Positive ruling for co-entrepreneurs in business partnerships

The annual profit of a person participating in a business partnership (e.g. GbR, oHG, KG, etc.) is not credited proportionally to the parental allowance if the parent has waived this according to the partnership agreement (so-called profit distribution resolution).

The Federal Social Court awarded an increased parental allowance to a co-entrepreneur in a civil law partnership (tax consultant) in a ruling dated December 13, 2018 (Case No. B 10 EG 5/17 R). She had run a tax office together with her brother. Both had regulated in the partnership agreement that a co-entrepreneur who was not professionally active due to parental leave should not receive a share of the profits.

When this case occurred, the tax advisor neither made withdrawals from her shareholder account, nor did she participate in the profits of the GbR for the period in which she received parental allowance. The parental allowance office nevertheless granted her only minimum parental allowance in the amount of 300 euros per month.

Wrongly, as the judges at the Federal Social Court found. The law does not (or no longer) provide for recourse to the tax assessment and attribution of fictitious income after the amendment to the parental allowance law of September 10, 2012 (Gesetz zur Vereinfachung des Elterngeldvollzugs, BGBl 2012 Teil I Nr. 42).

In view of the new legal provisions, the previous case law was adapted, according to which a shareholder’s annual profit was also to be credited proportionately as income during the reference period if the shareholder had waived his profit during the parental leave.

Parents who are affected by the unfavorable ruling and may only receive the minimum amount are advised to contact their parental allowance office with reference to the current ruling.

Co-entrepreneurs who are yet to apply for parental allowance are nevertheless advised to seek detailed advice, as the bureaucratic hurdles for correct application are still comparatively high.

Too complicated? - Our tip

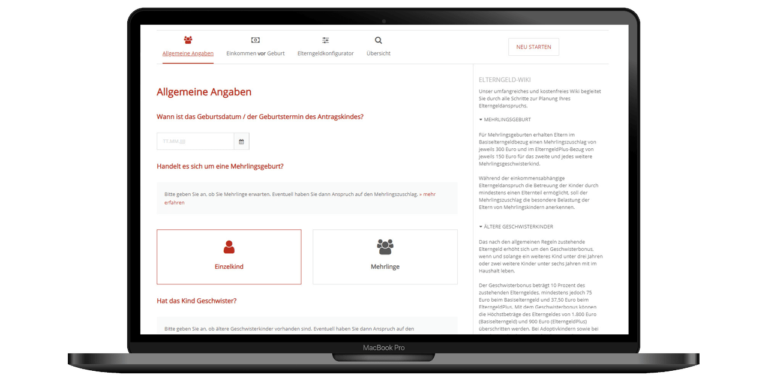

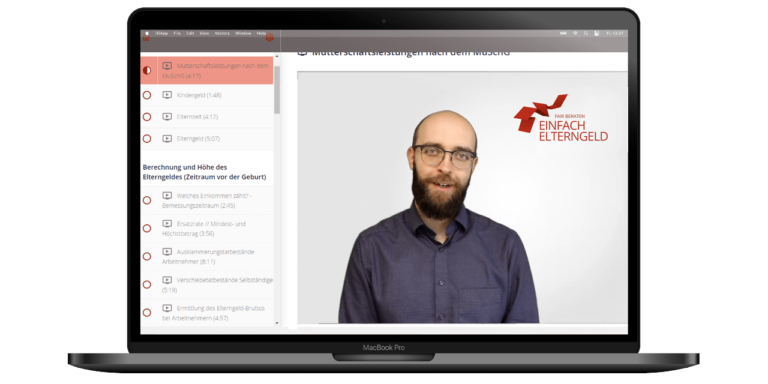

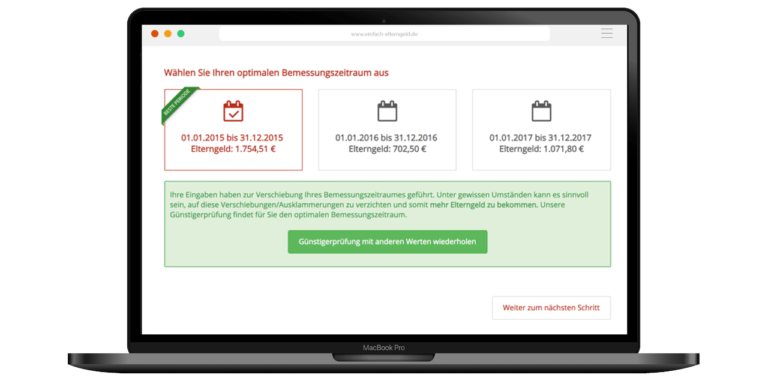

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in