Parental allowance for the second child

They are certainly the most common questions in the context of parental allowance:

- “How much parental allowance will I receive for my second child?”,

- “Will I receive the full parental allowance for my second child?” or

- “When is the best time to have a second child for parental allowance purposes?”.

Unfortunately, there is no simple or blanket answer to this question, because it depends – on your individual situation. In the following article, we explain how the parental allowance for your second child is calculated and give you tips on how you can even increase your parental allowance with your second child.

Here are the most important facts about parental allowance for the second (next) child:

- early planning is useful

- the next parental allowance can be even higher due to the sibling bonus

- The earlier the next child is born, the easier it is to receive the “full” parental allowance

- There are tricks/design leeway to use exclusion and deferral facts in your favor

- An ongoing parental leave should be terminated prematurely in accordance with Section 16 (3) sentence 3 BEEG in order to receive maternity leave payments again

- If necessary, you should shorten the current parental allowancePlus payment to avoid double payment.

Calculation of parental allowance for the second child

First of all, it should be mentioned that the parental allowance is always calculated according to the same principle, no matter how many children you already have. So here is an overview of how the parental allowance is calculated for the second child (or even third, fourth, etc.).

1) Determination of the original 12-month comparison period before birth

In principle, the 12 calendar months before the birth of the second child are used as the comparison period. However, if you were self-employed in the period since 1.1. of the year before the birth of the child (only one day is sufficient!), the period from January to December of the previous year of the birth applies.

2) Examination of exclusion and deferral facts

a) Exclusively employed

If you were exclusively employed during the original (initial) 12-month period, a check will be made to see if your period shifts or splits. Reasons for postponement/splitting may be: Maternity leave payment receipt (also around the birth of older siblings), parental allowance receipt of older siblings, but only up to their 14th month of life, or a loss of earnings due to a pregnancy-related illness during this period. This can be illustrated by an example as follows:

The original comparison period would be the 12-month period before the birth of child 2. This means May 2019 to April 2020, but there are now so-called exclusion and deferral facts as follows:

Thus, the comparison period for Child 2 splits and now includes two sections:

The income from this period is used to calculate the parental allowance for child 2. Unfortunately, the two months of May and June 2019, in which parental allowance plus was still received by child 1, are not excluded, which is why the parental allowance for the second child may be lower, because the parental allowance for child 2 cannot “arise” from parental allowance for child 1.

Parents of children, which were born before September 1st of 2021 can unfortunately not waive any exlusion criterias, so these parents can not benefit from the test of the most favorable assessment period. But parents of children which were born after August 31st of 2021 can enjoy the favorability test regarding their assessment period. More infos on tagt can be found in our Article regards the Parental allowance reform 2021.

As you can see, the parental allowance calculation for the second child is very much dependent on your individual situation. Therefore, take advantage of our free Parental allowance calculator, which quickly and easily shows you your comparison period. This allows you to easily and clearly plan your parental allowance.

b) (partially) self-employed

In the case of self-employed persons, it is somewhat easier with the deferral facts, because they are always based on full calendar years. The facts are the same as for salaried employees. Let’s take our example from 2a):

The original comparison period would therefore be the last calendar year before the birth of child 2, i.e. January 2019 to December 2019. However, there are so-called exclusion and deferral events as follows:

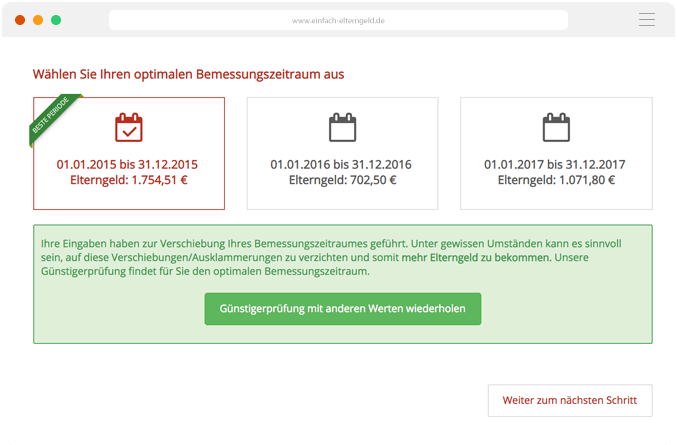

Self-employed persons can choose which comparison period is most favorable for them as part of a favorability test:

Option 1: January 2016 to December 2016

Option 2: January 2017 to December 2017

Option 3: January 2018 to December 2018

So you check which year’s earnings are the highest and, of course, which social security deductions result in the highest parental allowance taken as a whole, and you request that this comparative period be taken into account as part of your parental allowance application.

