Maternity leave payment from the public health insurance

The Maternity Leave Act (MuSchG) is used to regulate support for (expectant) mothers in order, among other things, to ensure income maintenance even though gainful employment is prohibited for reasons of protection. A core element of this is the ongoing maternity leave payment from the public health insurance system.

The most important facts about maternity leave payment from the public health insurance

- Pregnant women and mothers are subject to an employment prohibition (maternity leave) during the so-called protection periods before and after the birth of their child.

- During this period, mothers receive full net wage compensation (composed of the current maternity leave payment from the health insurance fund and the maternity leave contribution from the employer)

- Compulsorily and voluntarily insured mothers receive maternity leave payment from the health insurance fund.

- Self-employed mothers receive maternity leave payment under the voluntary public insurance scheme only if they have taken out a sickness compensation policy (which is usually more expensive)

- Privately insured persons may receive private daily sickness compensation (depending on the insurance contract).

- Civil servants, judges, etc. receive their full remuneration from the employer during the protection periods.

- Calculate your maternity leave payment quickly and easily with our free maternity leave payment calculator

Do you want to calculate your exact maternity leave period?

No problem: Use our Maternity Leave Calculator, with which you can quickly and easily calculate your time limits.

Maternity leave payment from the public health insurance

Maternity leave payment is paid by the public health insurance funds during the protection periods before and after childbirth as well as for the day of childbirth. Maternity leave payment from the public health insurance funds is only paid to members of the public health insurance funds who are voluntarily or compulsorily insured and who are entitled to payment of sickness compensation. Further prerequisites for receipt are:

- the mother must be in a work or home-based employment relationship during the protection periods, or

- the employer has permissibly terminated the employment relationship during the pregnancy, or

- the employment relationship does not begin until after the start of the protection period. In that case, the entitlement does not arise until the beginning of the employment relationship if the woman is a member of a public health insurance fund at that time.

Membership in a family insurance is therefore not sufficient. The amount of maternity leave payment is based on the average net pay, reduced by statutory deductions, for the last three fully accounted calendar months before the start of maternity leave. In the case of weekly payroll accounting, the last 13 weeks before the start of the protection period are used. The maternity leave payment from the health insurance fund amounts to a maximum of 13 euros per calendar day.

Example

The maternity leave starts on 14.05.2022. The statutory net income according to the pay checks in the three-month period before the maternity leave is as follows:

Net earnings are added together and divided by 90 (calendar days) in a standard amount to determine a calendar day’s net pay:

7.016,- EUR / 90 Calendar days = 77,96 EUR

Because the net pay per calendar day is more than EUR 13, the mother receives the maximum amount from the health insurance fund. The difference is paid by the employer as a so-called maternity leave contribution from the employer.

The maternity leave payment can be applied for at the earliest seven weeks before the presumed date of childbirth, as the relevant medical certificate may be issued at the earliest one week before the start of the protection period.

Maternity leave payment from the Federal Social Security Office (Bundesamt für Soziale Sicherung)

Employees who are not themselves members of a public health insurance fund (for example, women with private health insurance or family insurance in the public health insurance fund) receive maternity leave payment totaling a maximum of 210 euros.

The Federal Social Security Office (Maternity Leave Payment Office) is responsible for this. Information and application forms are available on the website of the Bundesamtes für Soziale Sicherung.

Payment in the event of employment prohibitions (maternity leave wages)

If a woman stops working in whole or in part before the start and after the end of the protection period due to a ban on employment, she still does not have to fear any financial disadvantages. She retains at least her average earnings (maternity leave wage). This also applies if the company transfers the expectant mother to another reasonable job so that she has to change her job.

Important Tip:

Have you heard of the so-called breastfeeding employment prohibition? Find out about this special form of employment ban today in our helpful article “Breastfeeding employment prohibition”.

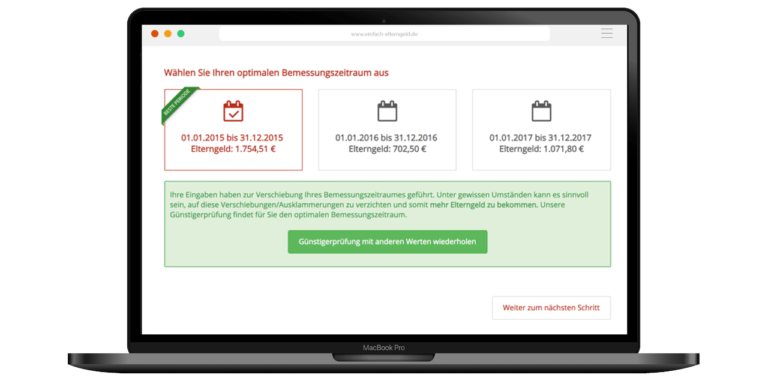

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service opportunities to apply for your parental allowance in the best possible way. We offer you many ways to make your parental allowance application as simple and straightforward as possible: