Parental allowance and tax return - how parental allowance is taxed correctly

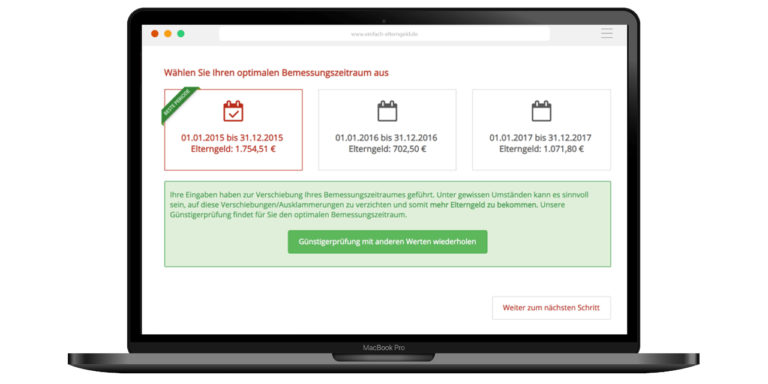

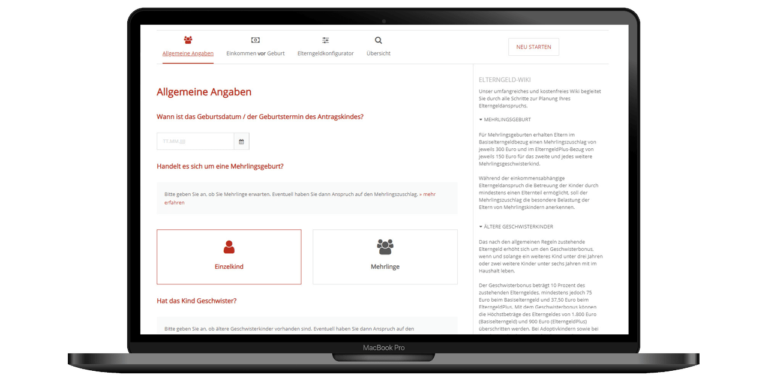

Money is often tight during parental leave and parents need information on taxation of parental allowance. Many parents try to keep their monthly income as high as possible. It is not uncommon for the working partner to switch to the most favorable tax bracket 3. But what helps at first can prove to be an expensive mistake later on: This article explains what effects parental allowance has on income tax. In another article, you can read how you can receive a higher parental allowance by applying for parental allowance: Tax class change

The most important facts about parental allowance and income tax

- Anyone who receives more than €410 in parental allowance in a calendar year must generally file an income tax return and pay tax on their parental allowance.

- Parental allowance is tax-free, but increases the average tax rate when filing the income tax return.

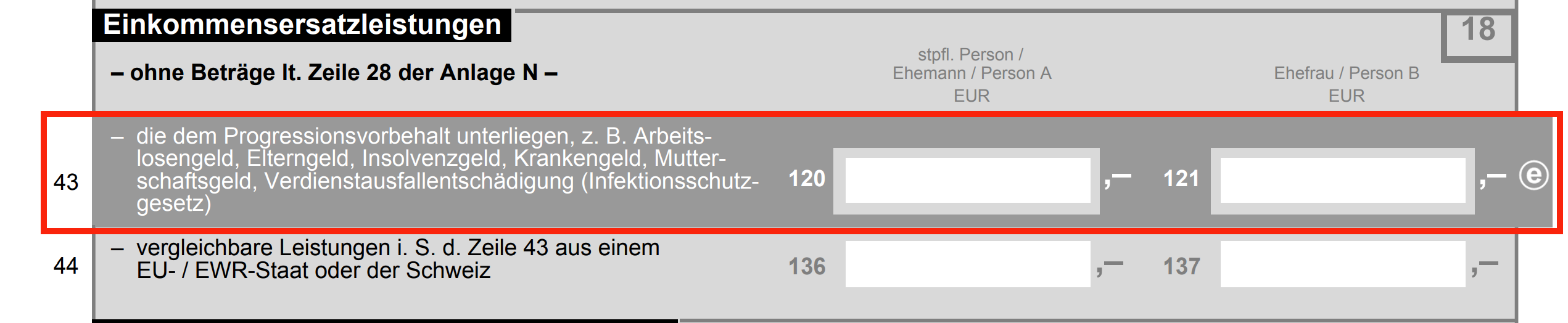

- Parental allowance is entered on the jacket sheet of the income tax return (line 43).