Important Tip:

Whoever starts a (small) self-employment after the birth of a child is then considered self-employed for the next child, which is why in these constellations the parental allowance amount often corresponds to the parental allowance from the sibling, especially if the children were born “close in time” one after the other. Read about this parental allowance “Trick” here.

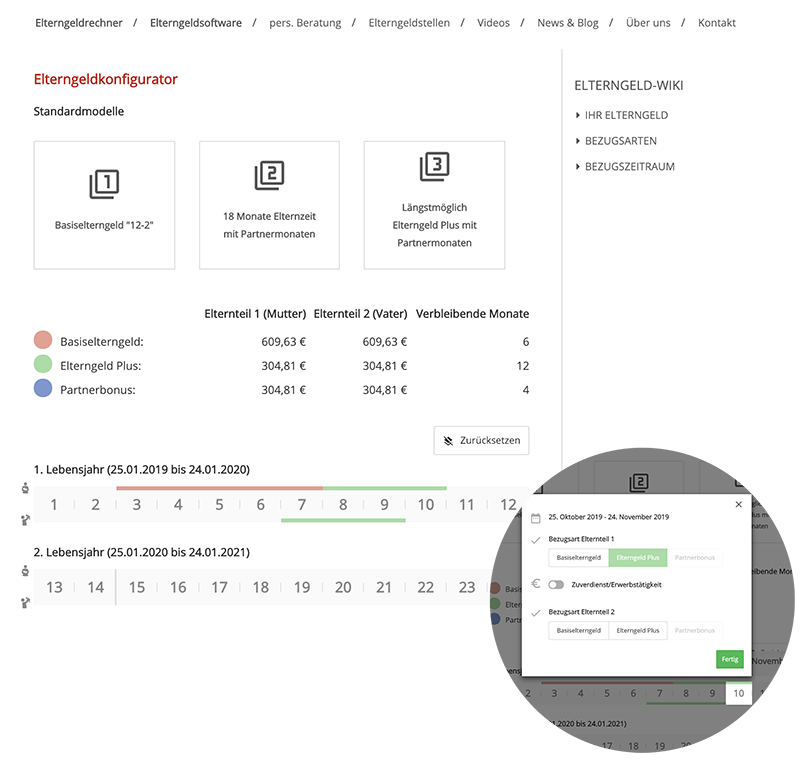

The calculation of parental allowance for the second child depends very much on your individual situation. Especially in the case of self-employed persons, there are many design options. Therefore, take advantage of our free parental allowance calculator, which quickly and easily determines your comparison period and calculates your different parental allowance variants. This allows you to plan your parental allowance easily and clearly:

And best of all: Take advantage of our Parental Allowance Software the unique feature test of the most favorable assessment period (“Günstigerprüfung”) and let us determine the best comparison period for you easily and automatically. You just enter your data and our software will tell you which comparison period is best for you and of course apply for this for you.

Pregnant during a parental leave - What to consider?

If you become pregnant during parental leave, this will initially have no effect on parental allowance for the older child. The parental leave itself is also not interrupted by a new pregnancy.

Tip:

You can end the parental leave early in order to go on maternity leave for the second child. The employer does not have to agree to this either (Section 16 (3) sentence 3 BEEG). You should end the parental leave early so that your entitlement to maternity leave payments is revived. You can still take any remaining parental leave later.

Parental allowancePlus of child 1 while parental allowance is being paid for child 2

If you have had your children “one after the other”, it may well be that your entitlement to parental allowance for child 1 collides with your entitlement to parental allowance for the second child. For example, if you applied for parental allowance plus for child 1 until month 22, and your second child was born one and a half years later, you may receive parental allowance “twice”.

Unfortunately, in these cases the parental allowance from the first child is reduced to the minimum amount (150€). Therefore, we do not recommend double receipt.

Tip:

If you suffer a reduction in parental allowance for child 1 due to another parental allowance claim, you should change the reference period of the first child retroactively. If you simply change your previous parental allowance plus months to basic parental allowance months, there will no longer be a collision and you will not lose any parental allowance. However, we only recommend this option if you did not earn any parental allowance-relevant income from a part-time job during the parental allowancePlus reference period, as otherwise your basic parental allowance entitlement will be reduced.

