Increase parental allowance | Tips and tricks

How can you get more parental allowance simply and easily?

Parental allowance replaces prenatal income as a payment replacement benefit. In this article, we show ways in which you can increase your parental allowance entitlement.

Here is the most important info on the subject:

- Parental allowance is at least 300€, but no more than 1,800€.

- The earlier one deals with the topic, the more chances of optimization one has

- Those who are entitled to the maximum amount do not necessarily have to worry about the increase, but focus on the reference period

- Salaried employees can increase their parental allowance by influencing their parental allowance-relevant income

- A change of tax class can also make sense, but it does not have to be mandatory

- Self-employed persons also have several options for increasing their parental allowance

- However, each optimization should be checked against the tax situation to determine whether it is advantageous for the bottom line.

Tips for employees

Employees should first determine the relevant assessment period. The assessment period is the prenatal comparison period that determines the amount of gross income relevant for parental allowance. Due to exclusion and postponement facts, the determination of the assessment period can become difficult, it is best to use for this purpose our free parental allowance calculator.

Once the assessment period has been determined, you can now check to what extent the gross income relevant for parental allowance can be increased. There are various options here:

Waive deferred compensation

Many employees benefit from the tax exemption of salary components in favor of company pension plans. It is often forgotten that the tax exemption means that the lower salary is included in the parental allowance assessment basis.

Example:

3,000€ current taxable gross, but 200€ of this is tax-free under deferred compensation -> only 2,800€ of parental allowance is still relevant, which with tax class 1 is almost 70€ less basic parental allowance per month.

Notice:

It is advisable to check the risks that may be associated with this. For example, in the case of contracts that also cover occupational disability insurance, a new health check may be necessary.

Spread one-time payments over other months

As is generally known, one-time payments and other benefits are unfortunately not taken into account in the calculation of parental allowance. This problem can be avoided if the one-time payments are distributed over the current months. Talk to your employer whether such a solution would be possible (possibly for a limited period). The effect is not negligible:

Example:

3,000€ current taxable gross and a one-time payment of 3,000€ in November of a year (classic Christmas bonus). In this case, the parental allowance amounts to 1,206€ per month of life in the basic parental allowance. If the one-time payment is paid out spread over all months, the parental allowance-relevant gross increases by an average of 250€ to a total of 3,250€, resulting in a basic parental allowance of 1,290€, which represents over 80€ more per month.

Example:

It is best to address this issue with your employer when you first want to have a child, but no later than when you become aware of your pregnancy, because the effect is weakened with each passing month.

Wage increases and overtime

Of course, it is positive for the parental allowance amount if you receive a pay increase, perhaps now is the perfect moment to enter into salary negotiations with the employer. Instead of working off overtime, you should check whether the employer would be willing to pay out the overtime with the salary as gross income relevant for parental allowance.

Is it worth changing tax classes?

The highly praised and repeatedly cited “trick” of parental allowance optimization has a sunny and a dark side. Those who meet the requirements of having tax class 3 in the majority of the calendar months of the assessment period – more on this in our article Parental allowance and tax class – can expect a significantly higher parental allowance.

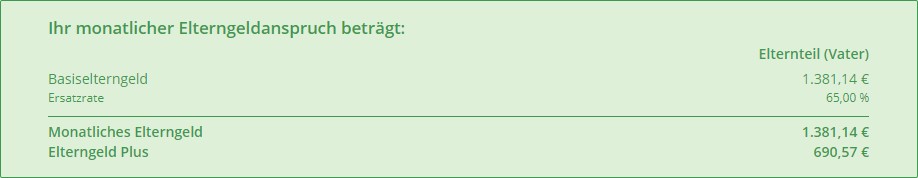

With a gross income of 3,000€, one receives a basic parental allowance of 1,206€ with tax class 4. With tax class 3, on the other hand, you can expect a basic parental allowance of €1,381:

That is more than 175€ more per month. But, as a rule, the partner receives the unfavorable tax class 5, which not only significantly weakens the actual prenatal net income, but also noticeably reduces his parental allowance entitlement. To stay with our example, this means that the partner only receives a parental allowance of only 986€.

