Parental allowance for foreigners and border crossers

Foreigners living in Germany are also entitled to German parental allowance under certain circumstances. The decisive factor is whether one is/is allowed to be gainfully employed in Germany and/or one has the right to remain in Germany (settlement permit). The most important questions in this regard are explained in this article, but a consultation with the parental allowance office or a professional parental allowance advisor can be very useful in these cases.

Parental allowance for EU/EEA citizens

Parental allowance law is largely harmonized across the EU. If you come from a country of the European Union, Switzerland or a country of the European Economic Area (EEA), you are considered a foreigner entitled to freedom of movement. This means that the same conditions for receiving parental allowance apply as for German citizens: you must be gainfully employed in Germany or live in Germany, care for and raise a child in your own household, not be in gainful employment or not be in full employment, and not exceed the income limits (€250,000 for an individual or €500,000 for a couple).

Notice:

You may receive benefits comparable to parental allowance from your country of citizenship. The entitlement to such benefits alone may be offset against the German parental allowance. In this case, it is essential that you seek advice.

Parental allowance for border crossers

Border crossers, that is, one lives and works in different countries, may be eligible for parental allowance. Border crossers can be divided into two categories:

Residence in Germany, work abroad

If you are resident in Germany and both parents work in another EU country (incl. Switzerland), you are generally entitled to German parental allowance, provided that the other basic requirements are met. In principle, the country of residence of the child forms the basis for the claim.

Deviating from this, the requirements of the country of employment apply if only one parent works abroad and the other parent does not work at all. However, in this case there may be claims for payment of differential amounts if the social benefits in the subordinate country (= Germany) are higher. It is essential that this claim is made formally – the differential amounts are not paid automatically.

Example:

The child’s father works in Switzerland and lives in Germany (cross-border commuter). The child’s mother was not gainfully employed during the assessment period. In principle, the Swiss benefits apply. However, since there are no family benefits there, the parents can claim the benefits from Germany in this case.

Important note for border crossers:

Please first apply for family benefits in the country of employment. The German parental allowance office will not finally process the application for German parental allowance until proof of the foreign family benefit has been received, as the former has priority. The deadlines for applying for German parental allowance remain the same. If necessary, apply for the German parental allowance first without the proof of the country of employment.

Residence abroad, working with a German employment contract

Parents who have an employment contract in Germany and live in another EU country or in Switzerland can apply for German parental allowance. In this case, the granting of parental allowance is based on the country of employment principle: the country in which you are employed is primarily responsible for family benefits.

Important note:

If you reside outside the EU or the EEA, you are generally not entitled to German parental allowance even if you are employed in Germany. Exceptions may apply for diplomats, employees of the NATO armed forces, development workers, etc. Please seek advice in these cases.

Parental allowance for foreign citizens from non-EU countries

For parents who are not entitled to freedom of movement, other requirements apply with regard to the claiming of parental allowance. The decisive factor is mainly whether the stay in Germany is expected to be permanent or not. If you are in permanent employment in Germany, you are generally eligible. Alternatively, the claim can be made by presenting a settlement permit or a residence permit.

If you have a settlement permit, you are generally entitled to parental allowance. In the case of a residence permit, it is decisive whether one has or had permission for gainful employment in Germany. If you do not have a permit for gainful employment, you are generally not entitled to parental allowance.

Important Notice:

Due to a so-called association agreement, special regulations apply to citizens from Morocco, Algeria, Tunisia or Turkey. As long as you are an employee in this case, you are entitled to parental allowance regardless of your residence permit. The only prerequisite is insurance in one of the German social insurances (e.g. pension or unemployment insurance).

