 or 32) by the number of working days agreed upon (in the example, by five). The result is then multiplied by the number of working days in the specific month of the child’s life, as specified in the binding part-time agreement.

Children born before 01.09.2021

A five-day week results in an average maximum permissible number of working days of 6 hours (30 hours per week divided by 5 working days). This must be multiplied by the number of agreed working days falling in the reference month.

With a five-day week, this results in

22 working days, the permissible working time is 132 hours and

138 hours for 23 working days.

A three-day week results in an average maximum permissible number of working days of 10 hours (30 hours per week divided by 3 working days). This must be multiplied by the number of agreed working days falling in the reference month.

With a three-day week, this results in

14 working days, the permissible working time is 140 hours and

150 hours for 15 working days.

Children born as of 01.09.2021

A five-day workweek results in an average maximum allowable workday hours of 6.4 hours (32 hours per week divided by 5 workdays).

This is to be multiplied by the number of agreed working days falling within the reference month.

For a five-day week, this results in

for 22 working days, the permissible working time is 140.8 hours and 147.2 hours for 23 working days.

A four-day week results in an average maximum permissible number of hours per working day of 8 hours (32 hours per week divided by 4 working days). This must be multiplied by the number of agreed working days falling in the reference month.

With a four-day week, this results in

18 working days would result in a permissible working time of 144 hours

and 152 hours for 19 working days.

Conclusion:

As a rule, the working time limit is verified by an informal certificate from the employer. Only if there are reasonable doubts about the actual implementation (for example, higher salary than agreed, indication of longer employment) does the parental allowance office request further evidence of the actual working hours (for example, a copy of the hourly account).

Notice:

For many occupational groups, regulations for the assessment of working hours or scope of work deviate from the classic model of working hours. Depending on the activity, the calculation is based on compulsory hours, flight hours, maximum load limits or also on workloads (case numbers).

The regulations made in individual cases follow the needs of the occupational field and can result from service agreements, collective bargaining agreements, EU law or state law.

If it becomes apparent during the examination of the parental allowance application that a special working time arrangement could exist, the maximum number of hours permitted is checked by linear conversion. In relation to a full-time working time of 40 hours, 32 hours correspond to a scope of employment of 80%, 24 hours (e.g. in the partnership bonus) to a scope of employment of 60%.

Example – child born before 01.09.2021:

The father is a teacher with a compulsory number of hours of 27: With a basic number of compulsory hours of 27 per week for teachers, 20.25 compulsory hours (27 * 0.75) correspond to 30 hours of work. A workload of 25 hours corresponds to 16.875 hours.

Example – child born after 01.09.2021:

The father is a teacher with a compulsory number of hours of 27: With a basic number of compulsory hours of 27 per week for teachers, 21.6 compulsory hours (27 * 0.8) correspond to 32 hours of work. An employment volume of 24 working hours corresponds to 16.2 hours.

In the calculation, the number of hours is neither rounded up nor down. Existing different state regulations, e.g. civil servant teachers, must be observed.

How does the parental allowance office check the working time for self-employed persons?

Self-employed persons are also only permitted to work up to 30 hours per week. This does not include work in the applicant’s own household. Applicants must declare that they will not exceed this limit and provide credible evidence to this effect. To this end, they must explain the extent of their working hours in the past and what arrangements have been made in the company to compensate for the reduction in their activity (e.g. hiring a replacement, having existing employees take over tasks, reducing the number of orders carried out in favor of childcare, etc.).

Conclusion:

As long as self-employed persons can plausibly prove their working hours, parental allowance offices have no problems following the application in the majority of cases. A working time account or similar does not have to be kept separately.

2) Eligible income

When considering which income is taken into account for parental allowance, a distinction is first made according to the type of income (employment or income from profits). Which income is relevant for parental allowance is shown here:

Employed (also mini- and midijob)

- Current and lump-sum taxed wages

According to the payroll tax guidelines, these are:

Current wages are wages which regularly accrue to the employee on an ongoing basis, in particular

- Monthly salaries,

- weekly and daily wages,

- overtime pay,

- bonuses and allowances,

- non-cash benefits from the permanent provision of company cars for private use,

- back payments and advance payments if these relate exclusively to wage payment periods ending in the calendar year of payment,

- wages for wage payment periods of the past calendar year that accrue within the first three weeks of the following calendar year.

