The partnership bonus months

08.07.2020

The partnership bonus in the parental allowance is a reward for those parents who share care and education for a period of time after the birth of their child and work part-time during that time.

This article explains exactly what the Partnership Bonus is and what you should look out for when you apply for the Partnership Bonus months:

- ✔ The partnership bonus months are Parental AllowancePlus months

- ✔ The bonus amounts to a minimum of 1.200€, maximum 7.200€

- ✔ The bonus months can only be applied for on four consecutive months of the child's life at the same time

- ✔ Both parents must work at least 25 and no more than 30 hours per week during these four months of life

- ✔ The partnership bonus months can also be applied for retroactively

- ✔ If you were planning to work part-time together anyway (or were working together before the child was born)

- ✔ Who can adapt the working time very flexibly and in the best case can positively influence the additional earnings/profit in the four months

What is the partnership bonus?

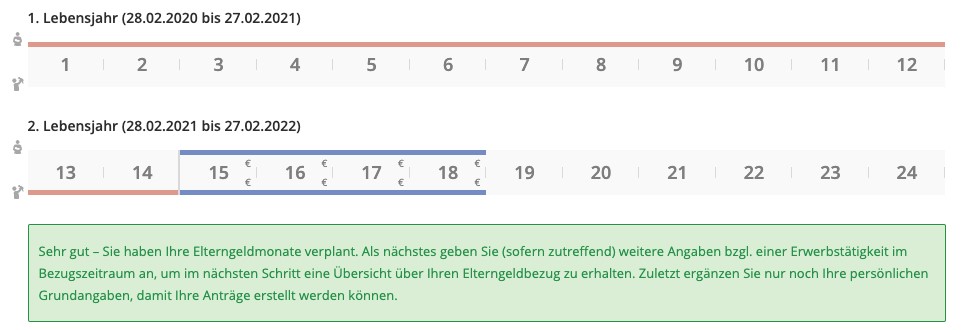

The so-called partnership bonus months are eight additional parental allowances plus months (four per parent), which can be claimed for four consecutive months of the child's life. In order to be eligible for Partnership Bonus Months, two conditions must be met:

- The general prerequisites for receiving parental allowance must be fulfilled by both parents for four consecutive months of life, and

- both parents must work at least 25 hours a week during this period and at most 30 hours a week in each of the four months of life.

The legislature thus promotes part-time employment for both parents with the aim of ensuring that the care and upbringing of the child is taken over by both parents to the greatest extent possible and that both parents "gently" return to work.

The partnership bonus can be claimed at any time after birth, so you do not have to apply for the "basic entitlement" first. Due to the forced part-time employment, however, the months are regularly applied for at the end of parental benefit receipt.

For whom are the partnership bonus months worthwhile?

In everyday consulting, the question often arises "Is it worth it for us? - As is so often the case with parental allowance, this question cannot be answered in a generalized way. It depends on your individual situation.

However, experience has shown that the partnership bonus months are claimed if both parents want to work part-time after the birth anyway. If the prerequisites for the bonus are, so to speak, fulfilled anyway. In this case one should definitely consider taking the minimum subsidy of EUR 1,200 for the family with you.

In addition, we recommend that parents consider the partnership bonus, as they can easily influence/design their working hours and additional income. This applies in particular to self-employed persons and tradesmen, managing partners and co-entrepreneurs in partnerships. You can read more about this below under Structuring the parental allowance through the partnership bonus months.

How is the bonus calculated?

The Partnership Bonus Months are "normal" Parental AllowancePlus Months with additional income. This means that the normal basic rules for additional income in Parental Allowance Plus.

Do I have to take anything into account when applying?

Yes, because what sounds great in the first moment can become a nightmare in the next moment. The current legal situation provides for the following procedure when applying for the partnership bonus: The bonus months are first provisionally approved by the parental allowance office after the expected working hours and the expected income in the period have been forecasted/credicted.

This means that after the partnership bonus months, the Parental Benefit Office will re-examine the eligibility. If, for example, the working hours have not been adhered to (also due to sickness-related absences with sick pay (!) or due to a one-time under- or overrun of the working time corridor - for example due to a flexible working time regulation), the entire partnership bonus is cancelled for both parents. And this can be expensive, especially if both parents have received more than the minimum amount.