In this case, we recommend that you delay the start of parental allowance for your second child, i.e. let the parental allowance from the first child “run out” first and then start with the parental allowance for the second child. The disadvantage of this option is that the parental allowance plus for child 1 will be reduced in the months in which maternity leave payment is paid.

Notice:

The regulations governing parental allowance can be extremely complicated in places. Especially when different problems coincide (parental leave periods, maternity protection periods/leave payments, parental allowance for children 1 and 2, etc.). We recommend you to book in these constellations a professional Parental allowance consulting. Our parental allowance advisors will help you to keep track of everything and to draw your parental allowance as unabridged and optimally as possible.

Parental allowance "trick" for employees - register self-employment for the second child

Unfortunately, only calendar months in which parental allowance was received for older siblings until the older sibling reached 14 months of age can be excluded from the assessment period for the second child. In particular, parents who have opted for a longer parental leave often have calendar months without parental allowance-relevant income in the assessment period for the second child. In order for these parents not to receive a lower parental allowance, parents have the possibility, by registering a trade/freelance activity and even an agricultural and forestry business, to receive a higher parental allowance with the second child than with the first child. How is this possible?

If you were actively (!) self-employed before the birth of a child, the assessment period is always a calendar year (i.e. January to December). If other postponement circumstances exist in this calendar year (parental allowance for older siblings, maternity leave payments for older siblings, etc.), the previous year can be used as a basis.

If the circumstances are not completely unfortunate, it is possible to fall back on the calendar year before the birth of the first child, which usually results in a significant increase in parental allowance. If the sibling bonus is added to this, the parental allowance is even higher than for the first child.

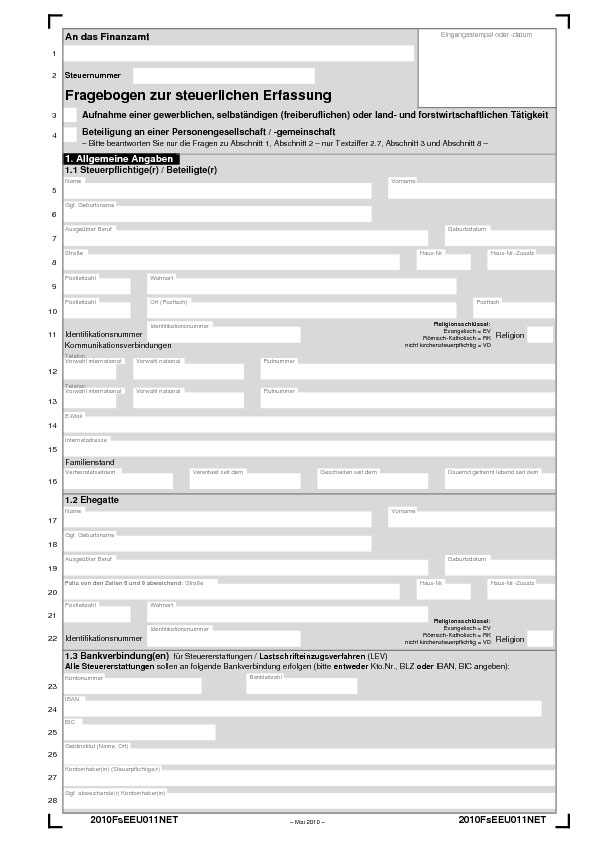

How do I register self-employment and how do I prove it to the parental allowance office?

As a rule, you register a trade at the public order office of your city. Everything else is then initiated by the city. You formally notify the tax office of a freelance activity by completing the “Questionnaire for Tax Registration”. Please note that by registering a self-employment you have to fulfill partly complex tax obligations (e.g. tax return obligation). You are actively pursuing the activity at the moment when operating income is generated or operating expenses are incurred. If, for example, you register the freelance activity of a “writer”, it is theoretically sufficient to buy paper and pen to be actively self-employed.

Notice:

We recommend that you only register self-employment if you seriously intend to pursue the activity, even if only for a few weeks. Taking up an activity only for the purpose of increasing the parental allowance can be considered by the parental allowance offices as an abuse of rights. You should therefore seek professional advice on parental allowance.