Self-employed

- chargeable is the taxable profit, i.e. the excess of operating income over operating expenses. Operating income is all operating income that is caused by business operations; this includes income from main, auxiliary and secondary business, in particular

- Current sales

- Sales tax received

- Revenue from the sale of fixed assets

- Free transfers of value

- and many more

3) Non-creditable income – Tip

There are possibilities to earn income while receiving parental allowance that does not reduce the parental allowance. Everyone should at least check whether he has the possibility to make use of this potential. Basically, the principle applies that what did not increase the parental allowance during the prenatal period must not reduce it during the reference period.

Employees in particular benefit

Tax-exempt wage components can be received in parallel with parental allowance in the same way as other/one-time payments without affecting parental allowance. According to the wage tax guidelines, other payments are wages that are not paid as regular wages. Other remuneration includes, in particular, one-time payments of wages that are paid in addition to current wages, e.g.:

- thirteenth and fourteenth monthly salaries,

- one-time severance payments and compensation,

- gratuities and bonuses that are not paid on a continuous basis,

- anniversary bonuses,

- vacation allowances that are not paid consecutively, and compensation in lieu of vacation not taken,

- remuneration for inventions,

- Christmas bonuses,

- additional payments and advance payments, if the total amount or a partial amount of the additional payment or advance payment relates to wage payment periods ending in a year other than the year in which the payment is made, or, if wages for wage payment periods of the past calendar year are received later than three weeks after the end of that year,

- compensatory payments for advance services rendered in the work phase due to a partial retirement relationship under the block model that is terminated before the end of the agreed period,

- payments within a calendar year as quarterly or half-yearly installments.

Tip:

Try to negotiate your options with the employer. In the best case, agree on a basic salary in the amount of the optimal parental allowancePlus gross and the rest is paid out in non-eligible wage types (e.g. in the form of bonuses).

Types of income that are not relevant

Income from private asset management (e.g. from renting and leasing or from capital assets) is not taken into account for parental allowance, nor is other income (e.g. private sales transactions). This means that you can receive your rental income, your interest or your open profit distributions from corporations without offsetting them against the parental allowance.

Caution in the case of pensions or other (remuneration-replacing) benefits

Although pensions and the like are classified as other income under income tax law (Section 22 of the German Income Tax Act) and are therefore not relevant to parental allowance, caution is advised here. Since parental allowance is a payment in lieu of remuneration, it cannot be drawn in parallel with other payments in lieu of remuneration. This applies in particular to maternity leave payments, accident insurance payments, etc. In the case of pensions, it is therefore necessary to check exactly what form of pension is involved, i.e. whether the pension has a remuneration-replacing character or not.

Additional income with basic parental allowance

As a rule, it is not worthwhile to generate additional income while receiving basic parental allowance, because there is theoretically no credit-free amount (except for approx. 105€ gross for salaried employees). This means that the value of your additional income decreases significantly, which means that the effort to generate the income is generally not worthwhile.

Example of additional income Basic parental allowance

The easiest way to illustrate this is with an example:

