Parental allowance and health insurance

An important topic when receiving parental allowance is the health insurance status during the parental leave, or the parental allowance. This article is intended to briefly and concisely present the most important case scenarios and provide a few tips:

In principle, parents who receive parental allowance are insured free of charge in the statutory health insurance. However, this only applies if they were previously compulsorily insured (and are on so-called parental leave while receiving parental allowance).

The situation is different for those with voluntary and private health insurance: This was recently experienced by a single mother who – as a high earner – had voluntary health insurance before receiving parental allowance. On November 30, 2016, the Federal Social Court (BSG) ruled that the woman must pay voluntary contributions to her health insurance even during the period in which she receives parental allowance (Case No. B 12 KR 6/15 R).

Before giving birth, the mother in question had an income above the annual income threshold and decided to take out voluntary health insurance at the statutory maximum contribution. During parental leave, she had to continue to take out voluntary health insurance on the basis of the minimum assessment basis. The Federal Social Court has now ruled that this is legal – but only just, as the report of the hearing shows. The court found that the legislature had respected the extreme limits of its freedom of design. The disadvantage compared to compulsorily insured persons – i.e. employees with lower incomes – is obvious.

§ Section 192 of the German Social Code, Book V, entitled “Continuation of membership of persons subject to compulsory insurance”, stipulates that the membership of persons subject to compulsory insurance is maintained as long as they are entitled to sickness payment or maternity leave payment or receive one of these benefits or, in accordance with statutory provisions, parental leave payment or parental leave or care support payment.

Tip for those affected:

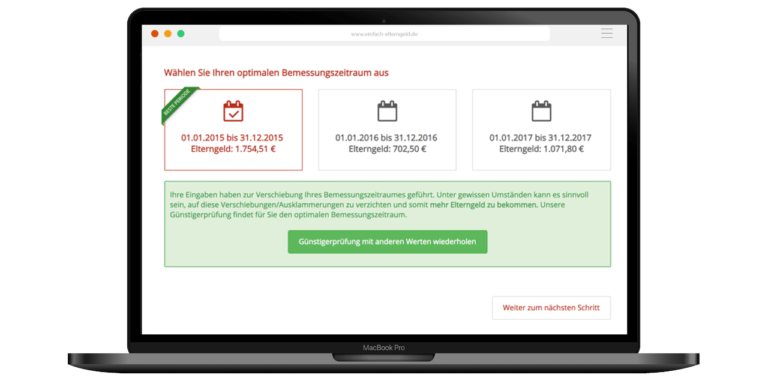

For high earners in a similar situation to the plaintiff, it may be worthwhile to reduce their salary in the so-called assessment period – to an amount below the annual income threshold. Under certain circumstances, it may be sufficient to reach an agreement with the employer on deferred compensation for the benefit of the company pension plan. It can also be worthwhile to transfer parts of the income from work to a company long-term account. The only important thing is that, in turn, compulsory insurance in the statutory health insurance system is created. This then remains in force during the period of parental allowance.

Finally, it should be noted that this procedure is only consistent, since no lump-sum deduction for health and long-term care insurance is deducted from the parental allowance gross amount when determining the fictitious parental allowance net amount. However, since most of the parents concerned are within the maximum amount of parental allowance even with a lump-sum deduction (EUR 1,800 basic parental allowance).

Better situation of married people

Incidentally, the problem outlined does not arise for parents with voluntary health insurance who are married and have a spouse with compulsory health insurance. During the period in which they receive parental allowance, they are covered by their spouse’s family insurance free of charge. Ergo: Marriage can also be worthwhile here for financial reasons.

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many options to make your parental allowance application as simple and straightforward as possible:

You might also be interested in