As proof at the parental allowance office, the business registration, a certificate from the tax office in tax matters (so-called entrepreneur’s certificate) or a tax assessment notice in which corresponding income is shown is sufficient.

Practical experiences

Responsibility for the administration, determination and payment of parental allowance lies with the federal states, which regulate the responsibilities differently in some cases. In some federal states, the municipalities are responsible, in others, state authorities.

Not only, but certainly also because of this, there are in some cases large regional differences in how life situations are legally assessed in parental allowance law. When it comes to “registering self-employment for the next child” in order to obtain a more favorable assessment period, there are parental allowance offices that approach the whole thing soberly and pragmatically, while others decide unlawfully and against the official guidelines.

We would like to highlight the most common traps in this context here:

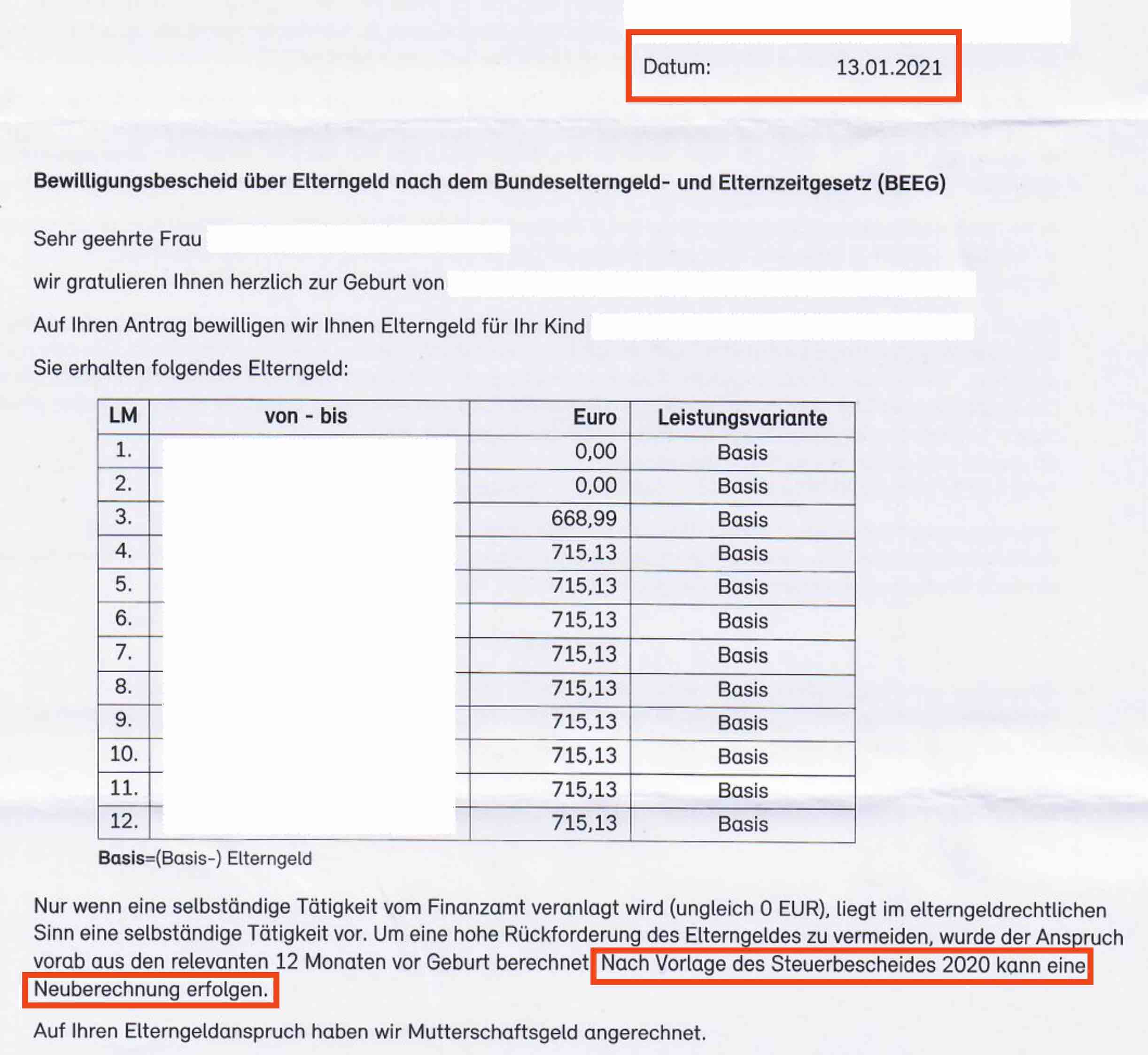

1. Self-employment is not recognized without a tax assessment

Parents most often encounter this problem. Logically, the income tax assessment with the self-employment income is not yet available when the application for parental allowance is filed. Often, self-employment is not registered until the year of birth.