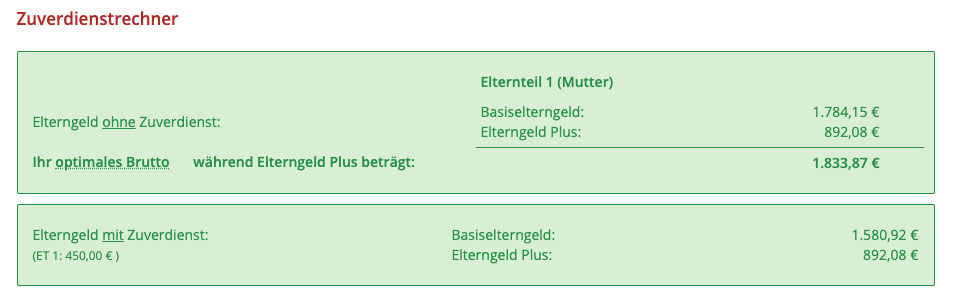

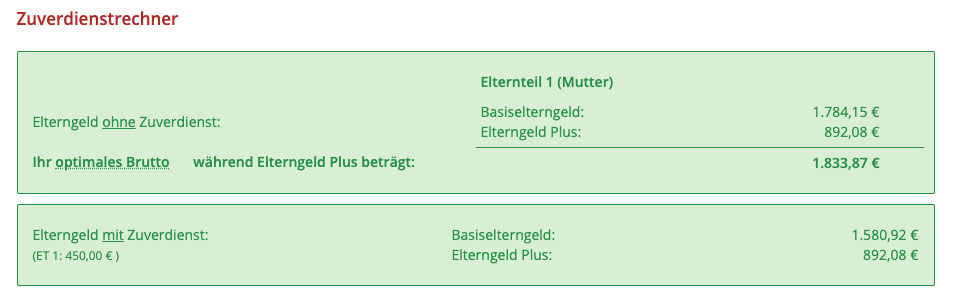

In the example, the mother’s basic parental allowance is EUR 1,784.15. She is now considering taking on a 450 EUR job from month 7 onwards. If she continues to receive basic parental allowance during this time, she will “only” receive 1,580.92 EUR per month of her child’s life. This is 203.20 EUR less, just because of a 450 EUR job. The additional income of 450 EUR per month is therefore worth “only” 246.80 EUR.

The mother should consider whether she receives parental allowance plus from month of life 7, then your parental allowance is not reduced either. The only disadvantage here is that the parental allowance continues until the child reaches the age of 18, but perhaps this is a good fit for her.

Whether additional income during basic parental allowance is worthwhile must always be examined on a case-by-case basis. There are also situations in which we recommend basic parental allowance despite a reduction (see, for example, here: Parental allowance and company car).

Additional income with parental allowance plus

With parental allowance plus, the additional income is immediately more interesting. This type of reference was created by the legislature in 2015, so that the additional income during the parental allowance is worthwhile, because until then, regardless of the timing of the additional income, the crediting dynamics applied as with the basic parental allowance.

But beware: parental allowance plus also has disadvantages, for example that it delays the receipt of parental allowance much longer (making it “less free” to return to full-time work or to generate income without “worrying”) and it is limited to half the basic parental allowance. This makes many parents “too short” financially for too long, which is where the legislator could start by simply increasing the parental allowance plus (additional income bonus or similar).

Example of additional income Parental allowance Plus

We take the same example as for the basic parental allowance. The 450 EUR job during the parental allowance plus period does not result in a reduction of the parental allowance. The mother can therefore earn the 450 EUR during the months of life 7-18 and still receive the 892.08 EUR parental allowance plus (half of the basic parental allowance).

Parental allowance plus is particularly worthwhile for those parents who have

- (wish to) earn additional income before the 12th month of life,

- have a high jointly assessed taxable income or

- would like to be on parental leave for as long as possible and receive monthly parental allowance.