- The parental allowance office has already notified the tax office of the specific amount of parental allowance you received in the calendar year (electronic data transmission).

The most important tips and advice on parental allowance and tax returns

- The lower the taxable income in a calendar year, the weaker the progression effect.

- Parents who are assessed together, where one earns very well and the other has a high parental allowance, are hit particularly “hard”.

- Set aside money for back taxes if the working parent pays income tax at wage tax bracket 3 during the partner’s parental leave.

- Have your tax liability calculated early to avoid any “bad surprises”.

- The inflow principle applies to progressive income. If parental allowance starts around the turn of the year, plan carefully in which year it is wiser to receive the first (back) payment from the parental allowance.

- It may make sense to spread the inflow of parental allowance through parental allowance plus over several tax assessment periods to mitigate the progression effect.

Is parental allowance subject to income tax?

No, it is even explicitly tax-free, see § 3 No. 67 lit. b) Income Tax Act. This means that the parental allowance is transferred 1:1 by the parental allowance office without tax deductions. However: According to § 32b para. 1 p. 1 lit. j) Income Tax Act, the parental allowance is subject to the so-called progression proviso. The progression proviso refers to a special calculation process in the income tax calculation, in which tax-free benefits, indirectly increase the tax rate on taxable income.

The best way to explain this is with a simple example:

Your taxable income in 2019 is EUR 50,000. The tax rate is (estimated) 25%, so the income tax is EUR 12,300. Now the tax office checks whether you have received so-called progression benefits (parental allowance, maternity leave payment, sickness payment, unemployment payment I, etc.) in this year. Let’s assume that you received 10,000 EUR parental allowance. Your “fictitious” taxable income is now 60,000.- EUR, the tax rate would be approx. 27%.

Now this (higher) tax rate is applied to your original taxable income. So on 50.000,- EUR now comes a tax rate of 27%, instead of 25%. The income tax increases by 1,200.- EUR to 13,500.- EUR due to the parental allowance. The effect of the parental allowance in this example is therefore €1,200.

How is parental allowance taxed? Entering parental allowance in the income tax return.

Parental allowance, like other income replacement benefits subject to progression (ALG I, maternity leave payment, sickness benefit, short-time allowance, etc.), is entered on line 43 of the tax return, separately according to the recipient and type of benefit.

The parental allowance office has already transmitted the amount of your parental allowance to the tax office electronically. If you participate in the electronic data retrieval procedure, you can automatically transfer the parental allowance to the correct line.

Tip:

As a rule, the employee lump sum of €1,000 is deducted from the parental allowance, which reduces the progression effect and effectively saves taxes.

However, the tax office does not currently deduct this lump sum if higher income-related expenses than €1,000 have already been deducted from taxable income from employment.

A constitutional complaint has been lodged against this. It is currently pending before the Federal Constitutional Court under file number 2 BvR 3057/14. We recommend filing an appeal for all affected assessment periods in order to have the lump sum deducted from the parental allowance in these cases as well. Last but not least, this is necessary to ensure equal treatment with self-employed persons, for whom all business expenses are regularly taken into account to reduce tax and the lump sum is additionally deducted from parental allowance.

Due to the pendency of the case before the Federal Constitutional Court, the appeals are likely to be suspended by law until the Federal Constitutional Court reaches a decision.

How do I avoid an additional payment for income tax?

Income tax is an annual tax. This means that the tax office checks with your tax return how much income tax you have to pay for the past calendar year. Whether you have to pay tax in arrears or receive a refund depends on how much you have paid in advance. There are different variants of income tax prepayments. The best known are probably:

- the payroll taxes (employees, civil servants, etc.),

- the quarterly advance income tax payments (self-employed, tradesmen, landlords, etc.) and

- the capital gains taxes.

If you are assessed alone (single, permanently separated, etc.), there is generally only an increased risk of an additional payment if you have above-average taxable income while receiving parental allowance (for example, due to rental income or similar).

Couples assessed together should examine the situation more closely. The greatest risk of an additional payment exists if both parents earned above-average wages before the birth and after the birth one parent receives the maximum amount of parental allowance while the other partner changes to tax class 3 with a continued high income or – if self-employed – has the advance income tax payments reduced.

FAQ

-

Where do I enter parental allowance on my tax return?

-

How much tax do I have to pay in arrears because of parental allowance?

-

When does parental allowance have to be taxed?

-

Is parental allowance taxable?

-

Do I have to file an income tax return because of the parental allowance?

You might also be interested in