Example:

Child 1 born on November 25, 2019. Parental allowance with parental allowance plus up to and including January 24, 2021 (month 14 of life).

Child 2 born on September 13, 2022. Self-employment started on 01 March 2022.

Parental allowance for child 2 is claimed on October 23, 2022. The income of the calendar months January to December 2018 should count as the assessment period due to the relevant deferral facts.

At that time, of course, there is no income tax assessment for 2022 (the tax return can be filed in March 2023 at the earliest; the parents, however, have significantly longer deadlines for filing their returns).

This case is clearly regulated by the guidelines to the Parental Allowance Act (Elterngeldgesetz):

Pursuant to Sec. 2s (2) Sentence 1 BEEG, income from profits is generally verified solely on the basis of the income tax assessment notice. In principle, the income tax assessment notice for the last completed tax assessment period is decisive. An assessment period is deemed to have been completed upon expiry of the last day of the assessment period and not only upon receipt of the tax assessment notice. This will often not yet be available when applying for parental allowance.

Then the income can be made credible in a simplified procedure by other documents, in particular by the last available income tax assessment. The parental allowance is paid provisionally on this basis until the relevant income tax assessment is subsequently submitted (§ 8 para. 3 ). (Guideline 2d.2.1 on § 2d BEEG)

In our example, the tax assessment for 2022 is not yet available. Therefore, the previous year’s tax assessment should be used as a basis, in the example the one for 2021. In this case, however, the self-employment has not yet been exercised, which is why this is not expedient. Alternative evidence of self-employment can be submitted as part of the simplified procedure and should also be accepted by the parental allowance office.

Alternative documentation may include:

- (Preliminary) Profit Calculation/BWA

- informal entrepreneur certificate from the tax authority

- informal tax advisor certificate

- Submission of business records within the meaning of § 22 UStG (outgoing, incoming invoices, bank statements, quotations, etc.).

However, in our opinion, the machine-generated notification of the allocation of a tax number from the tax office will regularly not be sufficient.

Notice:

It is understandable that the parental allowance offices are required to avoid high repayment rates. The basic approach is therefore understandable. However, we are concerned about the overreaching and ignorant decision-making of some parental allowance offices, which – without sufficient prior investigation of the facts – determine the parental allowance (albeit provisionally) to the disadvantage of the parents, contrary to the obvious and unambiguous request of the parents.

First and foremost, the parents should be granted a legal hearing and given the opportunity to provide alternative evidence of the facts.

2. Profit motive is questioned

Rarely, but nevertheless already the one or other time experienced, the parents’ allowance office doubts partly arbitrarily whether the activity is exercised with profit-making intention. This happens when there is a tax loss (i.e. more expenses than income).

The problem here is that the determination of the intention to make a profit lies with the tax authorities and is definitely not within the competence of the parental allowance office.

Note on the intention to make a profit:

Losses are only taken into account for income tax purposes if the activity is carried out with the intention of making a profit. However, the so-called intention to make a profit is an internal, subjective fact that is difficult to assess from the outside.

The highest tax jurisprudence assumes that initial losses do not speak against the existence of an intention to make a profit, that it can even be normal to make losses in the first five years of self-employment, as long as it can be made credible in a profit forecast that the initial losses will be balanced by later profits (however, it does not have to actually come to this, as it is only a forecast). Those affected should take legal action against the tax authorities, as this will have a not inconsiderable financial impact on parental allowance.

3. Self-employment exercised too late

First of all, you usually have enough time to register/exercise the self-employment in order for it to develop the desired right to defer. Nevertheless, in some cases it may be too late. We explain the temporal and legal requirements in detail again here:

§ Section 2b BEEG regulates the assessment period that is to be used as the basis for determining the assessment income in accordance with section 2(1) BEEG.