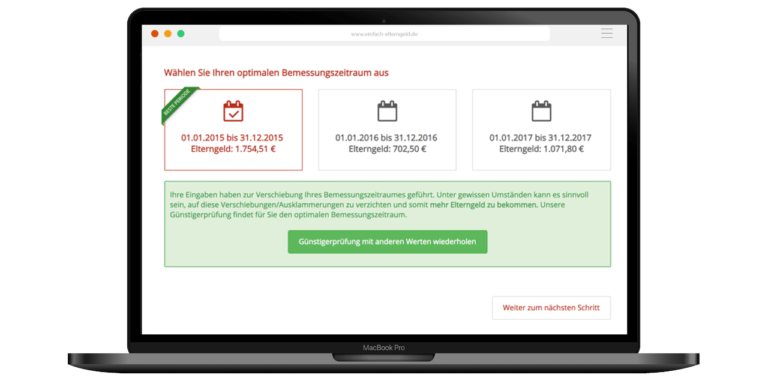

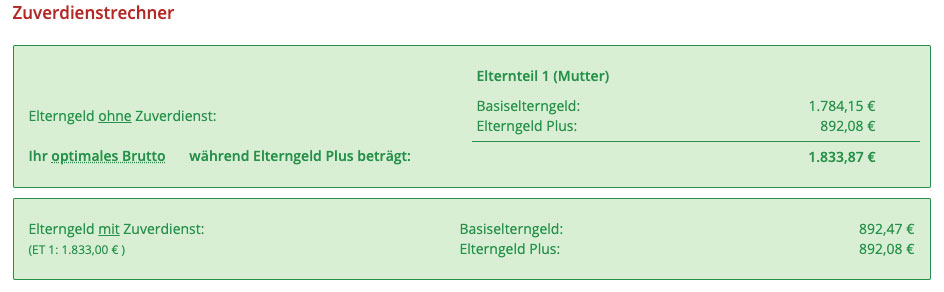

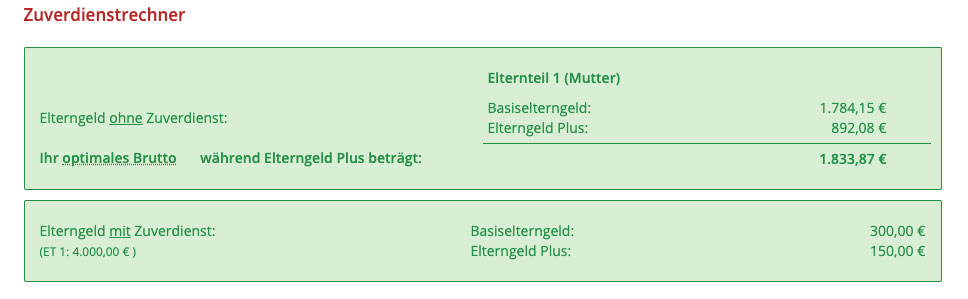

The "optimal" parental allowance plus gross amount

Up to a certain amount, you can earn additional income free of charge while receiving parental allowance plus. However, this is not unlimited; there is a limit above which the parental allowance plus is also reduced. We call this limit the “optimal parental allowance plus gross”. It is basically the gross additional income that can be earned during parental allowance plus without changing the parental allowance.

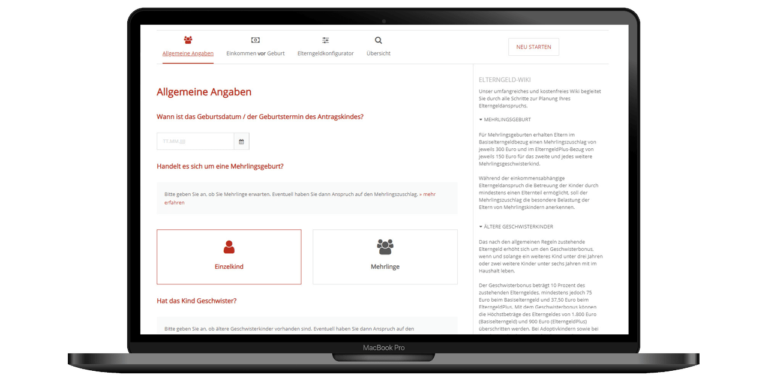

In simple terms, you can earn half of your pre-natal parental allowance net during parental allowance plus (in net). However, it is almost impossible to determine this value specifically for yourself in parental allowance planning and Internet research, as the parental allowance additional earnings calculation is very complex. In our specially developed Parental Allowance Software we have developed an additional earnings calculator that calculates your “optimal parental allowance plus gross amount” for your specific situation. And it does it in a matter of seconds.

In our example, the mother can earn up to EUR 1,833 gross without having her parental allowance plus of EUR 892 reduced. However, if she were to earn an additional EUR 4,000 per month of life, her parental allowance would be reduced to EUR 150 (minimum amount for parental allowance plus):

Our additional earnings calculator is worthwhile for those who are considering earning additional income while receiving parental allowance and for those who would like to apply for the partnership bonus.

Different models of income in reference period

Get the most out of it

In order to find out which additional income model is most suitable for you, a distinction must be made between the types of income in the reference period, because income from employment is treated differently than income from business-profits (like income from a self-employment).

Models of additional income for employees

Since the so-called modified inflow principle of income applies to income from employment, employees unfortunately cannot choose to structure their additional income based on the inflow date of the income.

At least €126.59 in wages/salaries of salaried employees remain free of charge.

Salaried employees whose children were born on or after 01.01.2023 and who are subject to statutory social security contributions can earn up to an additional €126.59 free of charge while receiving the basic parental allowance. The background is the following calculation:

Parental allowance gross in the reference period: 126,59€

minus 26,59€ for flat-rate social security contributions (21%)

less 100€ lump sum for work-related expenses

results in 0€ net additional earnings.

As a result, this amount is not relevant in terms of parental allowance law, even in the case of basic parental allowance.