Conclusion:

You should first check whether you can still change the tax class that is relevant for parental allowance. In the next step, you should be aware of the consequences (possibly lower actual net family income until the birth, which will be compensated by the tax return and possibly significantly lower parental allowance of the partner).

Tip:

In the year of the wedding, you can also change your tax class retroactively.

Tax class 3 for both parents

Many parents do not know that with good planning and a bit of luck, it is possible to create a situation where both parents benefit from the favorable tax class 3. All that is required is that both parents had tax class 3 in the individual assessment period.

The following example shows what this can look like:

- Date of birth: 16.12.2021

- In principle, both parents are employed

- In 2020 the father has tax class 3, the mother has tax class 5

When the pregnancy becomes known, they change the tax classes, so that the mother gets tax class 3 (maternity leave starts at the beginning of November, so the assessment period is 11/2020 to 10/2021 -> she must have tax class 3 in her pay check by May 2021 at the latest).

The father must only be actively self-employed in the period January 2020 to November 2021 at the latest (month before birth), then 2020 will be taken as a basis for him. There, he had tax class 3, which means that both parents will have tax class 3 as the basis for calculating the parental allowance.

Notice:

The disadvantage is that tax class 3 also counts for the net calculation in any additional earnings for both parents, regardless of the actual tax class in the reference period. To avoid surprises, you should seek advice.

Tips for self-employed

Self-employed persons should first check which assessment period and which income will be decisive for the calculation of parental allowance. In principle, the calendar year before the birth counts, although another calendar year can be used as a basis due to so-called postponement facts.

With the help of our free parental allowance calculator you can determine your assessment period quickly and easily. In the next step, you should be clear about which profit counts for you. In the video linked above, we go into detail about the different profit determination variants. Basically, however, you can remember that the taxable profit is decisive.

Maximum amount check | Minimum profit

Perhaps you are one of the lucky people who do not have to worry about optimization because you have already reached the maximum amount of parental allowance of 1,800€ due to the amount of your profit. You will have reached the parental allowance maximum amount if you give birth in 2021 with a taxable profit in 2020 of 39,680€. However, this figure only applies to you if you are exempt from the statutory social security obligation and also did not have to pay church taxes.

Notice:

Nevertheless, you should consider parental allowance consulting, because in your case the focus will be on the reference period, so that solutions can be found to ensure that you actually receive the unreduced maximum parental allowance.

Increase the profit for parental allowance

If the amount of your relevant profit does not bring you within the maximum amount of parental allowance, we recommend that you check extensively to what extent an increase in your taxable profit in favor of a higher parental allowance makes sense. Here, you must adhere to the tax regulations, because the parental allowance law is based on the tax law. We would like to present the following options for profit optimization:

Control operating income

As far as possible, you should receive / recognize your business income relevant for tax purposes in the calendar year of the assessment period (depending on the profit determination method). So try especially around the two turns of the year to control the invoicing / incoming payments accordingly, already even if there is a desire to have a child and no pregnancy has been confirmed yet.

Control operating expenses

If possible, you should receive / recognize your operating expenses outside the calendar year of the assessment period (depending on the profit determination method). So try especially around the two turns of the year to control the invoicing / outgoing payments accordingly, already even if there is a desire to have children and no pregnancy has been confirmed yet.

Last resort: Do not declare operating expenses

If absolutely necessary, you can also waive the recognition of operating expenses; this is possible under tax law, but may not make sense from a tax perspective.

Notice:

You should only go this route if various trial calculations by the tax advisor and parental allowance advisor confirm the advantage of the higher tax profit with regard to the higher parental allowance. Otherwise, you run the risk of losing the additional parental allowance due to a higher income tax burden.

You might also be interested in