Depending on the type of income, the determination of income is based on Section 2c BEEG (employee income) or Section 2d BEEG (profit income).

The determination of income from non-self-employment in mixed cases is based exclusively on the requirements of Section 2b(3) and Section 2b(4) (right of application for parents with low self-employment income).

§ Section 2b(3) BEEG is an exception to subsection 1 and regulates the assessment period for income from employment in cases where the entitled person has income from self-employment either in the twelve-month period under subsection 1 or in the assessment period under subsection 2 (so-called mixed income).

This is where the “problem” lies: “mixed income” in this sense is had by anyone who either

earns income from profits in the assessment period pursuant to Section 2b (1) BEEG, i.e. in the 12-month period prior to the birth (but note: exclusions may apply!)

or

earns income from self-employment in the assessment period under para. 2, i.e. in the last completed assessment period before the birth.

Example:

Child 1 born on November 25, 2019. Parental allowance with parental allowance plus up to and including January 24, 2021 (month 14 of life).

Child 2 born on September 13, 2022. Maternity leave started on 08 August 2022. Self-employment started on 01 August 2022.

Examination: Is there mixed income within the meaning of Section 2b (3) sentence 1 BEEG?

Requirement:

1. Was income from profits generated in the assessment period under section 2b(1) BEEG, i.e. in the 12-month period before the birth?

The assessment period under section 2b(1) BEEG covers the calendar months August 2021 to July 2022 (excluding August 2022 due to receipt of maternity leave payment).

==>> No

2. Was profit income generated in the assessment period pursuant to Section 2b (2) BEEG, i.e. in the last completed assessment period before the birth?

The assessment period under Section 2b (2) BEEG covers the calendar months January 2021 to December 2021.

==>> No

Result:

Accordingly, there is no mixed income within the meaning of Section 2b (3) sentence 1 BEEG. There is no entitlement to postponement.

Important notice:

Parents whose children were born after August 31, 2021, now have the option (again) to waive exclusions (see our article on the new test of the most favorable assessment period for employees, § 2b (1) sentence 3 BEEG).

The mother in the above example would therefore be advised to waive the exclusion of the calendar month August 2022 so that the self-employed income is available in the assessment period pursuant to Section 2b (1) BEEG.

Whether the new test of the most favorable assessment period is applicable in such cases has not yet been addressed in relevant commentaries, nor in the guidelines, we therefore assume that this is possible and recommend parents who are denied the test of the most favorable assessment period in these cases to consider legal recourse.

Important Tip:

The date of registration with the tax office can only be an indication of the start of the activity. Parents may have been self-employed before this date without any problems, but must provide alternative evidence (e.g. receipt of business income before this date). If in doubt, seek advice.

Warning:

On the Internet and on various social media platforms, parents are sometimes confused by claims that self-employment must have been registered/exercised in the calendar year before the birth of the other child in order to be eligible for postponement.

Do not let yourself be unsettled or put under pressure, this is misinformation.

4. Estimation of income in the reference period

In this context, it is regularly questionable what happens to self-employment after childbirth. As a rule, self-employment is suspended after childbirth in favor of childcare and childrearing. Suspension in the sense of parental allowance means no working hours, no income and no expenses during the reference period.

Parents often experience that parental allowance offices do not “accept” the suspension and assume profits from self-employment in the reference period by estimating profits as a general rule.

Parents should take legal action against this, because if it can be credibly shown that the activity is dormant, there is no legal basis for the estimate. If the activity is not dormant, the income and (if applicable) expenses must be forecast informally. This informal forecast has to be followed by the parental allowance office as long as there are no obvious reasons against the credibility. A request for the forecast on the parenting allowance office’s own forms lacks any legal basis – parents should also defend themselves against this.

Important Tip:

In order to avoid an unjustified estimate in the notification, you should already provide credible evidence/proof of what will happen to your self-employment in the reference period in as much detail as possible when submitting your application.

If you declare the suspension of the activity, this should be communicated clearly and unambiguously, if income is expected in the reference period, the forecast of the income and, if applicable, the expenses should also be as detailed as possible. In the latter case, you will first receive a provisional notice based on your forecast – the final notice will be issued after the reference period upon submission of the profit calculations and timesheets for the reference period.

FAQ

-

When to plan having a second child because of parental allowance?

-

How is the parental allowance for the 2nd child calculated?

-

How much is the parental allowance for the second child?

This might also interest you