Income from employment is considered to have accrued in parental allowance law at the moment when it was earned. As a rule, employees receive their wages/salary in arrears, which means that if, for example, you are employed during the parental allowance reference period and do not receive your wages until, let’s say, one and a half months later, outside the reference period, they are still considered to have been received during the reference period.

On the other hand, you can receive wages for previous months during the parental allowance reference period without these wages being taken into account to reduce the parental allowance.

During basic parental allowance, it is not really worthwhile for salaried employees to earn additional income because of the crediting.

In contrast, parents can earn additional income up to the individual limit during ElterngeldPlus (see “optimal ElterngeldPlus gross amount“).

Further notes/info on special employee combinations can be found at the end of this article (below), such as shareholder-managing directors, parents with non-cash benefits (company car/apartment, etc.).

Models of additional income for self-employed parents

Parents with income out of self-employment, such as

- income from agriculture and forestry (§ 13 EStG)

- income from trade (§ 15 EStG) and

- income from self-employment (§ 18 EStG)

distinguish in the reference period first of all according to the way in which they determine their profit under income tax law (method of determining profit).

Self-employed persons generally determine their taxable profit either according to the

- income statement (so-called EÜR) within the meaning of § 4 para. 3 EStG or

- by means of balance sheet accounting (§ 4 para. 1 in combination with § 5 para. 1 EStG).

Both profit determination methods have different consequences in the determination of income in the reference period.

Within the context of the Einnahmen-Überschuss-Rechnung (income statement), the strict inflow and outflow principle of operating income and expenses within the meaning of § 11 EStG (Income Tax Act) applies.

Example:

The father is a commercial sole trader, determines his profit with an EÜR and receives parental allowance in the period from 15.12.2022 up to and including 14.02.2023. In this specific period, he receives operating income in the amount of 4,500€ and incurs operating expenses in the amount of 2,200€ (incl. depreciation).

The profit in the reference period is therefore 2,300€, i.e. 1,150€/LM.

On the other hand, parents who draw up balance sheets are subject to the principle of economic affiliation. The strict inflow and outflow principle of § 11 EStG therefore does not apply here. As a rule, income is deemed to have been received at the time of invoicing – if in doubt, talk to your tax advisor.

The following additional earnings models for the self-employed are currently conceivable:

Self-employment rests in the reference period

When the activity is at rest, that is:

- no working time is performed

- no operating income is generated and

- no operating expenses are incurred,

the parents concerned receive parental allowance without income within the meaning of Section 2 (1) BEEG. A stumbling block are current operating expenses or also depreciation, which accrue in the financial accounting independently of the activity.

==> Particularly suitable for basic parental allowance.

Gap model

In the gap model, employment deliberately does not rest, but parents can become gainfully employed with up to 32 hours per week. Here, they take special care to avoid positive profits in the specific months of life with parental allowance by shifting business income to the gap months and, at best, business expenses to the reference months.

Parents must then show the number of hours per week for the months of life with parental allowance and prove the profit in the reference period by means of profit determination. Optimally, the profit is not greater than “0,-€”, which allows them to receive the unreduced (basic) parental allowance.

==> This is especially suitable for basic parental allowance. Is very bureaucratic, requires close consultation with the financial accounting.

Profit in the amount of the "optimal ElterngeldPlus gross amount"

Like salaried employees, self-employed persons can earn additional income free of charge up to the amount of their individual optimal ElterngeldPlus gross amount.

Parents can find out how much their individual optimal ElterngeldPlus gross amount is with the help of our parental allowance software or as part of our personal parental allowance consultation.

==> is suitable for ElterngeldPlus. Requires high control effort/agreement with financial accounting. Combination with gap model or suspension possible.

Special cases

Parents with income that does not classically arise in the context of a sole proprietorship, e.g. income from participations, must observe special features.

Sometimes it may be advisable for them to claim only the minimum amount or to make a profit distribution arrangement for the reference period. Please contact us in these special cases so that you do not give away any parental allowance (click here for personal parental allowance advice).

Federal Social Court creates legal uncertainty – Decision B 10 EG 4/20 R, dated October 27, 2022

In a decision dated October 27, 2022, the Federal Social Court decided that in a dispute, months with negative income are considered months in which the claimant receives parental allowance without gainful employment within the meaning of Section 2 (1) BEEG. As a result, positive income (profits) from individual months could not be netted against losses from other months of life.

