Parental allowance and Corona crisis

The Corona pandemic has changed the status quo for many people – also with a focus on parental allowance. The Federal Ministry of Family Affairs has attempted to cushion the sometimes precarious situation of families with various short-term changes in the law.

Read this article to find out what specific measures have been taken for families in connection with the Corona crisis:

Adjustment of parental allowance due to Covid-19 pandemic.

Families should not suffer any disadvantages in parental allowance due to the Corona crisis. With the law “Measures in parental allowance on the occasion of the Covid 19 pandemic”, which was approved by the Bundesrat on May 15, 2020, the legislator basically made three areas of parental allowance more flexible:

1) Postponement of parental allowance reference months

Normally, you can apply for basic parental allowance only up to the child’s 14th month of life. If you work in a system-related profession, this limit does not apply to you. You can also claim the basic parental allowance months after the 14th month of life, but no later than December 2021.

Example:

The child was born on 05.03.2019. The father applied for basic parental allowance for months 13 and 14 of life (= 05.03.2020 to 04.05.2020). Due to the Corona crisis, his employer (hospital) asked him to waive the parental leave. He now wants to take parental leave in months of life 23 and 24 (= 03/05/2021 to 05/04/2021). Due to the amending law, he can postpone his parental allowance.

Important note:

Normally, parental allowance months for older siblings are excludable from parental allowance for the second child only if they were taken within the first 14 months of the older child’s life (for more information on this: Parental allowance second child).

Currently, calendar months with parental allowance for an older sibling can also be excluded if they were taken after the older sibling’s 14th month of life. Whether parental allowance plus months are also affected by this is beyond our knowledge. It seems likely that only the crisis-related shifts are actually taken into account here.

2) Relaxations in the partnership bonus months

The partnership bonus months, which encourage parents to work part-time in parallel, do not apply if parents are unable to work the hours indicated with the original application due to the Covid 19 pandemic. The information provided at the time of application applies.

Example:

The child is born on 05.03.2019. The parents applied for the partnership bonus months for the months of life 13 to 16 (= 05.03.2020 to 04.07.2020). Due to the Corona crisis, the father could not reach the 25 hours (short-time work). The mother, in turn, worked more than 30 hours per week because she works in a system-relevant industry.

Normally, they would have to pay back the parental allowance of the partnership bonus months (at least €1,200), but due to the Covid 19 pandemic adjustments, it is not the actual hours worked and additional earnings that apply, but fictitiously the values that existed when the application was submitted (the original will is implemented).

It is questionable to what extent the relaxation is sufficient. If the partnership bonus months are started later than originally planned, e.g. due to the Corona crisis (daycare place can only be offered later), there is on the one hand the problem that a gap from month 15 onwards is not provided for by law and that in the case of an approved postponement the more favorable regulations no longer apply because the original application intention has already been changed due to Corona. Here, the administrative practice must offer – hopefully parent-friendly – solutions for those affected.

3) Exclusion of months with short-time allowance and unemployment

Pursuant to the third sentence of Section 2b(1), parents may, upon request, exclude calendar months (i.e., the affected calendar months are not included in the calculation) if they had a loss of income due to the Covid 19 pandemic during the period from March 1, 2020, to September 23, 2022. Loss of income due to the Covid 19 pandemic can occur, for example, due to reduced hours, time off, unemployment, or closure of the trade practiced. Reductions in income due to the Covid 19 pandemic also include indirect changes in income, such as reduction in work hours, interruption or non-resumption of employment in favor of child care. Only individual calendar months can also be excluded.

The applicant must provide credible evidence of the loss of income due to the Covid 19 pandemic. Suitable documents for this purpose include certificates, instructions or orders from the employer and – in the case of self-employed persons – a comparison with the previous year’s tax assessment. The connection between the loss of income and the pandemic can also be substantiated by submitting, for example, certificates, instructions or orders from the employer and orders from the health authorities to close certain businesses or facilities, or by submitting notifications, for example, that unemployment payments will not be received until March 1, 2020 or later. The regulation applies equally to non-self-employed persons and, in accordance with the further requirements of paragraphs 2 and 3, also to self-employed persons and to parents with mixed incomes.

