The annual income limit for parental allowance

Background, Facts and News

In order to be eligible for parental allowance, the applicant must meet various requirements. In this article, we pay attention to the last foundational requirement, the annual income limit within the meaning of Section 1 (8) BEEG.

Here the most important infos on the subject:

- Applicants with “high income” in the calendar year before the birth are by law excluded from parental allowance.

- The limit is currently €200,000 (and will be reduced to 175.000€ for childbirths after March 31, 2025)

- Income from the EU, EEA is included, unlike income from third countries.

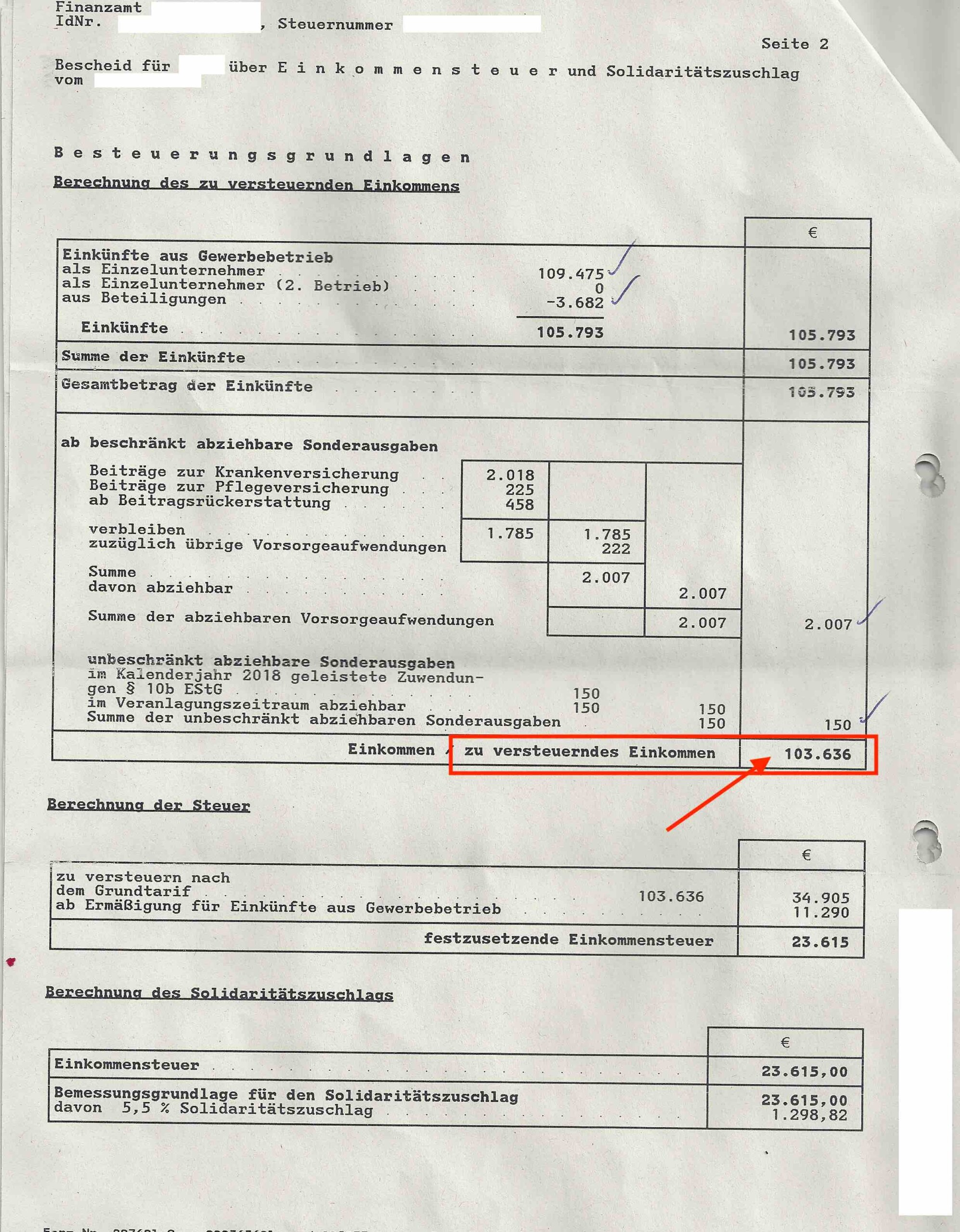

- The income tax assessment (Einkommensteuerbescheid) serves as proof; if this is not (yet) available, the parental allowance may be determined provisionally in accordance with § 8 para. 2 sentence 2 BEEG.

- Former limits were 500.000€, and 300.000€ for childbirths after August 31st, 2021 until March 31st, 2024.

Background Infos on the Limit

The annual income limit for parental allowance is a rigid limit for the social benefit “parental allowance”, which excludes eligible persons from the Allowance. Parents of children born since 01.04.2024 must not have a “taxable income” according to the income tax assessment of more than 200,000€ in the calendar year before the birth.

The “taxable income” is not to be confused with the gross salary, the total amount of income or other income figures. It is a fixed and clear figure in the income tax calculation. If you are unsure what your taxable income is or will be, it is best to consult a tax advisor.

Notice:

The taxable income of the year before the birth counts, not the income of the assessment period under parental benefit law as defined in § 2b BEEG.

Example:

The child is born on November 13, 2024, and the mother is employed (maternity leave startet November 2nd, 2024). The assessment period covers the months of October 2023 to September 2024. The taxable income from January to December 2023 is used to check the income limit.

Tip:

Capital gains that were subject to the final withholding tax within the meaning of Section 32d EStG and are therefore no longer listed in the tax assessment do not count towards the taxable income and are accordingly excluded from the income limit; Guidelines 1.8 to Section 1 (8) BEEG; (however, this is not the case with SG München, judgment dated February 9, 2018 – S 46 EG 87/17).

### Newsticker - Reduction of the income limit to 175.000€ ###

no further news here as the legislation process has finished

Are you impacted? What can you do?

- Check (together with your tax advisor, if necessary) whether you actually exceed the limit; the calculation of “taxable income” is complex.

- Write to your constituency MP, the members of the Federal Family Committee and the Family Minister herself.

- Check to see if you want to co-sign petitions.

- Consider appealing/suing if you receive a denial notice. It is quite likely that the proceedings will be put on hold because those affected may take the matter all the way to the Federal Constitutional Court.

Bundestag discusses the budget of the Federal Ministry for Family Affairs

05. September 2023

The Budget Act 2024 will be introduced in the Bundestag and from 12:45 p.m. to 2:30 p.m. there will be a debate on Section 17 of the Ministry for Family Affairs, Senior Citizens, Women and Youth.

Federal Cabinet approves the draft of the law

16. August 2023

On August 16, 2023, the cabinet approved Finance Minister Christian Lindner’s (FDP) draft budget financing bill. According to the bill, the income limit for entitlement to parental allowance is to be halved to 150,000 euros per year. According to the bill, the new limit would apply to people with joint parental allowance entitlement as well as to single parents.

Reduction would only affect parents whose children are born after 2023

09. July 2023

The Federal Ministry of Family Affairs confirms to the media that parents whose children will still be born in 2023 are not affected by the change in the law, meaning that the “old” income limit of €250,000 (single parents) or €300,000 (couples) still applies to them.

The constitutional lawyer Professor Gregor Kirchhof of the University of Augsburg considers meanwhile changes at the schedule for necessary.

“From a legal point of view, a significantly longer transition period is required in any case”,

said the expert in mid-July to Bayerischer Rundfunk.

The situation of couples who are currently expecting a child and would be affected by the new regulations from January is particularly problematic, he said. The planned cancellation of parental allowance for incomes of 150,000 euros or more would apply to births after January 1, 2024. Those already receiving parental allowance would still be eligible – as would parents whose child is born by the end of the year.

Those who decided to have offspring in the confidence that they would be entitled to parental allowance would no longer be eligible under the federal government’s current plans if the child is born from January 2024 and the parents are above the income threshold.

Expectant mothers who were already pregnant at the moment of the government’s decision could therefore also be affected.

Prof. Kirchhof comments:

“Cancelling parental benefits for partners who are expecting a child as a result of pregnancy is very problematic in terms of the protection of legitimate expectations. In constitutional law, the principle of a gentle transition applies. A complete cancellation of parental allowance without sufficient transition rules would contradict this.”

The media magazine “Quer” had numerous discussions with professors of constitutional law and of tax law on the planned changes to parental allowance. While individual experts saw rather no injury of the confidence protection, the majority of the asked professors would be the view that a failure of the law in its currently planned form before the Federal Constitutional Court would be at least possible.

For Prof. Christian Seiler, an expert in constitutional law from Tübingen, it is a difficult constitutional balancing act:

“According to the principle, citizens must always expect that the laws currently in force will be changed with effect for the future. However, if the state has established a trust of the citizens that is worthy of protection, the transitions must be designed appropriately. It is difficult to predict whether the Federal Constitutional Court would assume this for the rather short-term change in the parental allowance regulation.”

The Federal Ministry for Family Affairs made no reference to the aspect of the protection of legitimate expectations when asked by Bayerischer Rundfunk. Instead, the ministry cited precedent as evidence for the constitutionality of the short-term parental allowance amendment.

“A cut-off date regulation, according to which parents whose child is born on or after a cut-off date are not entitled to parental allowance, is constitutional. This was decided by the Federal Constitutional Court on the occasion of the introduction of parental allowance (non-acceptance decision of April 20, 2011, 1 BvR 1811/08). At the time, this concerned parents who, due to their income, would not have been entitled to the previous parental allowance, but who were entitled to parental allowance and whose child was born before the cut-off date for the introduction of the parental allowance regulations.”

However, experts see a serious difference between the case back then and the situation today: back then, lawmakers introduced additional benefits; today, existing benefits are to be eliminated.

Prof. Seiler of the University of Tübingen does not consider the ministry’s argumentation to be valid:

“The decision of the Federal Constitutional Court cannot be applied to the issue at hand. At that time, the court correctly determined that the principle of equality does not preclude cut-off date regulations when a new benefit is introduced. Today, the question is whether and to what extent citizens may trust in the continued existence of currently applicable laws.”

Prof. Kirchhof also rejects the ministry’s legal reasoning:

“Constitutionally, a distinction must be made between whether a benefit is granted on a cut-off date or whether it is to be reduced or withdrawn. The protection of trust of beneficiaries in an existing benefit is significantly higher. The Basic Law urges a gentle transition here.”

Plans became known for the first time

Beginning of July 2023

In view of a “tight” federal budget situation, Federal Finance Minister Christian Lindner asked Lisa Paus, the Federal Minister for Family Affairs, to discuss potential savings in her department. Ms. Paus proposed (reluctantly, according to her own information) to lower the income limit for parental allowance to EUR 150,000. The proposal was approved by the federal cabinet on 05.07.2023, before the parliamentary summer recess.

You might also be interested in