This netting principle formed the basis for the gap model and the income at the “optimal ElterngeldPlus gross” model. These models are therefore in danger of no longer being accepted by the parental allowance offices.

Instead, the parental allowance office would now have to take the average income of all months of life with positive income as a basis and leave out the loss months. This would not only result in considerable additional work in financial accounting for parental allowance recipients, but is also negative for parents in the vast majority of cases.

At present, the full text of the ruling is not yet available. It is currently impossible to estimate the extent to which the parental allowance offices will uphold this legal opinion; such decisions usually take quite a long time, so we do not expect a standardized procedure before the end of 2023.

In any case, we will keep parents up to date.

Report additional income retrospectively

You are not yet sure whether and when you would like to take up part-time employment? We recommend that you initially apply for parental allowance without part-time work, because you can notify the parental allowance office of the start of work later without any problems, but you should definitely notify the parental allowance office of this in good time before starting work. In this case, you should first apply for as many basic parental allowance months as possible. If necessary, you can later convert these into parental allowance plus months (this is only possible for months of life that are still in the future at the time of the change).

If you then know later when you would like to start part-time, it is best to tell us right away the number of hours per week and the expected earnings. As a rule, these must be certified by the employer or, in the case of self-employed persons, must be made credible/projected. Notifying a part-time job after the fact or not notifying it at all is at least a misdemeanor. We advise against this.

Tips and notes

Parental allowance and a parallel additional income can be very complicated in places. Here we give you a few tips for special cases:

Company cars and other non-cash benefits

Monetary benefits are generally taxed as current taxable wages in the salary statement. As a result, non-cash benefits must be taken into account in the reference period to reduce the parental allowance.

Therefore, if you are allowed to continue using the company car while receiving parental allowance, your parental allowance will be reduced proportionately. If the employer pays the running costs (gasoline, repairs, washing, inspection, etc.) in full, it may happen that the parental allowance reduction is offset in view of these savings.

Therefore, check exactly, for example with the help of our additional earnings calculator in the parental allowance software, how high the actual parental allowance reduction is in this case, so that you can estimate whether the “loss” in parental allowance will be compensated in view of the continuing employer benefits.

If the difference is out of proportion, e.g. due to a very high gross list price, you should consider applying for parental allowance plus or officially handing over the company car for the period of parental leave. The latter is evidenced by an employer’s certificate.

Day care workers

Daycare providers who prove their suitability within the meaning of Section 23 of Book VIII of the Social Code may not lose their entitlement to parental allowance even if they work more than 32 hours a week. This requires that they care for no more than five other children in day care in addition to caring for their child or children. Thus, when limited to caring for no more than five children, their own children are not considered, while each child in day care is considered a child for the purposes of this provision, regardless of the specific hours of care.

If a day care worker or a person employed for vocational training is also gainfully employed elsewhere, the hours of gainful employment shall be added to the hours of day care or vocational training. The time spent by the entitled person on day care or vocational training shall be taken into account at a maximum of 32 hours per week. Additional gainful employment as a daycare worker or by persons employed for vocational training is thus possible, provided that the daycare or vocational training comprises fewer than 32 hours per week.

Photovoltaic system

Income generated because of a photovoltaic system is generally income from business operations. The profit (excess of income over operating expenses) reduces the parental allowance proportionally.

If possible, try to schedule the payments from the energy suppliers so that you receive the income outside the parental allowance reference period. If, for example, you receive monthly deductions, this variant is more difficult than if you only receive the statement once a year. If you know the exact date of the annual settlement, you can simply schedule a “gap” in the parental allowance in this corresponding month of life and the photovoltaic system would no longer have a parental allowance-reducing effect.

Nevertheless, in this variant you also have income in the reference period without being actively gainfully employed yourself. This income and the corresponding profit (would be a loss in this case) must be declared when submitting the parental allowance application.

Good planning and consultation with the energy provider, which should take place in good time before the birth, is particularly important here.

Tip:

If you prove that this income is not taken into account for tax purposes (application for simplification or notice from the tax office), the income is also disregarded when determining your entitlement to parental allowance. In the case of photovoltaic systems, this regularly occurs if there is no intention to make a profit. More information in this BMF letter on the intention to generate profit with photovoltaic systems and combined heat and power plants.