It should also be noted that under the current legal situation the partnership bonus months do not constitute a separate type of benefit, but are counted as part of the Parental AllowancePlus months (with income). If parents have optimally designed their Parental AllowancePlus reference period (income in the amount of the gross income that is not taken into account), there is a risk that this construct will be jeopardised by the bonus, because the part-time income during the partnership bonus months generally increases the overall average income in the Parental AllowancePlus reference period and thus leads to a reduction of the parental allowance. In this case, the reference period should therefore be planned and calculated precisely, as otherwise you may be surprised by repayments.

Designing the parental allowance through the partnership bonus months

The partnership bonus months offer especially self-employed persons and employees with a lot of room for manoeuvre (managing directors, employees in family businesses, etc.) a lot of possibilities. However, one must not overdo it with the optimisation, as a social court decision of the Social Court of Stuttgart (decision of 07.06.2019 - Az: S 9 EG 3281/18) shows:

In the case of the ruling, the family father was a partner-managing director of his GmbH. The child's mother fulfilled the requirements of the partnership bonus without any further problems. The father, however, agreed - with himself (as fundamentally possible due to his position in the company) - on a weekly working time of 25 hours. However, he did not pay money as a salary, but only taxed his company car (gross list price: just over EUR 159,000) as part of a non-cash benefit. This even kept him within the scope of his credit-free allowance and he was able to claim EUR 3,600 Parental AllowancePlus during the partnership bonus months.

The Parental Benefits Office argued that the information on income and the number of weekly hours of 25 hours during the partnership bonus months was not credible and that the legal arrangement was abusive.

The Stuttgart Social Court has now confirmed the decision of the Parents' Benefit Office.

In the opinion of the Social Court, the plaintiff was not entitled to parental allowance during the partnership bonus months, as the legal structure chosen by him circumvented the meaning and purpose of the partnership bonus months and would therefore constitute an illegal exercise of rights.

On the one hand, the chosen legal structure had a favorable effect on the amount of the parental allowance. On the other hand, the waiver of salary was effected promptly after the reference period, since the plaintiff did not receive any salary during the first seven months of his life, but only at the beginning of the eighth month of life.

In addition, the plaintiff had, according to his own statements, only made this legal arrangement in order to achieve a wage payment by the receipt of parental allowance which exceeded the monetary advantage for the use of the car. Thus, the income was not lost due to the care of the child, but due to the decision of the plaintiff as managing director to reduce his own salary in order not to burden his own company with a managing director's salary, but to claim social benefits in return.

This contradicted the purpose of the partnership bonus months, which was to secure the economic existence of both parents in the long term, to reduce the risk of dependence on state transfer payments, to secure time with the child for fathers and mothers without losing touch with working life and to improve women's career development opportunities.

This objective is accompanied in particular by the fact that, in the case of a new job, not only must the working time be between 62.5 and 75% of a full-time job, but this must also be reflected in the salary paid for it. This was not the case with the plaintiff.

Finally, the plaintiff's legal structure did not correspond to what was customary among strangers, so that the third-party settlement also argued for the inadmissibility of the legal structure.

FAQ - Parental allowance and partnership bonus

What is the partnership bonus?

The partnership bonus is a special support for parental allowance if parents work part-time for four consecutive months of their child's life.

When do I get the partnership bonus?

The partnership bonus is granted provisionally upon application. As a rule, parents take the partnership bonus after receiving parental allowance, but you can claim it during the "normal" parental allowance period.

What is the difference between the affiliate months and the affiliate bonus months?

The partner months are two additional basic parental allowance months that parents receive when their partner also applies for parental allowance.

The Partnership Bonus is an additional support that goes beyond this with four additional Parental AllowancePlus months per parent.

How much is the partnership bonus?

The partnership bonus is at least €300 per month of life for both parents (€150 per parent). Those who earn less compared to their prenatal income can receive a higher bonus, even up to 1,800€.

The maximum partnership bonus is therefore 7,200€ (1,800€ for 4 months).

Too complicated? - Our tip

The parental allowance rules can be complicated. Make it easy and, like many other parents, use our services to get the most out of your parental allowance. We offer you many possibilities to make your application for parental leave as easy and uncomplicated as possible:

Parental Allowance Course Parental Money Software Personal Consultation