Example short-time work:

The child was born on 05.08.2020. The assessment period is August 2019 up to and including July 2020. Short-time allowance was drawn in the calendar months March up to and including May 2020. The assessment period is now split as follows: May 2019 to February 2020 and June 2020 to July 2020.

Example Self-employed:

The child is born on 05.03.2022. The assessment period is in principle the calendar year 2021. However, the taxable profit in 2021 and also in 2020 is significantly lower than in 2019 due to the crisis. The applicant may request that the assessment period be based on the calendar year 2019.

Other important info about family benefits due to Corona.

There are several other family benefits in Germany besides parental allowance. The following other changes in the legal situation should be of interest to families:

1) Corona child benefit bonus (one time payment in 2020 and 2021)

Families will receive a Corona child benefit bonus (one time payment in 2020 and 2021) of 300 euros for each child for whom there is an entitlement to child benefit in at least one month in 2020. The Corona child benefit bonus (one time payment in 2020 and 2021) is not offset against social benefits such as basic security or the advance on child support, and is not taken into account as income in the case of child benefit bonus (Kinderzuschlag) and housing benefit. It is paid automatically and usually in two installments (with payment of the September and October child benefits).

Children who were born in 2020 but did not participate in the regular payment (for example, because they were not born until November) will probably receive the Corona child benefit bonus (one time payment in 2020 and 2021) as a one-time payment with the first child benefit payment.

However, parents who earn well do not ultimately benefit from the Corona child benefit bonus (one time payment in 2020 and 2021), since the €300 “extra child benefit” counts as child benefit received in family benefit equalization (consideration of the child benefit) in income tax assessment.

Notice:

Parents will also receive a Corona child benefit bonus (one time payment 2020 and 2021) in 2021. The Corona child benefit bonus (one time payment 2020 and 2021) will be paid for each child for whom there is or was an entitlement to child benefit for at least one month in 2021.

It amounts to 150 euros per child. It will be paid in May 2021 for all children for whom there is an entitlement to child benefit in May 2021. The payment will be made a few days after the regular child benefit payment. The Corona child benefit bonus (one time payment 2020 and 2021) is not paid together with the child benefit, but as a separate payment. For children who are or were entitled to child benefit in another month in 2021, the Corona child benefit bonus (one time payment 2020 and 2021) will be paid at a later date. A separate application is not necessary for this.

2) Support for single parents

Single parents enjoy a temporary increase in the so-called relief amount for single parents in income tax (limited to the years 2020 and 2021) from currently 1908 € to 4008 €. The relief amount is an additional tax allowance that is intended to take into account the special burdens of single parents. For the tax benefit, single parents do not have to wait until their tax return. Provided that single parents have income tax class 2 in their income tax deduction characteristics, they can still benefit from the relief in the current year 2020.

3) Continued payment of wages due to school and daycare center closures

Schools and daycare centers were closed during the Corona pandemic. Depending on the situation in the respective federal state, the facilities reopened. Parents who continue to care for children and are therefore unable to work are entitled to continued payment of wages based on the Infection Protection Act.

The compensation corresponds to approximately 67 percent of the loss of earnings incurred (maximum 2016 euros) for up to six weeks. On May 28, 2020, the Bundestag decided that the duration of continued payment of wages will be extended from six to up to ten weeks for each caregiver. In the future, there will thus be a total entitlement to up to 20 weeks of continued pay – ten weeks each for mothers and 10 weeks for fathers. For single parents, the entitlement will also be extended to a maximum of 20 weeks. The maximum period of ten or 20 weeks does not have to be taken in one go, but can be spread over several months. The compensation is paid by the employer, who can submit a corresponding application to the relevant state authority.

The requirements for compensation are:

- That working parents are required to care for children under the age of twelve because care is not otherwise available and,

- that flexitime/overtime credits have already been exhausted.

4) Corona child benefit bonus (Corona-Kinderzuschlag)

Families with low incomes can receive a monthly child benefit bonus (Kinderzuschlag) of up to 185 euros per child. Whether the KiZ is paid, and if so, how much, depends on several factors – above all, on the family’s own income, housing costs, the size of the family and the age of the children.