Co-entrepreneurs in partnerships (GbR, oHG, KG, etc.)

The special income tax circumstances of partnerships have regularly challenged parental allowance law in the past.

Due to the so-called transparency principle, the profit is deemed to have accrued to the partner who generated it in the corresponding period, to his or her share. As a result, there were parents who were not gainfully employed but nevertheless generated earned income and were thus often only entitled to the minimum amount.

The parental allowance office therefore applied a lump sum by setting the partner’s annual profit share proportionately against the parental allowance entitlement in the reference period. This led to considerable injustice, which is why an affected tax advisor successfully sued against it before the Federal Social Court in December 2018 (case reference: BSG ruling of 13.12.2018 – B 10 EG 5/17 R).

Accordingly, co-entrepreneurs in partnerships can now reduce their profit share to 0% during the parental allowance reference period (informal shareholder resolution is sufficient for this), whereby they can receive unreduced parental allowance. The only other requirement is that you do not make any withdrawals from the partnership during the reference period.

Tip:

Co-entrepreneurs in partnerships should definitely plan their parental allowance withdrawal in detail before the reference period and discuss it with the co-partners. Otherwise, your regular parental allowance entitlement will be severely jeopardized. Get advice.

Shareholder-Managing Director

Shareholder-managing directors of corporations are another special case in parental allowance law. In particular, if they have sole power of representation, they are faced with enormous potential when it comes to receiving parental allowance.

Our basic recommendation here is probably to set a current gross income at the “optimal parental allowance plus gross”, and to exhaust the possibilities of miscellaneous/one-time payments as far as possible.

Alternatively, it is also possible to optimize a basic parental allowance very well via on-call duties for the corporation, which are remunerated with premiums on a one-time basis. Here, too, the following applies: Get advice so that you can apply for your parental allowance in the best possible way.

Volunteer allowance or honorary work allowance

A sideline activity (e.g. as an exercise instructor in sports clubs, as a trainer, educator, supervisor for the promotion of charitable, benevolent or ecclesiastical purposes) is only to be taken into account when determining the parental allowance entitlement if taxable income is generated from this, i.e. if the annual profit exceeds the respective tax-free allowance (until 2020: EUR 2,400/year, from 2021: EUR 3,000/year).

In this case, declare your profits in the parental allowance application. During the reference period, you should try not to exhaust the limits in order to avoid a reduction of the parental allowance.

Proceeds from disposals in the reference period

Have you sold your business (or part of it) during the reference period? Or sold your shares in a corporation? Under tax law, these transactions represent income from a business that is relevant for parental allowance (the taxable profit in each case is decisive). Try to realize the proceeds from the sale outside the reference period, or even better, during the assessment period. Be sure to discuss this topic with your tax advisor.

From the beginning minimum amount

It happens time and again that parents are unable to structure their additional income during the reference period and inevitably fall below the minimum amount. Particularly affected are insurance intermediaries who receive monthly commissions from their brokerage orders and retailers with a retail store or online store who “throw off” sales revenues on a daily basis. Often, these groups of people have little to no ability to generate accounting losses in the reference period. In these cases, to save red tape from the start, you should apply for the minimum amount right away.

Tip:

However, be sure to talk to your tax advisor beforehand to really explore all the possibilities. Perhaps he will recognize potential that you can use.

Notice:

The minimum amount, which is independent of earned income, is not a compensation benefit but a social benefit. This means that no proof of income is required, neither for the assessment period nor for the reference period. The only requirements that must be proven here are that

- you have your domicile/habitual residence in Germany

- you live in the same household as the child while receiving parental allowance

- you do not work more than 30 hours per week during the reference period and

- you have not exceeded the income limit (500,000€ (from 01.09.21 = 300,000€) taxable income for couples) in the calendar year before the birth.

Unfortunately, we have often experienced parental allowance offices that have nevertheless requested further proof of income. We recommend that you do not comply with these requirements. Also, in these cases, the “Declarations of income” of the parental allowance applications do not need to be filled out in detail.

FAQ

-

How much can I earn on top of the parental allowance?

-

Is a 450 EUR job counted towards parental allowance?

-

How much additional income am I allowed to earn with parental allowance plus?

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many ways to make your parental allowance application as simple and straightforward as possible:

You might also be interested in