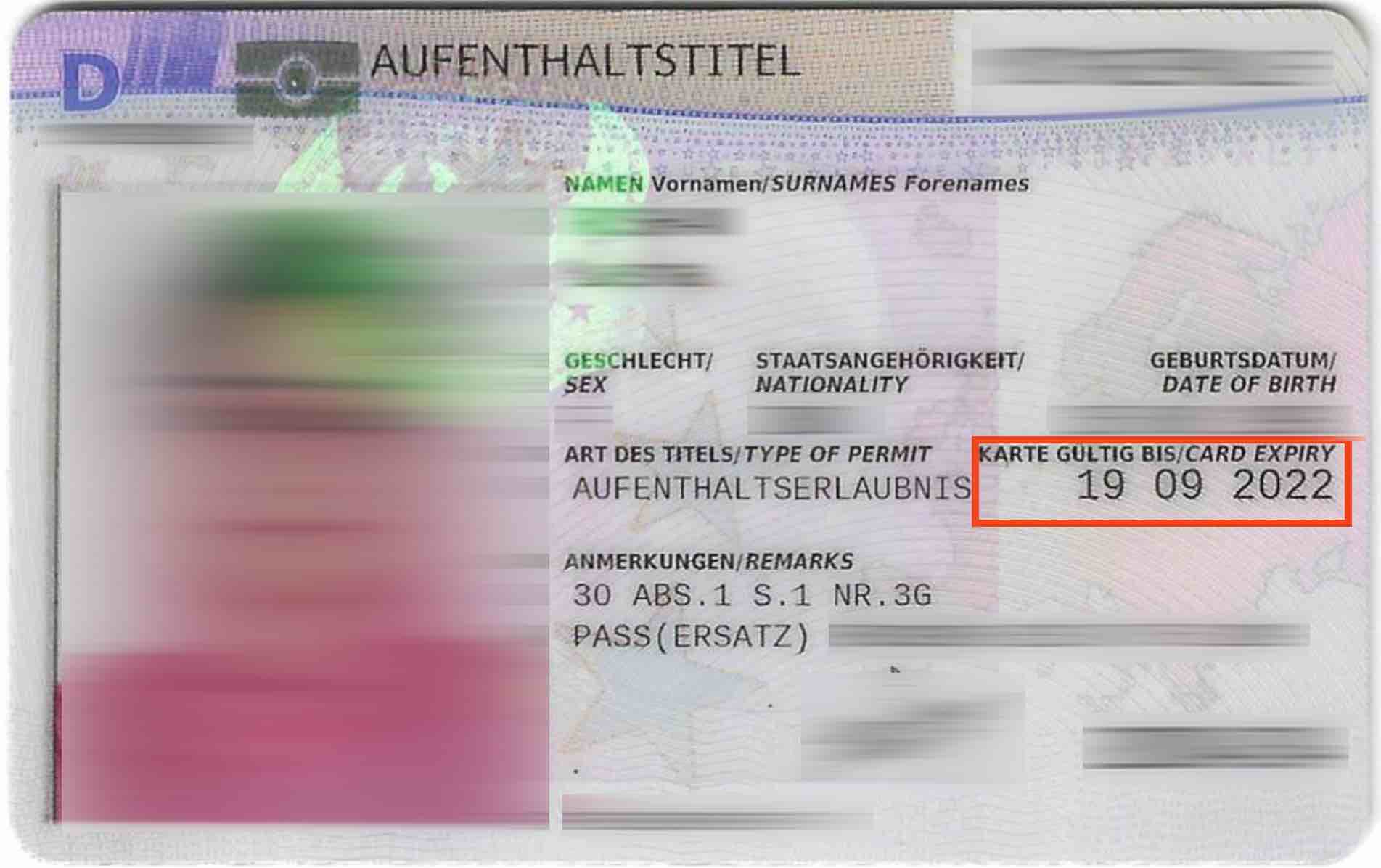

Note for applicants with a German residence title:

If the validity of your residence title ends during the period in which you receive parental allowance, you will initially be granted parental allowance for no longer than the lifemonth in which your residence title’s validity ends. You can then submit the new residence title to the parental allowance office, so that the remaining entitlement will be approved as well.

You can find out how long your title is valid on the front of your residence title:

Parental allowance as a war refugee

Parents who are not entitled to freedom of movement and who come from abroad do not receive parental allowance for various reasons. For example, if you have only received a residence permit in order to complete vocational training in Germany, you are not eligible to receive parental allowance.

Parents who have been granted a residence permit because they come from a country at war are also not entitled to parental allowance unless they have been in Germany for more than three years on the basis of a so-called hardship case and have also been gainfully employed here or have received German social benefits. This also applies if one has the residence permit only because one has received temporary protection through Germany. However, if the work permit is temporary, you are not entitled to parental allowance.

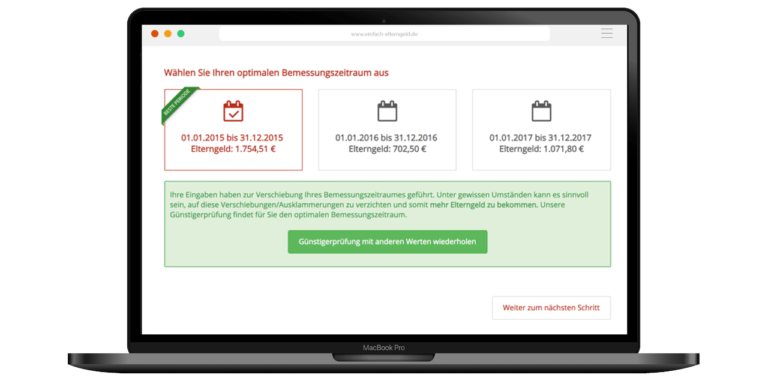

Too complicated? - Our tip

The parental allowance regulations can be complicated. Make it easy on yourself and, like many other parents, use our service offers to apply for your parental allowance in the best possible way. We offer you many ways to make your parental allowance application as simple and straightforward as possible:

You might also be interested in