The basis for calculating the child benefit bonus (Kinderzuschlag) is usually the average income of the last six months before the application. To enable families to benefit from the child benefit bonus (Kinderzuschlag) who have had to accept a short-term loss of earnings due to the Corona pandemic, an Corona child benefit bonus (Corona-Kinderzuschlag) came into force on April 1. As a result, families no longer have to provide proof of income for the last six months when applying for the KiZ, but only for the last month before the application. In addition, parents no longer have to provide information on assets if they do not have significant assets.

This regulation is valid until September 30, 2020, so it may be worthwhile to apply in April if you already had a significant loss of earnings in March. Another adjustment: If you have already been receiving the highest possible child benefit bonus (Kinderzuschlag) of 185 euros per child, your approval will be automatically extended for another six months without a new examination.

FAQ

-

Will I be disadvantaged in parental allowance because of Corona?

-

Short-time work and parental allowance?

-

Partnership bonus weekly hours not met?

Too complicated? - Our tip

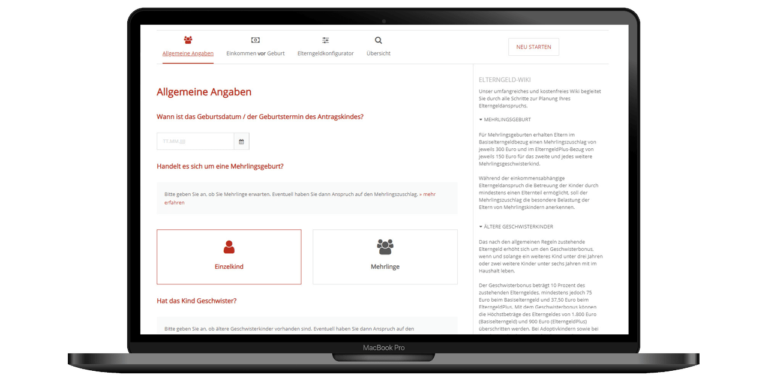

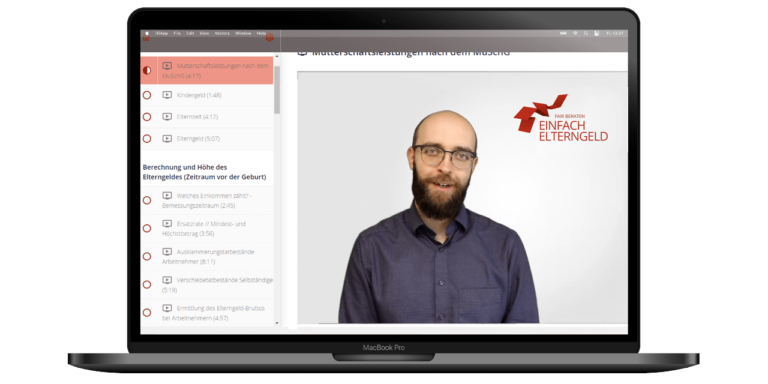

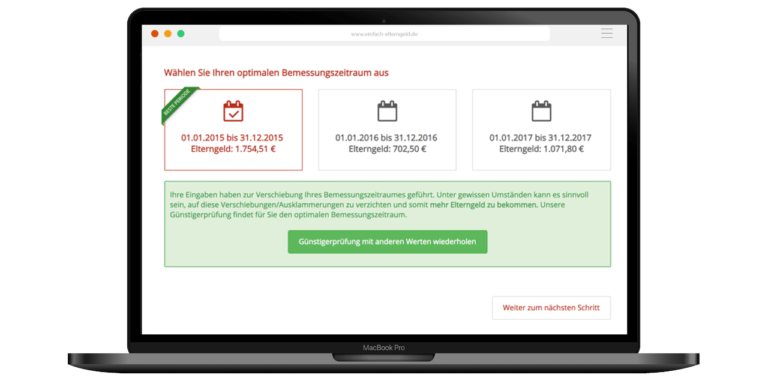

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in